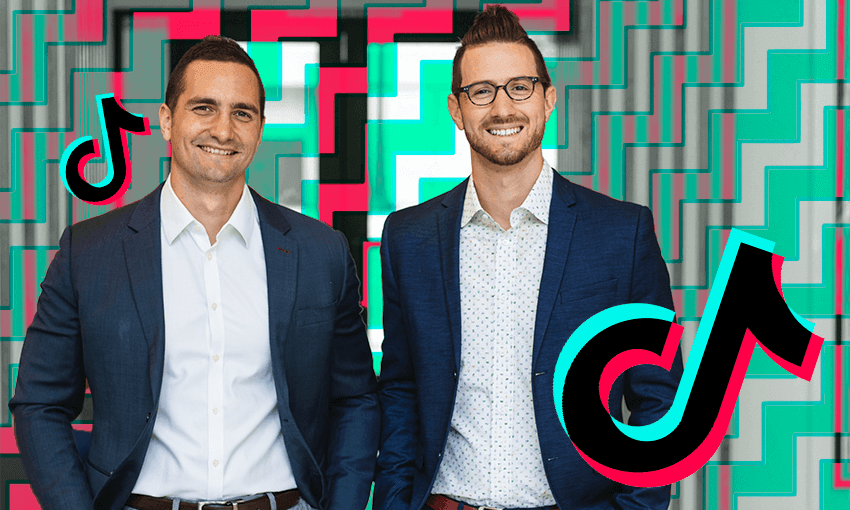

In 2016 Kale Panoho started a gym in Cromwell, which somehow led to him being part of the early growth campaign of the biggest new app in the world. He tells Duncan Greive his story.

It was 2018, and Kale Panoho was on a sales call with a prospective client. It was a social platform being built out of the ashes of a promising startup named Musical.ly that had been acquired by a Chinese technology giant. Panoho (Ngāpuhi) and his business partner Jonathan Maxim hadn’t heard of the company, but were curious enough to jump on a Zoom, even though it was midnight for Panoho and 3am for LA-based Maxim. They started out by explaining to the client how they liked to work.

“One of the things we try and recommend with apps is just changing the UX,” Panoho says. “So that may be a part of the consideration before we deep dive, but we need to get a hold of that.” Across the ocean, the client patiently heard them out, but wasn’t interested in their opinions about product and design. “That may be a consideration that we’ll look at,” she said. “But at the moment, we just need users.”

Panoho, now 32, laughs now when telling the story – at their naivety in giving feedback on user experience to this client in particular. Because the company that had bought Musical.ly was named ByteDance. And the app that just needed users? It was TikTok.

The app was barely a murmur outside of China (a version there is called Douyin, and is much more tightly restricted) in 2018, but went on an enormous growth curve in 2019 and 2020, becoming the most-downloaded app in the world in both years, and surpassed a billion monthly active users (MAUs) in 2021 – its CEO recently claimed 150 million in the US alone. Its revenues have increased from US$150m to US$9.4bn in 2022, according to the Business of Apps.

At the time of that sales call, though, it was just another ambitious social app, trying to build out a user base in a sector that seemed essentially closed off. Snapchat had been the last major social platform to launch, in 2011. Since then it appeared that the suite of apps built or bought by Facebook – including Instagram, WhatsApp and Messenger – owned the most lucrative parts of the social media universe. Snapchat and Twitter were stuck in a netherworld, too small to take on the giants. Facebook CEO Mark Zuckerberg would either buy or clone anyone daring to try and challenge his dominance.

So while businesses looked at Meta’s profit margins and saw huge opportunity, venture capitalists were loath to fund challengers, operating under the assumption that the network effects of Facebook and Instagram in particular were too powerful to be defeated. Perhaps that’s why it took an audacious Chinese technology company to properly attack Facebook (whose parent company would soon be renamed Meta) – and might explain why they were comfortable pulling every lever they could to try and build an audience. Including asking a relatively obscure agency, headquartered at the bottom of the South Island, how they would approach that goal.

Enter growth hacking

Panoho had always been curious about different ways to approach building a business. He’d worked as a personal trainer, and studied biochemistry at university, but fell into the tech world through a role at the successful startup Education Perfect in Dunedin. Not long after, in 2016, he, his cousin Jonny and Jonny’s partner Alex opened a gym in Cromwell, in Central Otago. They deployed a variety of sharp marketing ideas, using the cheap distribution of social media in that era, and over two weeks essentially pre-funded the setup of the gym by convincing people in a small South Island town to sign up for what was, at the time, just an idea.

He wrote about the experience as a case study for a publication named Influencive in the US, under a very clicky headline: “How we turned $200 into $202,000 of annual revenue in 14 days”. The piece became very widely shared in the hustle culture era, when the idea took hold that working long hours and dedicating your whole life to work was the only way to get ahead. In the aftermath Panoho found his inbox flooded with questions and requests to consult for people keen to replicate that jaw-dropping return on investment. Not long after, he co-founded K&J Growth with Maxim (K&J being the initials of their first names), to formalise the work they were doing into an agency model. Panoho would run the New Zealand office, while Maxim set up shop in Los Angeles.

They focused on performance marketing, which is geared toward achieving a specific and tangible business outcome, as opposed to fuzzier areas like brand or awareness. Most specifically, they set up camp in the approach known as growth hacking. The term was only defined in 2010, by a marketer named Shaun Ellis, and wrapped around the then-voguish idea that for certain technology companies, the only metric that counted was user growth, and that marketing efforts should stay tightly bound to techniques which impacted that at the expense of all else.

The term has since become the subject of considerable critiques, which see it as connected to the “move fast and break things” culture of firms like Facebook, which seemed indifferent to the impact of their hyperscaling on society or culture more broadly. Yet in 2016, when Panoho published his Cromwell gym case study, the tech world was still in a more innocent era.

Panoho became known as a consultant in the growth hacking area, and in 2018 went viral again, this time with a video for LinkedIn that described his growth hacking an audience on the platform. He says it was at the time the most-commented-on video in LinkedIn’s history, with just shy of 15,000, and it caught the attention of an investor with connections to TikTok, the still largely unknown app. Panoho and Maxim took the call, then got to work.

Start with 100,000 users, just as a test

Panoho says the brief was pretty staggering for a small New Zealand business, one that was turning over just $500,000 per annum at the time. TikTok was deploying multiple agencies around the world with a single-minded focus on user acquisition for the US – the most important market in the world. It was currently costing them around US$10 for each new account, says Panoho. Could they run a test to acquire 100,000 new users, with anything less than US$10 being considered a win? It was essentially an opportunity to more than triple the size of their business with a single client – and simply a test, with the promise of more to come.

Their initial techniques were not promising. It was a more open era for communications, and they initially tried airdropping spammy links at conferences, achieving a pitiful four downloads as a result. But not long after they hit upon a technique which would prove affordable and scalable. Panoho and his team gathered a group of Instagram micro-influencers – people with devoted followings, but not particularly large ones. They were paid to bulk message up to 150 of their followers a day. The technique they hit upon was to DM a small piece of content, with a tease about what came next. The catch was that the second half of the video actually sat on TikTok.

It had the double impact of not only bringing new users across, but also porting a content creator and their audience from a Zuckerberg-owned platform to ByteDance’s new challenger. Panoho says K&J created a piece of software to automate the messaging, and found it was cost-effective.

TikTok was thrilled, with its then-client lead Roxy Tang (now at its music streaming service SoundOn) saying of the initial period, “K&J helped us gain over 18,500 downloads in less than 30 days of working together”. Panoho and Maxim found themselves regularly on calls with its most senior leadership, flying to LA to meet executives, and being introduced to the incredible intensity of Chinese 9/9/6 work culture, which still operated wherever in the world its employees happened to be.

TikTok became by far their biggest and most important client, during a period in which it scaled to 5,000 employees and beyond. Panoho marvelled at the way even at that scale, it still behaved like a startup, with company-wide pivots from focusing on user growth to trust and safety, in the aftermath of disturbing stories about child predators’ use of the platform.

What has TikTok become?

Within a couple of years TikTok’s need for paid user acquisition melted away, as it became the most popular site on the internet in short order. Over time, its initial reputation as a place for cute dance crazes gave way into something more complex, with problems that seem inevitable with large-scale social media products. Just this week former NZ Herald journalist Olivia Carville wrote a BusinessWeek cover story on a tragic rise in TikTok-linked suicides. It has also become the centre of major geopolitical tension between China and the US, amid concerns over its links to the Chinese government, and the potential for abuse of its content mix.

As someone who played a small early role in that growth, Panoho remains highly impressed with the way the company operates. “As a tool for distributing content, the company’s growth is world-class. We implement growth for our clients at K&J from a mixture of our IP and our time working with them. The way they experiment, iterate and take products to market is exemplary and something we’re far from achieving in Aotearoa.”

For all that, he has much more complicated feelings about TikTok’s relationship with society. “When it comes to the impact of how much time is spent on the application by so many, I’m in dismay. I don’t have any social apps on my phone as I know I don’t have the willpower necessary not to use them, so I delete them altogether. TikTok can take hours from people without them realising, which makes it a double-edged sword – if you’re served content for education and action, great. If not, we’re letting hundreds of millions have their attention taken on a merry-go-round that can end in some dark places.

“The fact that I’m one of the people that helped hundreds of thousands of people go through this experience is something that my 32-year-old self would question compared to the naive 28-year-old who thought that growth at all costs was the smartest thing for every person involved… My job is to help turn attention into revenue, but I can’t help but ask the question of the cost of this on us as a society.”

As of now, while he remains on good terms with people at TikTok, Panoho is more focused on a startup of his own. It’s a free newsletter called Hakune / The Method, targeting New Zealand startups, aiming to cover the sector and share insights and ideas in a weekly email product. Panoho and his collaborator Rhys Jeffery write punchy, passionate stories about innovative New Zealand companies, without any of the sleepless nights that came from hyperscaling for TikTok. He emails me later asking to put a link to the newsletter in – Panoho never stops thinking about growth. Only now it’s for his own startup, not one of the biggest and most confronting companies in the world.