Improving the Māori economy by increasing capital supply could lead to a ‘paradigm shift’, say the group developing the new fund – which in turn could address the social disparities experienced by tangata whenua.

Mana motuhake looks different to different people. For some, it’s living in the bush, wearing nothing but a dog skin cloak and eating food from the land or sea. For others, like my uncles in Te Hiku, it’s issuing their own car warrants and refusing to pay taxes. Some people refuse to give their kids birth certificates and tax numbers. Others want a Māori parliament, or even a Māori-owned bank.

The Māori economy is currently valued at $92bn in assets and that number is expected to grow to $100bn by 2030. However, many Māori find it hard to get money when they need to borrow, whether it’s for building homes or businesses. Tangata whenua make up 17% of our population, but earn less than 9% of our nation’s income. This translates into average levels of GDP per capita – a measure of average income – that are more than 50% lower for Māori compared to the rest of the population.

This income gap translates into a range of large socioeconomic disparities for Māori compared to the rest of the population. These include lower rates of savings and home ownership, greater financial hardship, and relatively poor health and education outcomes.

It’s not something there’s an easy fix for, but one initiative is the creation of a Māori-owned sovereign wealth fund, similar to the NZ Super Fund, designed to generate long-term returns from investments in assets like stocks and real estate. Rauawa was established by the National Iwi Chairs Forum (NCIF) in 2023 to manage investment opportunities and improve capital access, aiming for systemic changes, Māori accountability and sustainable asset management. This community-driven fund, hoped to be operational as early as 2030 and no later than 2035, would be managed by Māori entities, and focus on sustainable investments aligned with Māori values. The overall goal is improving Māori life expectancy and quality of life by 2040.

“It’s a paradigm shift,” says June McCabe, lead on Māori access to capital for Pou Tahua, the economic pou (pillar) of NCIF. “It’s about our own paradigm and ourselves, let alone the institutions that exist currently and their paradigm shift.”

While the exact structure of the fund is still being developed, McCabe says it would operate according to its own tikanga, while still meeting regulatory requirements. The idea is for a tikanga-based and led fund backed by lenders interested in increasing capital supply to borrowers and focused on making measurable improvements to Māori social determinants, with a 100-year future outlook. It’s about eliminating a need for Māori enterprise to depend on the Crown, creating an enduring Māori asset class in the capital markets and aligning the supply and demand of capital in a sustainable way.

Currently, New Zealand’s four largest banks – ANZ Bank New Zealand, ASB Bank, Bank of New Zealand and Westpac New Zealand – are all owned by Australia’s “big four” banks. They’ve come under the spotlight in recent times for making record profits amid tough economic conditions. Combined with growing difficulties with access to capital and stunted economic growth, it’s easy to see why the Commerce Commission has launched an investigation into the sector, alongside finance minister Nicola Willis calling for a select committee inquiry into banking competition.

“They’re not taking risks. They put the risk somewhere else. That’s how banks operate,” McCabe says.

Historic Māori banking and financial services

Of course, where it’s difficult for non-Māori, it’s generally even more difficult for Māori. The finance sector and access to capital is no exception.

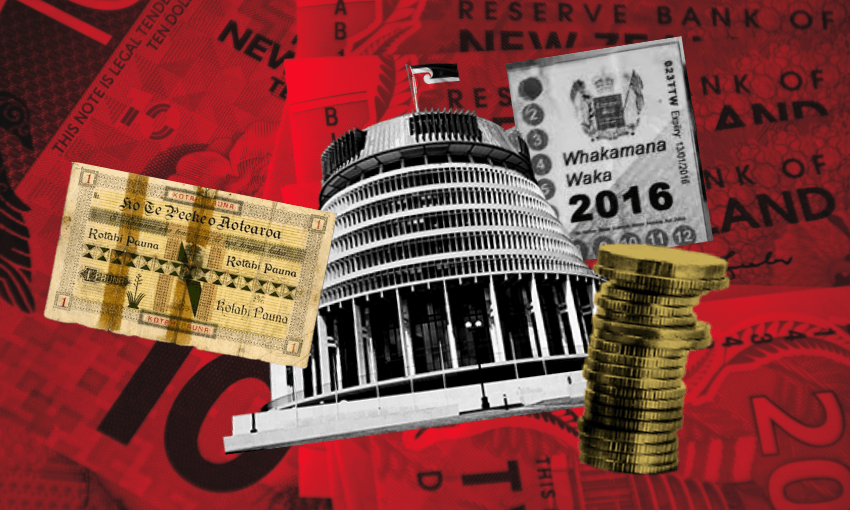

The colonial system of banking and finance was a key instrument in the colonisation of Aotearoa. Prior to the arrival of the British, Māori used a barter-based system where value was placed on useful resources such as pounamu or flax. Almost overnight, the introduction of a coin and paper-based economy, as well as the systematic alienation and removal of value from Māori land – in a western sense – decimated the value of Māori resources.

“Māori went from having assets and resources to trade to having not much at all. The value of the goods being traded by Māori was treated as being worthless,” says Matt Tukaki, chair of the Māori economic, social and environmental advocacy organisation the National Māori Authority.

However, Māori are not the type to sit back and watch things happen. Rather, Kīngi Tāwhiao decided to establish Te Peeke o Aotearoa in 1886, an exclusively Māori alternative to prevailing colonial financial institutions. The bank provided retail functions including deposits, chequing, note issue, and lending facilities. Te Peeke o Aotearoa operated until as late as 1905, where Tukaki says it became a victim of its inability to operate at scale.

“The other problem with growing to scale was it was happening at the same time that other banks were also scaling up in New Zealand and taking advantage of things like the gold rush in Otago,” Tukaki says.

The downfall of Te Peeke o Aotearoa was symptomatic of the ongoing colonisation of New Zealand’s financial system and siphoning of wealth from Māori to Pākehā through colonial instruments designed to do so. To this day, the effects of the introduction of colonial financial systems continue to detrimentally impact Māori outcomes and wellbeing, both financially and otherwise.

Current reality

Money isn’t everything, but it certainly helps. Without fair access to capital or resources, a majority of Māori have remained trapped in the poverty cycle for generations. Social deprivation leads to poorer outcomes for Māori. The gap between Māori and non-Māori life expectancy at birth was 7.5 years for males and 7.3 years for females in 2017-2019. Average annual household income in June 2022 was $55,446 for European families and $46,579 for Māori, a difference of $8,867.

The Iwi Chairs Forum estimates the economic impact and associated expenses resulting from social deprivation experienced by Māori to be around $8 billion per annum. This figure includes the financial burden on society and the economy due to the multifaceted consequences of social deprivation among the Māori population: healthcare, welfare payments, lost productivity, educational underachievement, crime and justice, housing, and social services. Around $1.6bn of this figure is paid out in cash every year.

“If we improve the Māori economy, then every 10% change in the level of deprivation is worth $160 million in cash,” McCabe says.

Research into Māori access to capital released by the Reserve Bank of New Zealand in 2022 found Māori are under-represented in business ownership. Only 8% of companies have at least one Māori shareholder or director, despite Māori making up 17% of the population. Māori businesses also face higher funding costs than non-Māori businesses, due to higher debt ratios, less debt funding from shareholders, slightly lower productivity, and a tendency to operate with negative equity, often due to the younger age of Māori business owners. Information asymmetry, or gaps in investors’ understanding, and costly credit enhancements, used to reduce the credit risk to the investors, are two of the major barriers for Māori when it comes to lending.

However, Māori access to capital is part of a changing dynamic of resource allocation in Aotearoa, due in large to treaty settlements. Although the fiscal envelope for treaty settlements was originally set at $1bn, the value of total redress now sits between $2.4bn to $2.5bn. The value of assets under control of the 10 largest post-settlement entities is approximately $8.1bn. These entities take a holistic approach to their diversified investment portfolios but there is some difficulty in ensuring the money trickles down to all Māori.

“We need to be smart about readiness because the flow of capital, if it was on stream today, it wouldn’t be able to go anywhere,” says McCabe.

Banks have a major role to play in addressing the inequalities within the country’s financial systems and after 180 years, they’re finally beginning to make the changes needed. In 2021, Māori leaders from the banking sector established the first Māori bankers rōpū, known as Tāwhia. Banks have begun to relax lending criteria for Māori, particularly on Māori whenua, and reduce information asymmetry or the knowledge gap that exists between banks and Māori borrowers. However, issues around access to capital for Māori persist.

“We have policies that support better outcomes for Māori by lending on whenua Māori. We also have a Māori banking team that can support Māori with access to capital, access to finance, pathways to home ownership, etc,” says Anthony Ririnui, national manager of Māori banking services for ASB Bank.

The way forward

Given the historical context of colonial efforts to undermine the economic foundations of iwi and hapū, Te Peeke o Aotearoa served as a way to centralise iwi wealth and facilitate its distribution. Over time, there have been persistent calls for the establishment of a Māori-owned bank, reflecting a continued desire for economic self-determination and financial sovereignty.

The Māori economy contributes $23bn to GDP and is expected to grow significantly, with $40bn in acceleration capital, particularly through enhanced Māori land and agrifood production. But coordinated efforts and integrated investment solutions are crucial for achieving these goals.

“I see a more inclusive banking system that is supporting the wellbeing of our people,” Ririnui says when asked about the future of Māori banking.

Advocates such as Tukaki argue a Māori-owned bank would help to eliminate the issues Māori face around access to capital and lending. But McCabe says Māori don’t have the need nor the capacity to buy or operate a bank. Instead, she says the focus should be on shifting the paradigm when it comes to capital supply for Māori economic development.

“There is an opportunity to empower ourselves.”

The key is ensuring the flow of capital goes beyond the initial lenders and trickles down the supply chain to all Māori. The current difficulty with this idea, McCabe says, sits on the demand side, with a lack of Māori capacity and readiness to receive the funds. It’s a chicken and egg scenario.

“The PGF (Provincial Growth Fund) had $3bn and a significant sum for Māori, but we don’t know how much of that actually translated into Māori economic development,” says McCabe.

By establishing credit systems outside the legal-financial infrastructure of the coloniser, Te Peeke o Aotearoa aimed to give Māori back their financial independence. It was a powerful symbolic assertion of rangatiratanga that reminded Pākehā of the right of Māori, as tangata whenua and as guaranteed by the Te Tiriti o Waitangi, to self-determination. The concept of a sovereign Māori wealth fund extends on the idea and purpose behind Te Peeke, and has the potential to enable a major shift in power.

This is Public Interest Journalism funded by NZ On Air.