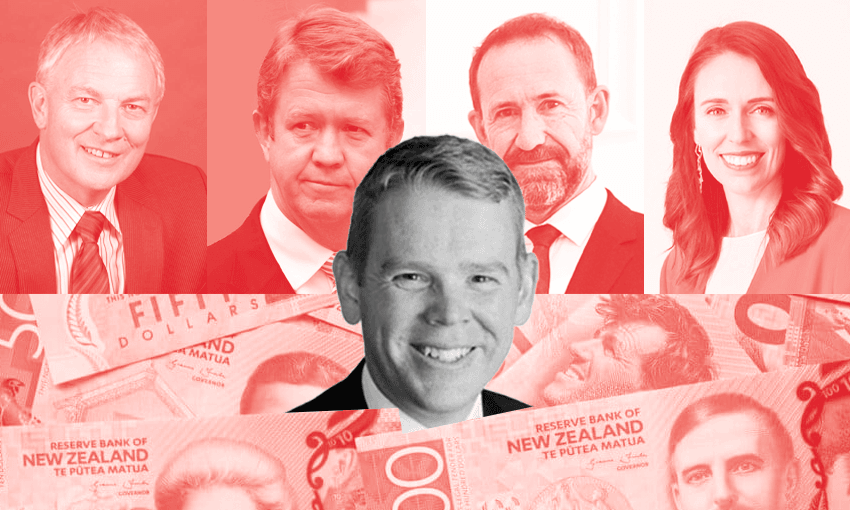

After ruling out a number of taxes at the last election, the Labour leader now says all taxes are back on the table. Max Rashbrooke assesses how likely Hipkins is to actually do something about it.

The year is 2049, and the recently elected leader of the Labour Party is calling for “a conversation” about taxes and New Zealand’s failure to tax either wealth or the income it generates. This scenario is, following Chris Hipkins’s re-opening of the tax debate last Sunday, a wearyingly predictable one. We have been here before, had this “conversation” countless times, to no avail. It is the tax obsessive’s equivalent of Groundhog Day.

Here, though, is another, equally plausible scenario: the year is 2019, and the recently elected leader of the Labour Party, having unequivocally campaigned in 2017 on introducing a capital gains tax, is now overseeing the first year’s takings.

This scenario is credible because tax reform in this country is not, despite its many setbacks, a lost cause. Its failures to date have as much to do with internal Labour Party dynamics as with any obstinate reluctance on the part of the public to entertain the idea of change.

The recent history of our tax debates starts in 2008, after Helen Clark’s government, having not overseen any major changes bar a new 39% top rate, is removed from office. At this point Labour clocks something the Greens have long since identified: a massive loophole in the tax system. Income from wages and salaries is taxed, and quite thoroughly to boot; with some minor exceptions, income generated by selling assets – capital gains, in other words – is not.

This loophole – for such it is, even if the term is not always used – spurs Labour to campaign in 2011 and 2014 on a capital gains tax (CGT). The proposal is only modestly popular, achieving perhaps 30-40% support, and leaders Phil Goff and David Cunliffe both get tripped up in debates trying to answer questions about it.

Next comes the crucial moment: Cunliffe’s successor, Andrew Little, takes CGT off the table, saying he won’t campaign on it. This is vital because, when Jacinda Ardern comes to power just before the 2017 election, the party has not carried out detailed policy plans, campaigned on or even been prepared to defend a CGT for two and a half years.

It is thus entirely unprepared for the wave of National Party attacks that begin once Ardern throws CGT back into the fray. Labour panics, promises a tax working group, and then, in government, is unable to defend its own policy for 18 months while the group does its thing. In the meantime a torrent of right-wing attacks, CGT counter-arguments and outright misinformation pours into the breach. The debate is lost, Winston Peters (at that point deputy prime minister) opposes any meaningful CGT, and the opportunity vanishes. Ardern rules out a CGT not just for now but for all (her political life) time, something that effectively prevents the party from making good use of its post-2020 absolute majority. It remains entirely possible that, had Labour campaigned consistently from 2011 to 2017, it could have faced down the attacks, won the debate, and got a CGT over the line; but that is not what has happened.

Tax reform, then, seems dead and buried. But the party keeps making ham-fisted attempts to disinter it. Post-2020, Cabinet agrees to let David Parker commission a report from Inland Revenue that – it should be clear even at this early stage – will expose the fact that rich people effectively pay very low tax rates. Cabinet does not seem to have thought hard about the problem this will create: either the government will have to bring in some kind of tax to deal with the situation, or it will have to stand up and say, “We are very pleased to have exposed this terrible issue that we intend to do nothing about.”

When the report comes out in April 2023, and reveals that our richest people pay a tax rate on their income (including capital gains) of roughly 9%, Cabinet ostensibly chooses the second option. Among tax reformers, a now-familiar sense of despair descends. Then, in June, it transpires that, for the past 12 months, Parker and finance minister Grant Robertson have been exploring not a CGT but something altogether more radical: a wealth tax.

Whereas a CGT taxes the income people earn when they sell an asset, a wealth tax, as the name suggests, just taxes the wealth itself. Labour’s proposal, it turns out, was to ask people to pay an annual 1.5% levy on all the wealth they hold over a $5m threshold. The plan is similar to, though less ambitious than, the policy on which the Greens campaigned in 2020. The moment the public learns of this plan, however, is also the moment Hipkins rules it out. The gloom of despair becomes an enveloping black cloud.

But post-election, it becomes clear that, by dangling the prospect of major reform and then taking it away, Hipkins has sparked serious discontent within Labour, and indeed the wider left. As one Labour MP told me last year: “We’ve uncorked something here that can’t be put back in the bottle.”

Hipkins knows all this history, and must be aware that to call once more for “a conversation” on tax and then do nothing would surely spark more than just discontent. While the ability of the Labour Party to disappoint its support base should never be underestimated, the intent this time must be serious.

Life has moved on, too. A CGT, for instance, is now a familiar – if still controversial – topic. I have seen unpublished polling that has support at roughly one-third of voters, opposition at one-quarter, and the vast majority of people unsure or neutral. The public is at least open to being convinced, and a CGT has a ready-made pitch: income is income. Let’s tax it all the same way. A wealth tax also seems to do well in surveys, although pollsters suspect that its support crumbles once people better understand the idea.

There are, finally, growing pressures on public spending – the need to deal with climate change’s effects, for instance, or the health demands of an ageing population – that will be hard to answer without major tax reform. It is not impossible, of course, that we are still in a tax-based Groundhog Day loop, and have just reached the equivalent of the point in the film where Bill Murray has spent several thousand days learning to play boogie-woogie piano. But we may also have broken the pattern. This time, it might be different.