The government has found $4b to trim from the public service over the next four years and National reveals it will release its fully-costed tax policy this week, writes Anna Rawhiti-Connell in this excerpt from The Bulletin, The Spinoff’s morning news round-up. To receive The Bulletin in full each weekday, sign up here.

Public sector cuts and consultant spending to reduce

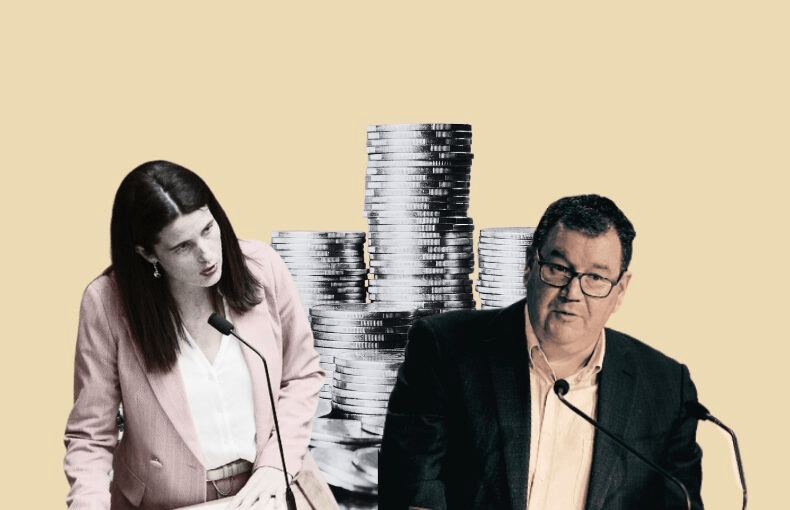

Some might call it cynical; some, the purview and privilege of an incumbent government. Yesterday the government announced that it has found $4b to trim from the public service over the next four years, on top of the $4b saved in the Budget 2023 in May. Finance minister Grant Robertson made the announcement yesterday, saying a “savings and efficiency exercise” was underway with government accounts for the 11 months to the end of May showing tax revenue $2b below forecast. Contractor and consultant spending will be reduced and public sector agencies have been directed to trim one or two percent off their existing baselines. Here’s a breakdown of where savings will come from and where cuts will be made. The news was greeted with a “too little, too late” by the National party.

PREFU preparation amid slowing growth

The move comes ahead of the pre-election opening of the books, or Pre-election Economic and Fiscal Update (PREFU) on September 12. interest.co.nz’s Dan Brunskill writes that “deeper deficits were likely to be revealed in the PREFU that could show Labour failing to meet its own fiscal rules. To prevent that from happening, finance minister Grant Robertson has searched for savings that can be baked into the PREFU numbers and get the Crown accounts back into surplus.” As Tom Pullar-Strecker and Luke Malpass report in The Post this morning, the International Monetary Fund (IMF) is predicting that New Zealand’s economic growth rate in 2024 will be the lowest in the Asia Pacific region and amongst the lowest in the world next year. As an aside, the IMF aren’t fans of Labour’s policy to cut GST on fruit and vegetable and once again requested that we revive the notion of a capital gains tax.

Will this affect National’s plans?

The announcement is potentially something of a double-edged sword for National’s financial spokesperson Nicola Willis. On one hand, it proves that a line of questioning in the House on August 3 from Willis about directives to government departments to save money was not off the mark but, as the Herald’s Thomas Coughlan writes (paywalled), the “exercise shows Robertson using all the perks of incumbency to lay the path ahead with landmines”. Coughlan cites the party’s plan to trim consultant spending to fund its childcare tax credit policy as an example of Robertson robbing National of a potential campaign promise. Brunskill’s report also reveals details of National’s tax policy, which Willis has said will be revealed this week, apparently before Saturday, freeing up fiscal nerds to enjoy their lives, unchained from the shackles of what’s felt like unending speculation. Willis has already said the policy is “fully funded” and “will not require funding from future operating allowances or debt funding”. There’s been some speculation (paywalled) that a carbon dividend paid to households could be involved. That’s money from the Emissions Trading Scheme that’s currently funnelled into climate change projects.

Up the Wahs?

With all the tax and PREFU talk, let’s end with yesterday’s post-cabinet press conference, the last before the House rises on Thursday and the 53rd parliament is adjourned. The prime minister’s last utterance from the podium before signing off? Responding “Why not?” when asked if he’d front a video with Christopher Luxon saying “Up the Wahs” if the Warriors make the NRL grand final. That followed questioning about whether the correct catchcry for supporters was “Up the Wahs” or “Let’s gone Warriors”. Apparently, Hipkins isn’t an avid league fan (paywalled) and hedged his bets answering that.