Opinion: National gets away with mixed messages over tax cuts because Labour has failed to grasp the nettle and frame tax as both a fairness and patriotism issue, argues Simon Louisson

The left’s failure to frame the tax debate since the last election has put it firmly on track to spend three more years in opposition.

This, despite amazing contortions by National last week, when, days after the finance minister, Bill English, said his government would behave responsibly and repay debt and investing in infrastructure rather than cutting taxes, the prime minister put tax cuts back on the agenda.

Vernon Small in the Dominion Post put it well when he observed that John Key “displayed another of his under-appreciated ‘silky skills’ – how to argue from both sides at the same time and come down alongside voters on both.”

He noted that it is political gold to pull off such tricks. Key did it before the last election and given Labour’s silence on its own tax plans, seems just as likely to succeed with the same stunt.

Small also said it was philosophical poison for National not to be cutting taxes, or at least promising to cut them. Whether or not tax cuts eventuate, you have to ask, why are cuts, or the promise of cuts, such a vote winner?

According to cognitive linguist George Lakoff of the University of California, it is because the right has captured the framing and language used in the tax debate.

Best known for his thesis describing how the lives of individuals are significantly influenced by the central metaphors they use to explain complex phenomena, Lakoff says the language and framing capture explains why so many voters have been so willing to vote against their own interests.

Any discussion on tax is automatically framed in such a way that less tax is seen as good, and new, or higher tax rates, are deemed bad.

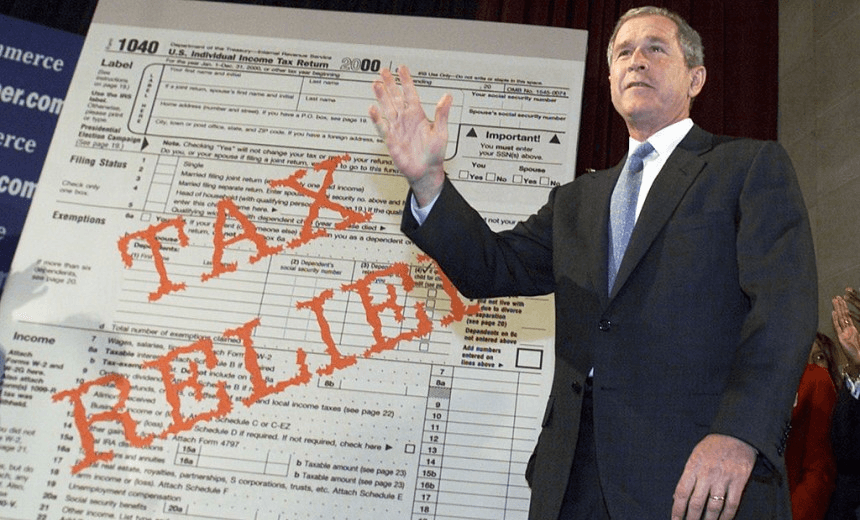

In the US, from the 1980s, the right, led by President Ronald Reagan and the Bush presidents, have used the term “tax relief”. It is an unbeatable shorthand metaphor that conjures up tax as an affliction. Thus those proposing to cut taxes are portrayed as heroes and those advocating holding, or raising tax, are portrayed as villains.

Similarly, the widely used term “nanny state” succinctly and negatively frames any initiative to improve society’s wellbeing, such as the current debate on reducing sugar use.

Messaging on taxes by those on the right has been highly effective in winning long stints in power which has been used to smash unions into submission, resulting in lower real wages.

Ironically, once workers’ pay is near subsistence levels, they then become more susceptible to the message of tax “relief”, often voting for parties proposing lower taxes and less progressive tax regimes such as lower income tax but higher GST, which results in spending cuts that undercut the very support programmes in health, education and security that they need to live adequately.

Lakoff outlines how the left has failed to find similar effective framing and language for its argument that taxes are what people pay to build our community – that they allow us to live in a civilised, democratic, society which uses progressive taxes to try to equalise opportunity.

The left needs to frame tax as both a fairness and patriotism issue. For example, in the current Panama Papers scandal, Labour has failed, by trying to pin instances of tax dodging on Key and his mates, instead of broadening the issue out to one that portrays the rich as finding immoral ways not to pay their fair share, legally or not, so the rest of us have to take up the slack.

Labour Party leader Andrew Little and his predecessors have been inept in front-footing tax.

In the previous electoral cycle, David Cunliffe proposed a capital gains tax as a measure to curb house price inflation. Instead of immediately stating that revenue raised by the new tax would be offset by lower taxes elsewhere, Labour allowed itself to be tarred as the tax and spend party.

Bernie Sanders, the 74-year-old never-wozzer Senator, who has run Hilary Clinton so close in the Democratic Primaries, has garnered huge support and momentum, particularly from young Americans, via a campaign focused on raising taxes to boost health, education and security.

Similarly, the equally surprising elevation of Jeremy Corbyn to the leadership of the UK Labour Party, is based on the desire for similar policies of higher taxes on the wealthy to be used to restore social services that have been slashed by government of the right.

The success of Sanders and Corbyn strongly suggests there is an appetite among large sections of the electorate to listen to messages that everyone should pay their fair share of tax to create a fairer society.

Little has totally failed to tap that mood.

Yesterday, Labour finance spokesperson Grant Robertson acknowledged Labour will increase taxes for some before the next election to finance initiatives in health, education and housing. He said a Tax Working Group would be set up after the election “to correct imbalances”.

“I think it is only fair to New Zealand we go to the next election with some sense of the direction of our tax policy,” Robertson said.

Labour has finally woken up to Key’s comments last week that a tax cut plan will be put before the electorate for the next election guaranteeing tax will be front and centre of any campaign.

Yet the tone of Robertson’s comments are abjectly apologetic. Little and Labour need to front-foot this. They have telegraphed the policy with no detail so National can wade in with counter punches before Labour has begun the frame, let alone the rational narrative. It’s an action replay of the half-baked announcement of the Universal Basic Income and a repeat of the CGT fiasco.

Lakoff stresses that framing must come before policy. Framing is not selling policy and policy should be about fitting frames.

The frame Labour should be presenting is its moral vision of empathy, responsibility, protection, fairness, equality and empowerment. The narrative should be reiterated that New Zealand, thanks mainly to previous Labour governments, has a history of looking after people, and Labour plans to build on that.

That should be contrasted with National’s emphasis on individualism, self interest (going it alone), profits, privateering (the cross between privatisation and profit, such as Serco running the prisons), markets and privilege.

National’s move to cut taxes has resulted in the removal of protections previous governments have created to ensure all citizens have the opportunity to fully participate in society and are cared for properly.

Finally, Labour has to be able to get across the startling message of an OECD study, (PDF) published in 2014, which unequivocally showed that more equal societies have had better economic performance – or, to look at it another way, the more inequality grows the worse the economy performs.

This study totally contradicts the hogwash that lower taxes result in better economic outcomes.

Unless Little and his colleagues grasp this tax nettle properly and find the framing and language that demonstrates how paying tax improves our society, they can expect to languish in opposition and will doubtless then tear themselves further apart in the ensuing frustration.