Unless you have to sell now, your fears about negative equity are probably overblown, writes Bernard Hickey.

This is an edited version of an article first published on Bernard Hickey’s newsletter The Kākā.

TL:DR: Unexpected situations are naturally unnerving, but it’s worth taking a closer look to see if they’re really as dangerous as they seem at first glance. A whole generation of home buyers are seeing commentary about negative equity for the first time and some are spooked.

They needn’t be, unless they’re a couple who have just bought and are just getting divorced, or one of them has just died. In those cases, negative equity won’t be their biggest problem, or much of a problem at all. Everyone should just chill a bit on negative equity. It is renters with children who are in the worst financial stress right now.

*

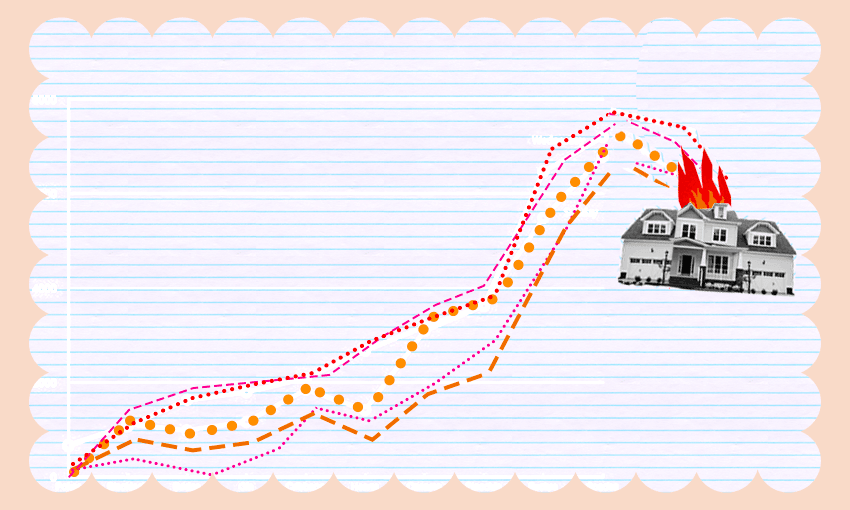

The Reserve Bank’s updated forecast last week of a peak-to-trough fall in house prices of as much as 20% seems to have unnerved a new generation of home buyers who never thought such a fall possible, and certainly haven’t seen one in their lifetimes. Nominal house prices fell as much as 10% in 2008/09 in the Global Financial Crisis so the likely double-digit fall — albeit after a 45% rise in the previous 18 months — has a few people shaken. They shouldn’t be.

Follow Bernard Hickey’s When the Facts Change on Apple Podcasts, Spotify or your favourite podcast provider.

This morning Stuff’s Geraden Cann published a story about people in negative equity after a 20% fall in house prices. It’s a useful read and not sensational at all, but the headlines from the last few days seemed to have caused a few of us to flick nervously to the real-time house valuation sites such as homes.co.nz. I was even called on to talk about it this morning on Breakfast on 1News. The assumption was the news would not be good. You can hear the tone of surprise in Jenny-May Clarkson’s voice at my responses in the clip.

The short version of my view is that barely anyone will ever have to sell and realise a complete loss in their equity, let alone force the bank to realise a loss. And when I say barely anyone, I mean the actual number of first-home-buying couples who will lose their entire life savings in the deposits they put into their homes will be lucky to get into double digits, let alone triple digits. And the main reason for that loss will have nothing to do with the housing market itself. Let me explain.

Really? Aren’t they mortgaged to the hilt?

Only first-home buyers forced to sell because of a divorce or death might get into trouble, and even then there will be a relatively short window of time for them to get into that trouble and for the bank to force a mortgagee sale. That’s because prices in the “bleeding-edge” markets such as Auckland City and Wellington City will be well into rebound mode within the next year, in my view.

Banks here also have no need or desire to do what American or Irish or Spanish banks were forced to do during the Global Financial Crisis. Faced with being stuck with debt that could not be serviced because of unemployment, and fearing even bigger house price falls that could destroy what was left of their almost non-existent equity reserves, those banks forced mortgagee sales on those in negative equity with mortgages they could not service.

Here in Aotearoa-NZ, our banks now have twice as much equity in reserve as they did in 2008/09, and around four times more than those US, Irish and Spanish banks had in 2008/09. Also, unemployment here is 3.3%, not the levels near or over 10% seen in those other markets back in the GFC.

Hang on a minute. Doesn’t a 20% fall in prices mean carnage?

If you doubt that less than 10 people might be forced out of their homes having lost their deposit, it’s worth showing the figures on the numbers of borrowers in trouble now, how many could find themselves in negative equity, and how many could be in the sad and unusual position of getting divorced or dying in the next year.

There were six (yes, as in single digit six) mortgagee sales in the three months to the end of January. That is an average of one every two weeks for the entire country.

CoreLogic estimates that as many as 500 first home borrowers who bought near the peak of the market in October or November could now be in that negative equity situation if their house prices have fallen 20%, as has been seen in some parts of Auckland City and Wellington City.

“Of course, with unemployment low, provided that they don’t need to sell, negative equity on paper needn’t be a disaster,” CoreLogic’s chief economist Kelvin Davidson wrote last week.

So if 500 might be at risk, you’d have to work out what the chances are of divorce or relationship breakdown, death, dual unemployment or sickness that might force a bank’s hand. Statistics NZ estimates about one in five marriages end within a decade so the chances are about 10 of those 500 buyers might experience divorce in the next year. The mortality rate per 100,000 people for those aged 30-50 is around 80 per 100,000. So that works out at about half a person being likely to die out of the 500.

So it’s not outrageous to say that less than 10 first home buyers in the whole country might be in a position to be forced to sell their home within the next year and have to take a complete loss. Even then, the prospects of a bank forcing a young, recently divorced couple or just-bereaved widow or widower to sell at a loss that might also force the bank to take a loss is low. That’s why I’m confident in saying the number would be less than 10, and most likely under five. That is the scale of the issue.

Here’s more detail from CoreLogic about the proportion of people who sell their house for less than they bought them, and the size of their losses. In the June quarter, just 1.5% of the houses sold were let go for less than what the buyer paid for it. The median loss for those home buyers was $25,000, which would be significantly less than the equity still in those homes. Also, it’s worth remembering that the median hold period for a loss-making seller was just over a year.

But what about the massive mortgages and rising interest rates?

We’ve been conditioned to think that first home buyers are mortgaged to the eyeballs and can barely afford a flat white because of all the interest they’re paying when they take out their first mortgage and that the rise from 2% to 5.5% for mortgage rates must have tipped them all over the edge. But the truth is banks don’t let first home buyers have a mortgage unless they can afford more like 6.5% or 7%, as this Reserve Bank chart on the serviceability test rates shows.

Some of those first home buyers might have to economise on holidays and blocks of tasty cheese, but they will be a long way from defaulting on their mortgages. And it’s not just because the banks made sure they had some fat in case of higher interest rates. Incomes for couples on higher incomes in their 30s and 40s are rising at double digit rates at the moment, partly due to higher hourly wage inflation, and partly because more people per household are working more hours per week. That’s what happens when unemployment is at 3.3%.

You can see the lack of stress in in the non-performing loan rates reported by banks through the Reserve Bank.

So in summary, NZ Inc does not have a negative equity problem because so few borrowers are at risk, so few banks are ready to pull the trigger, and unemployment is so low. The only risk would be some sort of mass divorce or extinction event for first home buyers, and I suspect that would be a bigger issue than the housing market.

The rebound isn’t that far away. Seriously.

All that everyone has to do is wait for the inevitable rebound in house price inflation, which is not that far away. In my view, house prices have already stopped falling in the “bleeding edge” markets of Auckland City and Wellington City. They are already up to the 20% quota the Reserve Bank has set. Other areas outside of Auckland still have some catching up to do, but not as much as you might think.

That’s because:

- Labour started loosening the migration taps last weekend and National is itching to open the taps even wider if it wins late next year

- Fixed mortgage rates stopped rising about a month ago because inflation is now coming off the boil globally and wholesale interest rates have peaked;

- Banks are emerging from their shells and need to keep growing lending to meet their profit growth quotas set in Australia; and,

- New housing supply growth is slowing rapidly.

There are already early indications that the market is starting to bounce. Tony Alexander’s survey of mortgage brokers found a net increase in first home buyer inquiries in August for the first time in a year. The survey also found brokers saying banks were more willing to lend than at any time since November 2020.