The clock started on National’s first 100-day plan yesterday. Inflation data is out today and economists say a change of government will make very little difference to the country’s fiscal outlook, writes Anna Rawhiti-Connell in this excerpt from The Bulletin, The Spinoff’s morning news round-up. To receive The Bulletin in full each weekday, sign up here.

A country waits

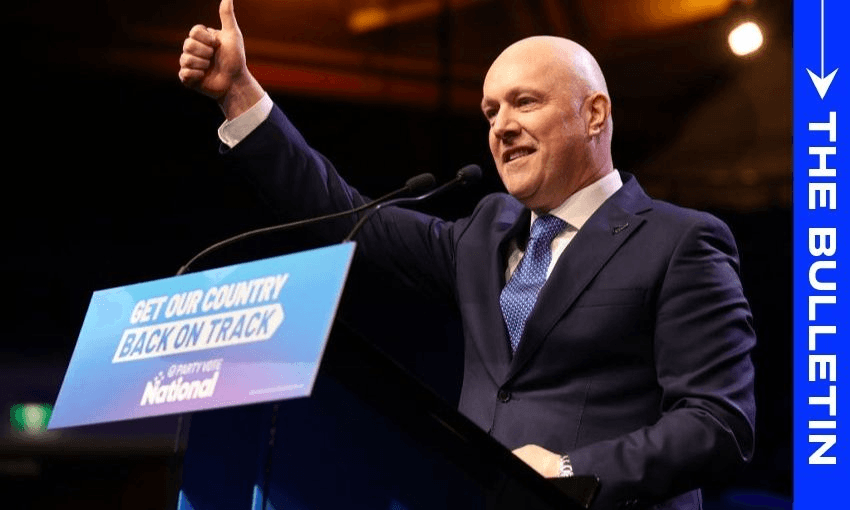

The country is now suspended in limbo as we await the final count of special votes. The vacuum is being filled by attempts to get Christopher Luxon to spill on the negotiation process and speculation about what’s on the table for Act and what NZ First is up to. For the latest on that, the Herald’s Thomas Coughlan has you covered. Luxon maintains that the process will not play out via the media. In my humble opinion, all rumours and suggestions about what might be in play should be taken with a grain of salt. This morning, Duncan Greive makes the case for a fast negotiation process and doing a deal with Winston Peters before special votes are counted. National, Act and NZ First all say the government’s books are in dangerous territory. “Don’t tell us you’re concerned – show us. A short, sharp, sensible negotiation maximises your useful time in power, and gets whatever your planned fix is in motion faster,” he writes.

‘Same sized milkshake, different flavour’

Onto the state of the government’s books. In a typically dry fashion, one I always find reassuring amid the fervour, economists have weighed in on what the change of government might mean for the country’s fiscal outlook. The quote of the day award goes to ANZ senior economist Miles Workman. In explaining the “on paper” assessment of the differences between the outgoing and incoming governments, Workman heads a section in his research note, “Same sized milkshake, different flavour.” BNZ’s head of research Stephen Toplis noted National’s promise to get the books under control faster than the current government but said, “We doubt that the incoming government will find it particularly easy to achieve its fiscal objectives. The economic cycle will be unhelpful, we are not convinced revenue will be as easy to come by as assumed, and it will be difficult to cut fiscal expenditure as anticipated”.

Fuel prices likely to keep inflation rate high

In case you’re wondering where the first 100-day plan comes from, it can be traced back to the presidency of Franklin D. Roosevelt. A top aide to President Obama once called it a “Hallmark Holiday”—lots of attention but no significance. With 99 days to go on National’s first 100-day plan, today’s economic scene-setter is the consumer price index data. Stats NZ will report that later today. As Susan Edmunds reports for Stuff, fuel prices are the main factor in assessments from economists about where the rate of inflation would land. I drove past queues of cars and what looked like a few near-collisions at a petrol station over the weekend offering a 25c p/l discount. Gareth Kiernan, chief forecaster at Infometrics, said he expected inflation to be up 2.5% in the quarter, and 6.4% for the year. That is up from an annual rate of 6% in the June quarter.

Last inflation data release before November OCR decision

As Catherine noted yesterday, there is excitement among the property sector about the incoming government. For anyone with a bog-standard one home, one mortgage lifestyle, today’s inflation data is important. As Kiwibank’s senior economist Mary Jo Vergara notes (paywalled), it’s the last release before the Reserve Bank’s (RBNZ) decision about the official cash rate in November. “The RBNZ has adopted a data-dependent approach. And where next week’s print will land will be key in deciding their next move.” There is still debate about whether the central bank will lift or maintain the rate, but most economists agree it’s certainly not headed downward for a while and that a hike is still on the cards. ANZ economist Henry Russell says, “It’s going to take a solid body of evidence to draw the [Monetary Policy] Committee back to the hiking table, naturally. But we do think that evidence will accrue; the question is one of timing.”