At Techweek’17, over breakfast baps and muesli cups, Henry Oliver looked into the future. Of money.

In the ASB cube in Wynyard Quarter, upstairs from an enormous version of Michael Parekowhai’s Six60 cover art (jokes – it’s called ‘Achy Breaky Heart’ and it’s cool), a room full of young bankers in smart casual, ex-bankers in quilted puffer jackets, start-up types in personality hats, and investor types with freshly cut hair, gathered to hear about the future of the root of all evil, that thing many of wishes didn’t exist but because it does exist want as much of as we can – money.

There in time for a quick breakfast of mini-breakfast baps and muesli cups, I overhear people talking about “using technology to solve real problems” and “moving from California to build a house on Waiheke”. At first, I’m the only one who doesn’t know everyone else, but quickly learn that these are the kinds of people that sit in the empty seat between two strangers and, instead of quietly pulling out their phone to pretend to check their important email, promptly introduce themselves to the attendees either side. I want to be those people.

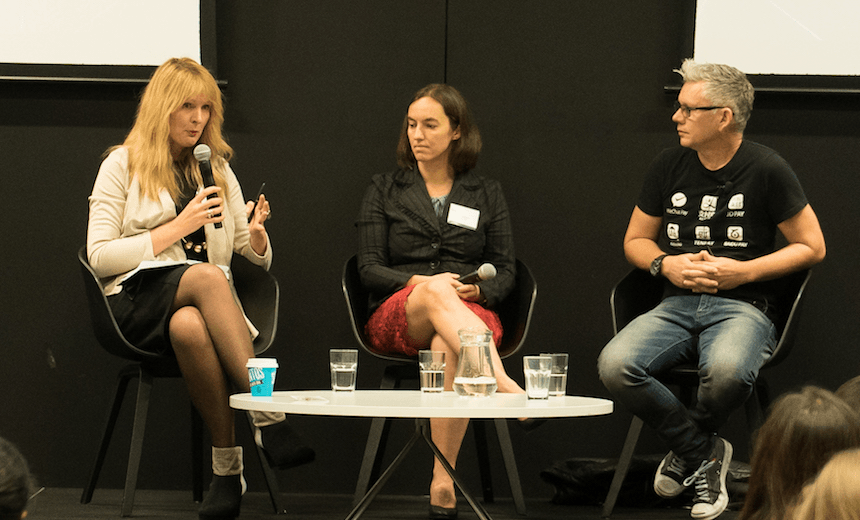

The talk is chaired by Frances Valintine, founder of The Mind Lab and Tech Futures Lab, and the guests are Mandy Simpson, former COO of NZX and current CEO of Cyber Toa, a cybersecurity firm; and Leigh Flounders, a former banker and current CEO LatiPay, the first online Yuan to NZD/AUD payment service. All people who know a lot more about money than me, a writer and editor with two dependants, no major assets, and no savings.

Valintine, as you’d expect from someone running one of the most specialised and technology education providers in the country, is optimistic about the possibility of a wave of industry-changing fintech (“financial technology”) innovations coming out of New Zealand, but worries that big businesses, the banks, and the major financial institutions, are struggling to “move the ship”. She says we need to look not only beyond our shores but past the traditional technology outposts in the US and the UK, towards nations that are adopting and adapting technology to suit their needs. “We no longer represent the majority of the world,” she says to an audience of mostly middle-aged New Zealanders. It’s the developing nations and the young are who will dominate the next phase of fintech innovation.

Mandy Simpson, who is particularly interested in the possibility in Blockchain – a peer-to-peer distributed database that can record any kind of financial (and non-financial) transaction, from payments to insurance to asset ownership – sees things really starting to change in the next three-to-five years. A couple of years ago when she would ask about Bitcoin and then Blockchain, she would get blank stares from people. Now, it’s not just hackers, but bank execs and accounting partners.

Fintech, she says, is now where the internet was in the mid-90s – full of potential, with change obviously on the way, but still as unpredictable as the internet once was. (As a banker at Deloitte in the UK in the mid-’90s, Simpson had asked a partner whether the firm had registered the deloitte.co.uk URL. “No,” he said. “The internet’s not a thing.”)

Simpson predicts one of the biggest area of growth will be micropayments, which currently cost too much to facilitate to make it worth it. New technologies like self-driving cars will require new forms of payment and exchange – there’s less need for an Uber if you can frictionlessly pay your AI driver over the blockchain. Similarly, micropayments could create new revenue opportunities in industries like media that are desperately looking for new revenue models. (Would you pay 4c to read this? Okay, don’t answer.)

Flounders – looking every bit the startup front person in a black LatiPay t-shirt, distressed jeans and chuck taylors – has a pitch for us, for you: “the future of money can come from New Zealand”.

In a little over two years, LatiPay has grown from four employees to 28, raising $3m in capital in Singapore just three months ago and winning the fintech 60-second pitch competition at this year’s SXSW.

Flounders points to China as a possible future of money. In China, only 12% of online payments are credit card transactions. Chinese consumers pay through a variety of means – from traditional bank transactions through to transfer options on apps like WeChat, many of which are hard for non-Chinese e-commerce sites to interact with. LatiPay is trying to bridge that gap, as an aggregate of all major Chinese online payment methods so non-Chinese sellers can easily access the Chinese consumer market.

In China, consumers use apps like WeChat to for a variety of functions: not just chat and social, but financial transactions and insurance – you can even insure your liver on WeChat before you go out drinking. As well as China, Flounders and Simpson point to India and the UK, where the big fintech innovations are happening.

Since 2009, India has been collecting the biometric information (fingerprints and eyescans to begin with) of its citizens in a bid to issue biometric ID cards to its 1.3 billion residents. Plus, in November last year, India started a huge demonetisation process, invalidating all ₹500 and ₹1,000 banknotes overnight. With biometrics, Flounders says, “you don’t need a phone, you don’t need a card, you are the money”. (What could go wrong?)

UK-based peer-to-peer insurance provider Lemonade utilises the Blockchain to operate cheaply and efficiently. Simpson once saw Lemonade pay out a claim for a stolen jacket in three seconds. Simpson also mentions a startup (whose name I didn’t catch) which loans small businesses working capital based on an application process where they (with permission) scrape a company’s Facebook page for all the information it needs to assess an application. With AI and machine learning, things like loan applications will get more efficient as the machine will know long before a human could of potential risk factors.

So, if you’re looking to the future to see how to make some money, where are there still opportunities? Look in two areas, Simpson and Flounders say: Where are customers unhappy and where is significant money being made? You don’t need to take on the incumbents head on, just look for the most profitable or the most neglected bit and aim there.

And what if you’re just a person in the world, making a little bit and spending a little bit. What’s going to change for you? Well, sending and receiving money is only going to get cheaper, the insurance market is getting more competitive, and paying for your groceries could be done in the blink of an eye. Forget swiping your card. Forget Paywave or Apple Pay. Just look into the lens of your AI teller. Think of the time you’ll save by not being asked how your day was.

Techweek’17: a week of events bringing together New Zealand’s brightest technology and innovation talent to tackle global issues with local ingenuity. May 6-14, Nationwide. techweek.co.nz