The prime minister has laid out his priorities for the upcoming budget, evaporating any speculation that a new tax could be unveiled in order to tackle growing wealth inequality in New Zealand.

It’s been just one day since a bombshell IRD report laid out in stark detail just how much more tax the average New Zealander pays compared to the country’s richest. It gave, as Toby Manhire wrote earlier today, a brief opportunity for the revenue minister David Parker to imagine a world in which a capital gains tax could be implemented right this very minute.

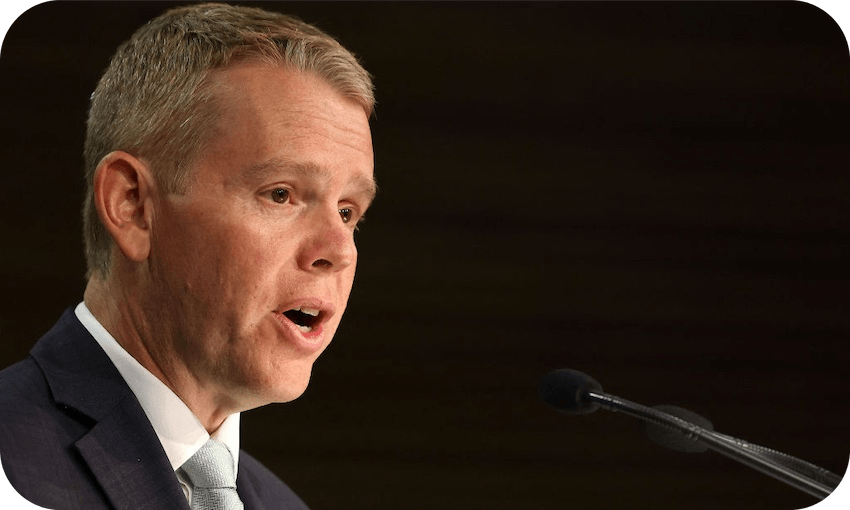

But that’s not happening. The biggest takeaway from a speech delivered by Chris Hipkins in Auckland this afternoon was simple. This year’s budget will have no capital gains tax, no wealth tax and no “cyclone tax”.

He said it exactly twice in his speech and several times at a subsequent press conference: “The government will not introduce any major tax changes like a wealth tax or capital gains tax in this budget”.

The speech was Hipkins’ biggest headlining address since taking office a few months ago, so it’s no surprise he used it to tease his upcoming budget. It’s a budget he said he was “energised” by, though the business audience he was speaking to at times appeared more energised by the catered meal on their plates than the prime minister’s words. Sure, using eye contact and applause as a measure of anything is arbitrary – but there was a definite reservedness in the room during and after Hipkins’ address.

It was also, probably, the first speech where Hipkins hasn’t chosen to mention his favourite foods “bread and butter”, even as he detailed his shopping habits at Pak’nSave Upper Hutt. The PM’s overused catchphrase was replaced by “no frills”, meaning, he said, that this budget was about “getting the basics right”.

Since taking on the leadership earlier this year, Hipkins has sought to reframe his government’s relationship with the business community. Historically Labour has been perceived as more business-averse than National, and Jacinda Ardern’s tenure did little to change this image. It’s no coincidence, therefore, that Hipkins first engagement as prime minister and his biggest speech to date were both in front of the Auckland business community. “It’s a relationship I have sought to develop in the three months I’ve been in the job,” he said.

While quick to use his speech to extinguish speculation of any new taxes in next month’s budget, Hipkins was more reluctant to play the “rule in, rule out” game more broadly when it came to the months ahead. He was careful with his words, explicitly choosing not to rule out the possibility of Labour’s election campaign involving new taxes or changes to the current tax system.

“In this budget” was the key phrase Hipkins used when describing his ruling out of any tax changes. Asked by The Spinoff whether the current tax system was fair, Hipkins said no. “I think there is evidence our tax system doesn’t always incentivise hard work. The solutions to that are more complicated, but the research does suggest there is some unfairness in our tax system.”

Would he be doing anything about it, then? Not yet. “We made some commitments in 2020 around what we would do in this term of government around tax and around the tax system and I am honouring those commitments. I think it’s important that when you are looking at potential changes to the tax system that you have a mandate from the public for any changes that you want to make.”

Asked what the point of yesterday’s research was if it wasn’t going to trigger new policy, Hipkins very much left the door ajar for future announcements. “If you look at the research and analysis the government does across a range of areas on a day-to-day basis it doesn’t always lead to immediate decisions. Good, responsible governments build an evidence base for decision-making,” said Hipkins.

“That evidence base doesn’t always point to one decision, it can point to a range of options that governments have. The tax research does exactly that.” All parties, Labour included, would be able to use yesterday’s research as a jumping off point for election year policy, Hipkins signalled.

The prime minister was more open to teasing future tax changes that weren’t related specifically to wealth or capital gains. The current tax thresholds, for example, needed to be adjusted “from time to time”.

With roughly two weeks until budget day 2023, we already know that it will be “no frills”, a phrase coming to define Chris Hipkins’ approach to the top job. And while today’s speech included little to no detail on what more courageous changes could be implemented in the future, the explicit decision not to rule anything out gave us perhaps the biggest indication of what we might see in time for election day 2023.

Follow our politics podcast Gone By Lunchtime on Apple Podcasts, Spotify or your favourite podcast app.