Managing your money isn’t all about Excel sheets and financial diaries. Here are just a few apps we recommend to help you on your way.

Money Lover

This probably sounds bizarre, but there’s something oddly therapeutic about monitoring your money with an expense tracking app. Not only does it help keep how much you’re spending in a day/week at the forefront of your mind, but it also offers a small sense of security in knowing exactly how much of your money goes in and out.

As a result, I’ve tried a lot of expense tracking apps over the years, and Money Lover happens to be the one I’ve stuck to the most. It’s got a clean and intuitive user interface which means logging purchases takes about as much time as it takes to check your email/Twitter feed/Instagram likes. These transactions can be sorted into categories like bills, shopping and petrol which is great since you can see exactly where your money’s going in one fell swoop. And if you think you’re spending too much on a certain area like food or groceries, you can, for example, set up a limit which alerts you when you’re getting close to overspending.

An important part of any good expense tracker is also having the ability to set up recurring transactions – you don’t want to be stuck logging the same old transactions you know are going to happen every week, like rent and salary. There are also some pretty cool features like travel mode which allows you to distinguish holiday spending from regular spending in any currency you like. Best of all? It’s free, so unless you decide to upgrade to premium, Money Lover won’t cost you a cent. / Jihee Junn, staff writer at The Spinoff

CashNav

If manually tracking expenses isn’t really your thing, you’ll be pleased to know more and more banks are offering tools that automatically track spending based on transactions from your bank account. As a Westpac customer, I use CashNav, which is a pretty nifty tool that tells you how much you’re spending on a pretty accurate level. After all, most of my purchases either go through my card or online banking, so the fact that CashNav logs all these transactions automatically is great for when manual tracking just isn’t an option.

CashNav isn’t perfect (for example, it’s automatic categorisation is occasionally wrong) but it’s great for identifying big picture trends as it shows how much you spend in a typical month. So if you’re a Westpac customer and you’re not using CashNav, what are you waiting for? And if you’re not with Westpac, it’s worth finding out if your bank offers something similar (eg: ASB’s Track My Spending). / JJ

You Need A Budget

Since discovering You Need A Budget around August last year, it’s transformed my finances and brought peace and control into the insane world of my bank accounts. As a full-time freelancer for the past six years, I’ve had to get used to having thousands pile into my account on the 20th of one month, then having an eight-week dry spell while I write new stories and invoices work their way through the system. I never put enough away for taxes and bills, so I’d get awful frights when they came in – not fun.

YNAB is a cheerful but deceptively powerful web-based app that uses the envelope system to help you understand exactly how much money you have and don’t have. Instead of showing you what you’ve spent in the past like so many personal finance apps, it helps you see where you need to put money for the future, and to get you to the point where you have at least 30 days’ funds sitting in your bank so you’re living ahead of your money and bills, rather than behind them. It forces you to plan for those “surprises” that aren’t really surprises, such as car maintenance, the dentist, and the insurance bill (of course, this only works if you actually have enough money to cover all this stuff, so PAY YOUR WORKERS MORE AND FIX THE HOUSING CRISIS).

YNAB took me a few goes to get started and a lot of getting used to, but now it’s a daily habit to update the app and reprioritise my precious pennies based on whatever bill disaster has lately befallen me.

When I use it I always think of that David Copperfield quote: “Annual income twenty pounds, annual expenditure nineteen nineteen six, result happiness. Annual income twenty pounds, annual expenditure twenty pounds nought and six, result misery.” YNAB has drilled that into me. / Naomi Arnold, freelance journalist

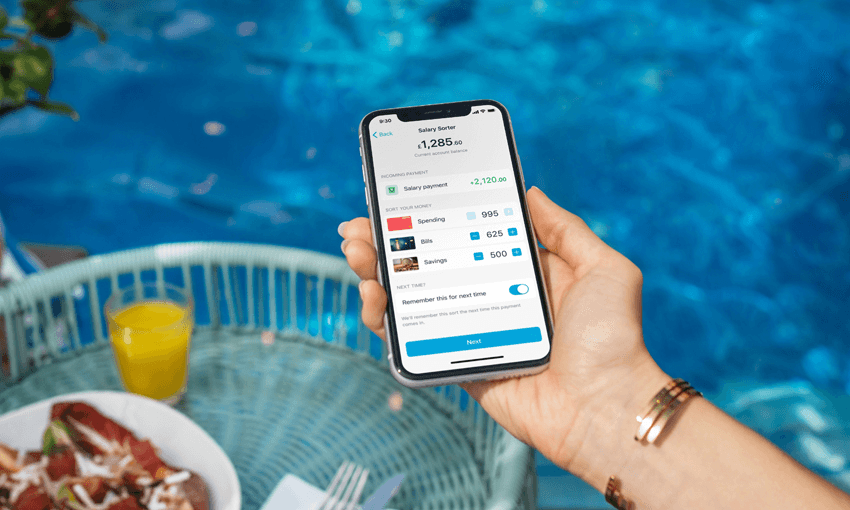

Monzo

I’ve never used a cash passport card/specialised travel card or credit card for travel and probably never will. Too many fees, too hard – blergh.

Monzo is a UK banking app that’s recently moved to the US as well. There are no actual banks, just a freakishly bright orange card and a very user-friendly app. If you’re one of the zillions of Kiwis living in the UK, or you’re visiting the country for a while and have an address you can get the card sent to, you can join.

You can use the card in any country, at any place that accepts Mastercard without paying a cent in fees. If you want to get cash out, you can do that for free in the 38 countries in the European Economic Area. Outside of the EEA, you can still get £200 ($400NZD) out per month, with no fees. How good? Very good.

With that said, if you’re just wanting to set a savings goal and stick to it, you don’t really need a specialised app. With some creative license you can use your normal banking app as a very effective savings tool. Decide what you want to save for, make a separate account, give it a picture if you can, and a name, ideally with the words !!!DO NOT TOUCH, YOU IDIOT!!! included. Make it a long term savings account, which will likely whack a penalty fee on every time you touch it – there’s really nothing like crushing guilt to improve your budgeting. / Kristin Hall, TVNZ reporter