In return for access to the upper end of our property market, foreigners will be taxed 15% on housing purchases here. But how much will NZ really make from the end of the foreign buyers ban, asks Catherine McGregor in this excerpt from The Bulletin, The Spinoff’s morning news round-up. To receive The Bulletin in full each weekday, sign up here.

A plan to attract cashed-up foreign home buyers

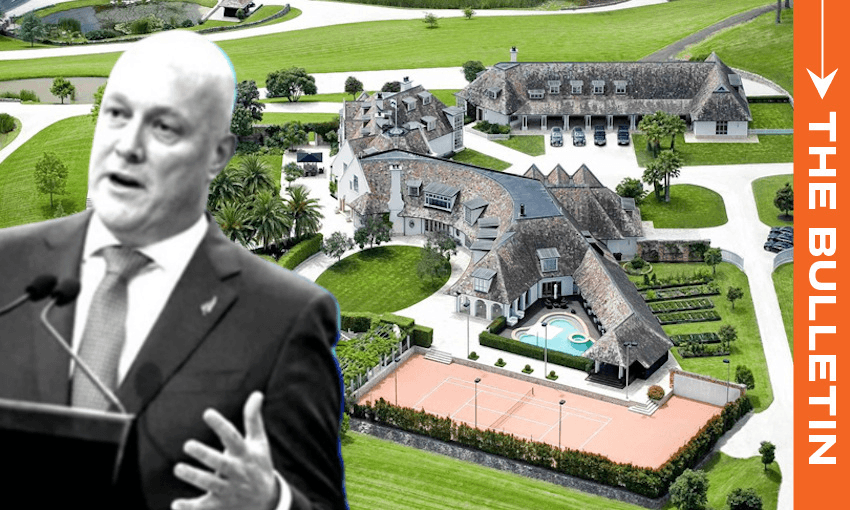

It’s rare that The Bulletin covers a topic three days running, but National’s tax plan is meaty enough – and controversial enough – to warrant it. Yesterday the media focus turned to a specific policy within the plan: axing the foreign buyers ban on homes over $2 million and requiring non-NZ purchasers to pay a 15% tax on those homes. According to CoreLogic, there are currently around 50,000 New Zealand homes valued at $2m or more, making up around 3% of New Zealand’s 1.7 million properties. That’s 3% nationally; the story is quite different in more expensive markets like Auckland and Queenstown where, respectively, around 15% and 11% of homes would be available to foreign buyers, Stuff’s Geraden Cann reports. The foreign buyers ban, introduced by the Labour government in 2018, prohibits the sale of existing homes to non-NZ residents. Reversing the ban and bringing the bright line test down to only two years could make New Zealand very attractive to foreigners looking to “park wealth” somewhere, says CoreLogic’s Nick Goodall, “even with the 15% tax on the purchase”.

Do National’s numbers add up?

Ah yes, the 15% tax. National says it expects it to bring in $740m each year, which would require $4.9b worth of annual sales to foreign buyers. That figure has left some experts scratching their heads. As Ben Leahy notes in the NZ Herald, $4.9b represents around half of all homes sold for more than $2m last year. National hasn’t released details on how it came up with $740m a year, though leader Christopher Luxon says the party is “rock solid on our numbers”. Still, given that only 3% of all house sales across New Zealand typically involved foreign buyers prior to the ban, it’s challenging to see how the numbers work. Ironically enough, in 2018 Amy Adams, National’s finance spokesperson at the time, cited the low number of foreign buyers as a reason why the ban was unnecessary. Another spanner in the works could be the text of our tax treaties with nations including China, reports Glen McConnell for Stuff. “Non-discrimination” articles in these treaties prevent non-residents from being taxed in a way that is “more burdensome” than for New Zealand residents. For the 15% tax to go into effect these treaties would need to be renegotiated or otherwise resolved, says tax lawyer Brendan Brown.

The debate over whether foreign buyers help or hurt the economy

Then there’s the question of what the return of foreign buyers would do to house prices and the wider economy. Luxury real estate agent Ollie Wall tells Leahy that wealthy foreigners bring more investment to NZ – “You give people a taste of this country … they see what it’s all about and then they spend more time and more money here” – but Infometrics economist Brad Olsen says he hasn’t seen any evidence that foreign buyers bring large investments with them. What has been studied is the effect of foreign buyer bans and taxes on the wider property market. In formulating the policy, National referenced the work of US researchers who found that foreign buyer taxes passed in big Canadian and Australian cities had “significantly negative and persistent effects” on house prices, Cann writes. “New Zealand’s ban on foreign buyers, for existing housing, had no statistically significant effect on house price growth.”

Landlords welcome investor-friendly tax policies

There are two other big property-focused pledges in National’s tax plan: bringing the bright line test down to just two years, and reinstating mortgage interest deductibility for landlords. Both policies should make property investment more attractive, which National believes will be good news for renters. Others, like University of Auckland property lecturer Michael Rehm, say the policies will help reinflate a property bubble that has only recently floated back down to earth. Property investors are welcoming the potential return of the tax breaks after a tough couple of years in the market, but Renters United’s Geordie Rogers tells Morning Report people relying on interest deductibility to survive should not be in the business in the first place.