The Reserve Bank followed through on a widely predicted double rates cut. As Stewart Sowman-Lund writes in this extract from The Bulletin, it’s just the beginning.

To receive The Bulletin in full each weekday, sign up here.

Victory in battle with inflation

The Reserve Bank has met expectations, opting yesterday afternoon to cut the official cash rate by 50 basis points instead of the typical 25. It brings the OCR down to 4.75%, explained RNZ, the lowest level since February last year. While there was no opportunity to hear directly from the Reserve Bank governor Adrian Orr, the Monetary Policy Committee said in a statement that it agreed the cut was “appropriate” in order to “achieve and maintain low and stable inflation, while seeking to avoid unnecessary instability in output, employment, interest rates, and the exchange rate”.

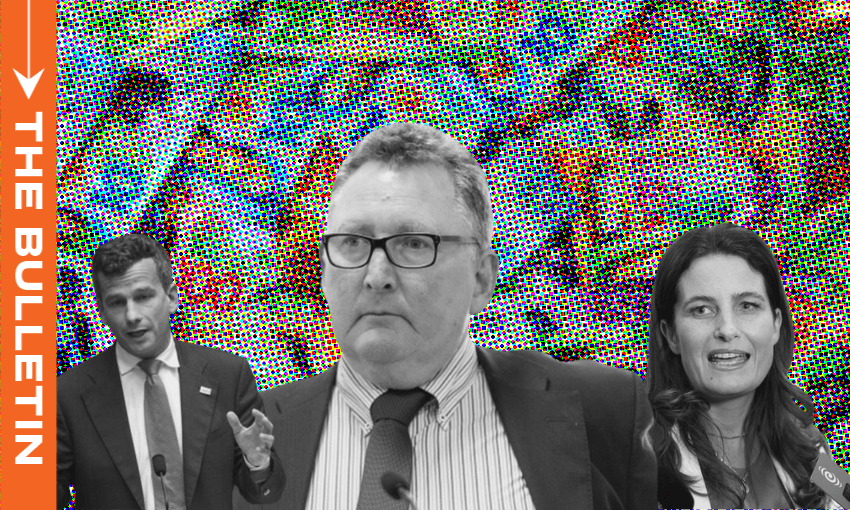

The decision was welcomed by the coalition government who, as is something of a tradition when it comes to positive economic news, took some of the credit. Speaking in Christchurch, finance minister Nicola Willis said the move was a “sign we’ve got inflation coming under control” and it would help boost confidence in the economy.

Yes. After a prolonged cost of living crisis, I am excited to see inflation coming under control and interest rates dropping.

— Nicola Willis (@NicolaWillisMP) October 9, 2024

Rapid rates drop

The Reserve Bank’s double whammy cut wasn’t a surprise. Last month, the US Federal Reserve opted to make a similar “jumbo cut”, which BNZ’s chief economist Mike Jones said could put “more pressure” on our central bank to take a heftier axe to interest rates. By last week, there was a general consensus among leading economists that a 50 basis point cut was the right call (Kiwibank even pre-emptively slashed its rates in a “marketing” move) though some acknowledged that the Reserve Bank may opt for a more cautious option. The most recent business survey by the NZ Institute of Economic Research appeared to be the catalyst for this, with overall confidence improving but “continued softness in economic activity”.

Writing for Interest earlier in the week, David Hargreaves described Adrian Orr’s approach as being “shoot on sight”, meaning that if he believed the cash rate should be hurriedly dropped, “then dropped in a big hurry it will be”. That’s precisely what has happened – and we could see things ramp up from here.

The response from mortgage holders has been almost instantaneous, reported The Post, while the New Zealand sharemarket surged 1.75%.

‘Brighter days ahead’

Back in May, before announcing her first budget, finance minister Nicola Willis evoked Florence + the Machine when describing the state of the economy. “It’s always darkest before the dawn,” she said, telling The Post’s Luke Malpass that “in all likelihood, the fiscals look worse next year than this year. And that’s just the reality of bad growth”. By the time we got to September’s official cash rate cut, the forecast had improved. “It is cloudy, but rays of light are getting through,” Willis said. Yesterday? “We are confident that brighter days are ahead.” In short, the government’s narrative appears to be that we are turning a corner when it comes to the cost of living crisis.

The Reserve Bank appears increasingly confident of that too, explained Interest’s Dan Brunskill. It believed that the forthcoming consumer price index release would show that annual inflation was comfortably within the 1-3% target range, and close to bang on 2%. In a follow up report, headlined “THE WAR IS OVER”, Brunskill declared that inflation had been “defeated”.

A dose of realism

So when might the sun, to borrow Willis’s weather metaphors, finally break through? Writing for the Herald (paywalled), Liam Dann explained that while yesterday’s announcement was already great news for borrowers (homeowners in particular), further cuts are likely. It’s widely pegged the Reserve Bank will slash a further 50 basis points off the official cash rate before the end of the year, as BusinessDesk’s Rebecca Howard (paywalled) explained. Some predict another double cut in early 2025, while Infometrics economist Brad Olsen said there was “real potential” for a 75 point cut this side of Christmas.

But throwing in a healthy dose of realism, Dann noted that while we can celebrate the end of the inflation battle, “we need to pinch ourselves and remember that central banks don’t deliver outsized cuts to interest rates unless the economy is in very bad shape”. Rising unemployment is one concern, while economist Craig Renney told the NBR (paywalled) that low income New Zealanders who rent “might not feel the benefits of an interest rate cut”.

Associate finance minister, and Act leader, David Seymour had similar critiques on the broader state of the economy and was quick to blame the Reserve Bank for the mess that he claimed was now being cleaned up. “A 50 basis-point cut is a multi-billion dollar mea culpa [on the Reserve Bank’s part],” Seymour said in a statement. “And the latest twist of a nauseating three-year fiscal and monetary roller coaster.”