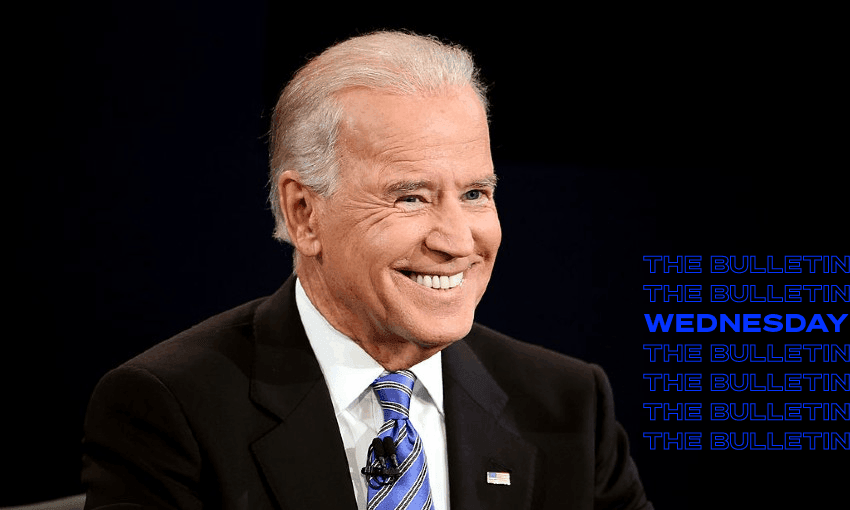

Following US president Joe Biden’s announcement about forgiving student debt, the debate about doing the same in New Zealand has fired up again, writes Anna Rawhiti-Connell in The Bulletin.

US announcement restarts debate in New Zealand

US president Joe Biden announced last week that he was cancelling billions of dollars of student loans. Naturally it has also reinvigorated debate about whether New Zealand should follow suit. I also imagine nurses and midwives are looking to Australia with envy as their counterparts in Victoria will now have their university fees paid off by the Victorian government. I don’t think this is currently a live political issue for the main parties, although the Greens campaigned on some student loan policy change in 2020. We seem to have just accepted student loans as a given.

Student loan impact on ability to get home loan

As evidence points to life being financially horrible for Gen Z and millennials, perhaps it should be something we discuss more. I was always told that your student loan didn’t matter when it came to getting a home loan. Terrible advice. I asked David Cunningham, CEO of mortgage broker Squirrel about this yesterday. He said anyone looking to maximise their ability to borrow will be hampered by their student loans, but hopefully their income is higher from having a qualification. I also asked about the impact of recent interest rate rises. Cunningham said the “assessment rate” of 7.5% to 8% all banks use to assess affordability on a loan aren’t impacted by the student loan per se, but because the assessment rates have risen, that reduces the amount a customer can borrow. Your student loan repayments are also considered an expense.

Rather see nurses get a pay rise than wipe student debt

Speaking to Stuff’s Rob Stock about whether we should follow in the US’s footsteps, economist Brad Olsen doesn’t see a need to. He’d rather see nurses get a pay rise. The NZ Initiative has recently said interest should be reintroduced on new student loans, arguing that it would free up money for students who have a greater need for financial support. Jack Tame doesn’t think tertiary education should be free as education is an investment for an individual. As a case for free tertiary education, chief justice Dame Helen Winklemann’s comments in 2019 about the relationship between the socio-economic diversity among New Zealand’s current crop of judges and free education in the 70s and 80s, have stuck with me.

Student loan forgiveness as compensation for unfairness of GST

The Bay of Plenty Times’ Jo Raphael (paywalled) writes that having student debt impacts major life decisions including whether or not you should have children or stay in New Zealand. Spokesperson for Child Poverty Action group Susan St John has just written a very critical assessment of our current tax system saying an overhaul of our low-rate broad-base tax system would go a long way to addressing our huge wealth gap. St John’s argument is centred around the unfairness of GST and she suggests that student loan forgiveness is one way to compensate for that unfairness among low-income adults without children.“These must not be viewed as handouts, but recognised as the price to be paid for our simple but regressive tax system.”