House price inflation has already blown through the forecasts put out by the Reserve Bank and Treasury last week. Buyers and voters have stopped believing all the warnings about potential house price falls and higher interest rates, writes Bernard Hickey.

This story was originally published in Bernard Hickey’s email newsletter The Kākā and is republished with permission.

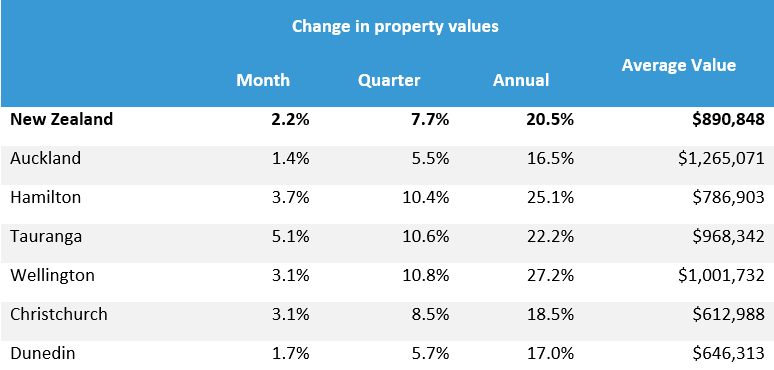

CoreLogic reported last night house value inflation nationally of 7.7% in the three months to the end of May, despite the March 1 reimposition of LVR restrictions, the shock announcement on March 23 tax deductibility removal for landlords’ existing homes and the May 1 increase in deposit requirements for landlord buyers of existing homes to 40% from 30%.

I spoke to CoreLogic’s Head of Research Nick Goodall last night and he said the initial signs were still stronger than implied in Treasury’s forecast on May 21 of annual house price inflation slowing to 0.9% by the middle of next year and in the Reserve Bank’s forecast last week of inflation slowing to 0.4% by June 2022.

Even in the last three months, house price inflation is already running much hotter than the Reserve Bank and Treasury have forecast. Just last week, the Reserve Bank saw house price inflation of 5.5% in the June quarter. That inflation has already been achieved with a third of the quarter yet to go.

So far, the CoreLogic index has risen 5.6% since the end of March, 15% since the late November announcements from finance minister Grant Robertson of a “demand and supply policy reset” and the imposition of a sustainable house prices mandate on the Reserve Bank. They are up 23% since the arrival of Covid-19. The value of the housing market has risen by $278b to $1.5 trillion since the start of Covid.

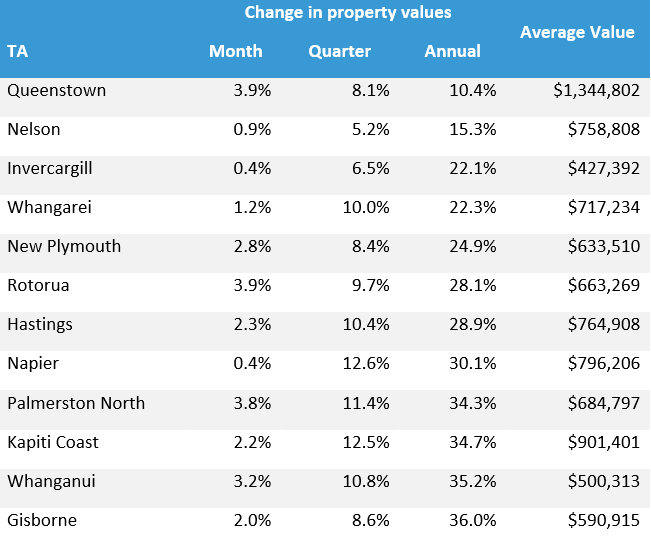

The numbers continue to astonish. Wellington’s average house value rose over $1m for the first time in May and was up 27% from a year ago. Annual house price inflation in Napier, Palmerston North, Kāpiti Coast, Whanganui and Gisborne were all over 30%. Values in Wairoa were up 52.4% from a year ago.

‘We don’t believe you any more’

Home buyers, be they first home buyers or landlords, simply don’t believe either the Reserve Bank or the government any more when they say they’re serious about making house prices affordable, or warn that buyers might be over-extending themselves or be burnt by a rise in interest rates. Central bank governors and finance ministers have cried wolf too many times over the last decade to be believable.

The voting and home buying/renting public have seen what the Reserve Bank and the government have actually done and not done over the last decade and have stopped believing the forecasts or the reassurances. They saw the Reserve Bank and the government act in March last year to ensure the protection of the housing market, which is now not only too big to fail but is the only tool for the Reserve Bank and government to stimulate the economy and reassure nervous median voters and small businesses in a crisis.

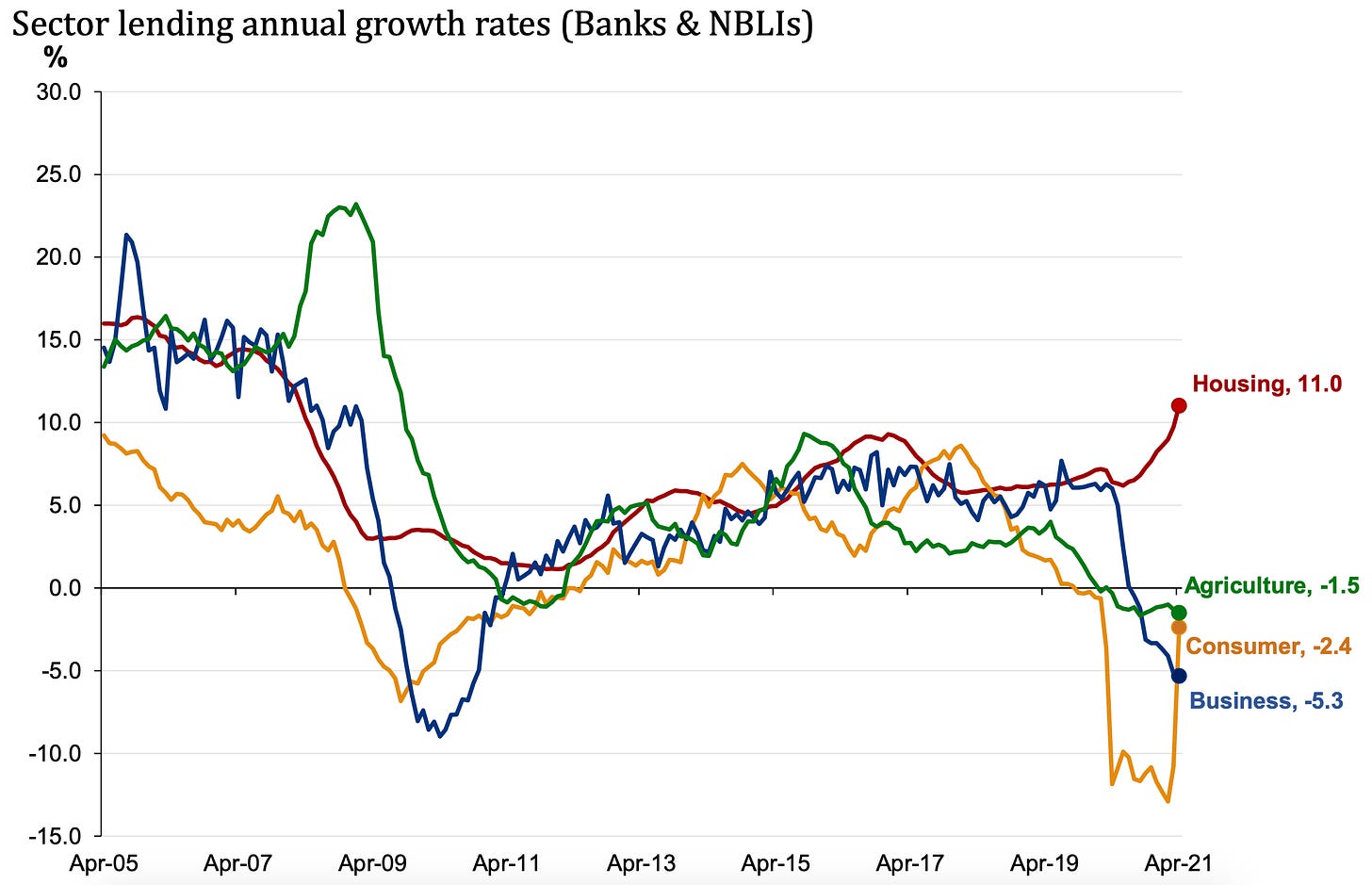

The Reserve Bank slashed interest rates and promised to print $100b to boost the wealth effect of the housing market on consumers and businesses. It removed the bank restrictions on lending and then created a scheme to lend to banks at 0.25% so they could further boost housing market values. It also delayed the introduction of tougher capital requirements to ensure banks kept lending into the housing market. Reserve Bank stats show banks have lent an extra $21b into the housing market since the first lockdown.

Voters and buyers have seen the continued refusal of councils and the government to use their balance sheets to properly fund the housing and transport infrastructure needed to build the 500,000 houses needed to deliver the supply shock that would make house prices affordable. They saw the prime minister promise never to introduce a capital gains tax in her political lifetime and promise not to tax wealth at the last election.

Boosting housing’s wealth effect is a feature, not a bug

Understandably, home buyers have stopped believing the “grown-ups” when they say house prices could fall and that buyers and investors should abandon their “silly fear of missing out” approach to the housing market. There have been so many times in the last decade when it seemed prices were totally crazy, out of whack and unsustainable, and yet rose another 20% or 50% or 100% within a few months, years or a decade.

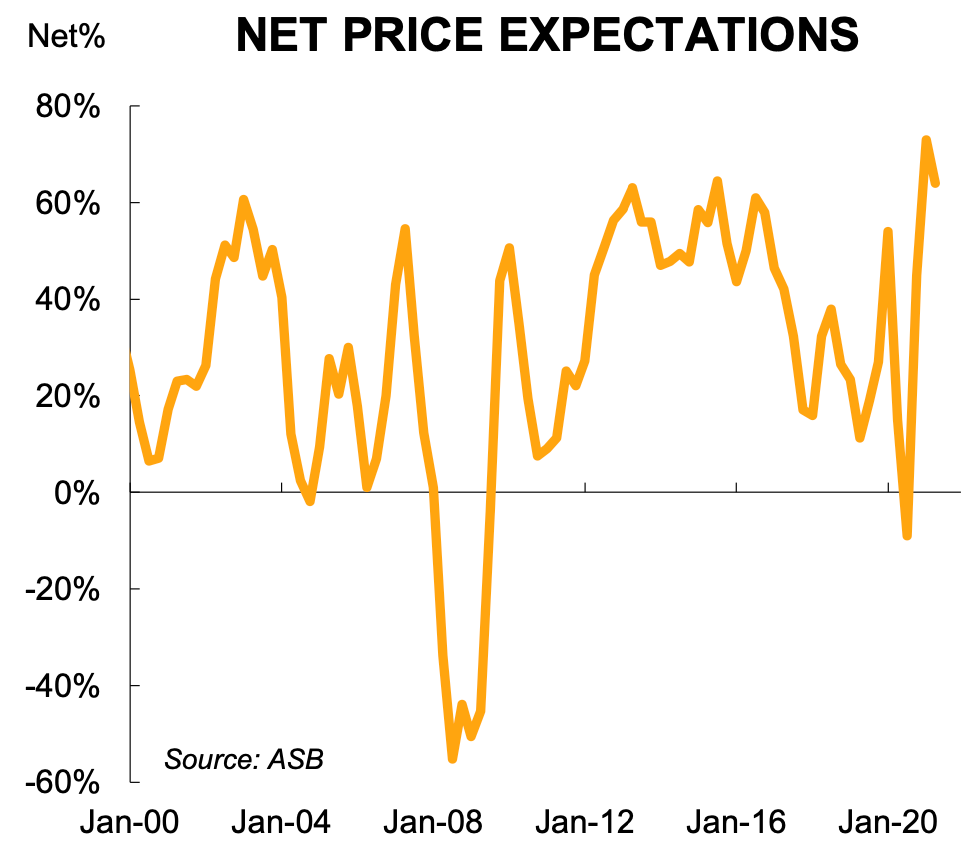

As this ASB survey from last week shows, a net 64% of those surveyed expect house prices to rise over the next year and only once in the last two decades have those expectations wobbled. It turns out the voting and home-buying public were a much more accurate forecaster of the housing market than the Reserve Bank and the Treasury.

Follow When the Facts Change, Bernard Hickey’s essential weekly guide to the intersection of economics, politics and business on Apple Podcasts, Spotify or your favourite podcast provider.