Net migration figures have bounced back fast and are being cited as a key factor in tomorrow’s OCR decision but is it a sustained trend or a spike, asks Anna Rawhiti-Connell in this excerpt from The Bulletin, The Spinoff’s morning news round-up. To receive The Bulletin in full each weekday, sign up here.

Treasury predicts a drop-off after spike

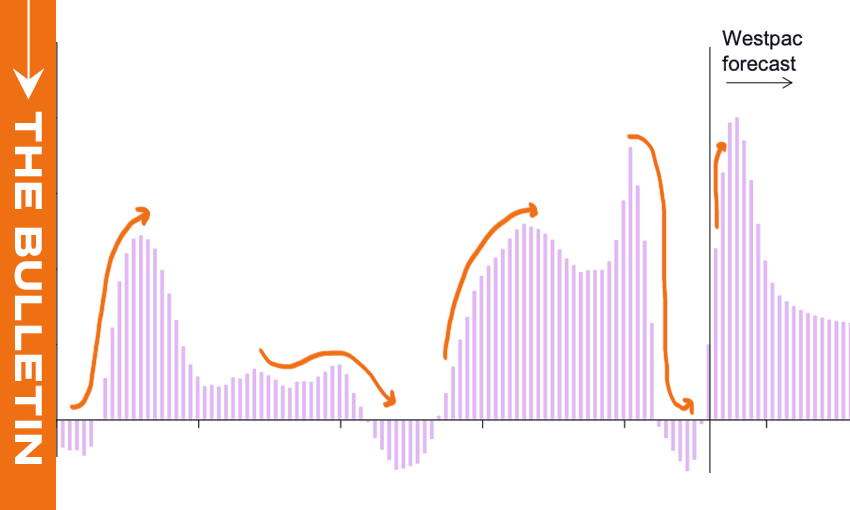

In the last 18 months, we’ve had the immigration reset, the immigration rebalance, the immigration u-turn and now, what appears to be the immigration resurgence. It’s almost enough to warrant an Eras-like tour but instead of Taylor Swift trying to find her mark on stage, it’s forecasters, economists, policy-makers and politicians trying to establish a mid-term view on exactly what might happen with net migration. Newsroom’s Jono Milne leans into the sense of befuddlement by asking “What the hell’s going on with migrant workers?” Milne points to the faster-than expected surge in net migration and the equally-as-fast fall Treasury is predicting. “The strange and short-lived spike in migrant workers has confounded the government and risks plunging the economy into a recession – just as Treasury had predicted we might avoid one,” he writes.

Is the spike really short-lived?

BusinessDesk’s Jem Traylen counters on Treasury’s predictions (paywalled) by noting that the figures used in the budget estimate of net migration are already out of date. As Traylen notes, the Treasury forecast “is the key economic variable underpinning the rest of their economic outlook, as well as gauging the demand for housing and public services.” Is the spike we’ve seen due to pent-up demand after border closures or will “the tight labour market mean demand for migrant labour is likely to be sustained at a much higher level for a lot longer?” Peter Wilson, one of the experts advising the Productivity Commission’s inquiry on immigration settings, told Traylen the last time migration crashed like Treasury is expecting it to in the next couple of months, is because we closed the border.

Disturbance in the force

Westpac economists are predicting that the Reserve Bank (RBNZ) will need to raise the Official Cash Rate (OCR) to as high as 6%. The RBNZ makes its next OCR announcement tomorrow. While acknowledging a lot of uncertainty, the economists say the surge in migration “has the potential to disturb the grand plan” the Reserve Bank has for reining in inflation. Westpac economists are forecasting a net inflow of 100,000 people over 2023, adding almost 2% to New Zealand’s population. That would be the fastest rate of population growth New Zealand has seen in decades.

Hail to the bus drivers

In a real world example of the see-sawing on immigration policy, and in news that will give commuters cause to cheer, 559 new bus drivers have been recruited and a return to full service is in sight. The government further loosened immigration settings in December, essentially obliterating any remnants of the great immigration reset or rebalance, and created a temporary residence pathway for bus and truck drivers. Bus drivers from the Philippines, India and Fiji have filled vacancies. Great for commuters and business, but the eternal question about what the population of this country should be and how we ensure growth is accounted for, remains unsettled. Paul Spoonley is calling for a government population statement, writing that “we need to know what population growth rates are sustainable and make sense alongside labour market supply needs, infrastructural provision and equity for New Zealand communities, immigrant or host.” Finally, and I think I can get away with saying this is tangentially related, the ratio of sheep to people in New Zealand has fallen below five to one for the first time since the 1850s according to Stats NZ’s Agricultural Production Census for 2022.