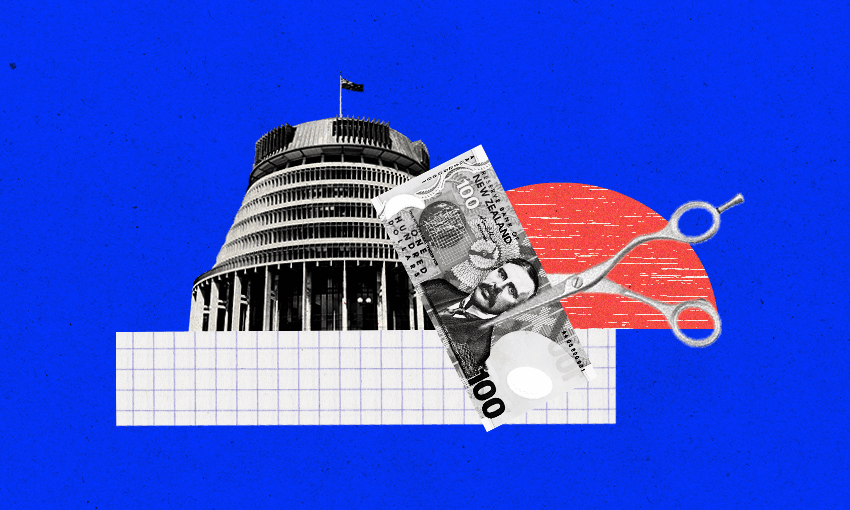

Every week that passes seems to tighten the fiscal noose for Christopher Luxon and co – a noose, moreover, of their own making.

“Don’t tell me what you value: show me your budget, and I’ll tell you what you value.” This phrase, a favourite of US president Joe Biden’s, resonates here at a time when our National-led government is reducing the rate of benefit increases in order to fund a $2.9bn tax cut for landlords.

Budgets more generally are also posing a problem for Christopher Luxon and co. Every week that passes seems to tighten the fiscal noose – a noose, moreover, of their own making.

Last month came the little-reported news of a massive financial mistake in National’s estimates. During last year’s election campaign, the party had claimed that by increasing benefits more slowly than Labour had planned (linking them to inflation rather than wages, in technical terms), it would save $2bn over four years. The true figure, it turns out, is $669.5m.

And the news keeps getting worse. Two weeks ago, we discovered that National’s largesse towards landlords, reinstating their ability to deduct mortgage interest costs from their tax bill, will cost substantially more than the $2.1bn previously estimated. And last week, Inland Revenue estimated that the planned tax on online casino operators would raise just $145m over four years, far short of the $719m figure National bandied about on the campaign trail.

Yet worse news may be due. Last year National costed its plan to raise tax thresholds at $8.9bn. But wage increases since then will have pushed more people into higher brackets, further raising the cost of cutting their tax bills. The Climate Commission, meanwhile, has warned that auctions of carbon credits – earmarked by National to help fund $2.4bn of its tax cuts – are “not a reliable source of income”.

And don’t forget that – thanks to Winston Peters’s veto – National has to do without the $3bn that it (somewhat implausibly) claimed it would get by taxing foreign house-buyers. Even just based on what we already know, the government has to find at least an extra $5.7bn to fulfil the financial plan it outlined on the campaign trail. Peters acknowledged as much at the weekend.

It is, admittedly, hard to cost policies in opposition, when a party lacks access to Beehive spreadsheets and models. (Which is why the finance minister, Nicola Willis, should make good on her previously expressed support for an independent fiscal institution that would, among other things, cost opposition policies.) But despite National being supposedly the party of the economy, and despite Luxon having had a much-vaunted team of fiscal wonks advising him, the party seems to have made a terrible fist of the job.

Not only were independent economists right to be sceptical last year about the party’s pledges; its future claims will be even more closely scrutinised. New Zealanders expect their leaders to be both compassionate and competent, but currently National is struggling on both counts.

It also faces a familiar dilemma as the May 30 budget approaches. To fill the $5.7bn gap and run its promised surplus by 2028, it has three main options: raise more revenue, borrow more, or cut more public services.

User charges – such as the higher car-registration fees trailed by transport minister Simeon Brown – could boost the coffers, but not by $5.7bn. The tax threshold rises could be delayed, effectively increasing revenue – but at the cost of some embarrassment to Willis. Borrowing more for infrastructure, and delaying the date of returning to surplus, would be perfectly sensible, and Luxon has refused to recommit to the 2028 target. But any big moves here would run counter to National’s anti-borrowing rhetoric.

Deeper public service cuts, therefore, may be in prospect. National has insisted that its efficiency drive, including 6.5-7.5% budget cuts for dozens of agencies, will, over four years, shave $6bn off government spending without harming “frontline” services.

But while most public servants would admit there is some back-office fat to be trimmed, analysis by trade union economist Craig Renney – who was consistently right about National’s financial problems on the campaign trail – suggests some services currently within scope for cuts are absolutely those that Joe Average would consider “frontline”. These include Customs, firefighting, search and rescue, Predator Free New Zealand, cybersecurity and District Court services.

The axe may, ultimately, fall elsewhere. But even the prospect of cuts to such services heightens the absurdity of the $2.9bn landlord tax break.

Bear in mind there is no hard evidence that Labour’s removal of the interest-deductibility provisions increased rents. Treasury research refutes the idea that landlords’ costs are the main driver of rent increases; far more important are tenants’ incomes, which determine how much landlords can realistically extract, and a lack of houses, which inhibits the competition that might otherwise force rents down.

There is no serious reason to believe landlords will pass on any substantial amount of their $2.9bn tax cut to tenants. Nor, at a time when we want to shift investment away from property and make life easier for first-time buyers, is there any logic in allowing landlords the same interest deductions that other businesses enjoy.

And so the tax cut remains a huge handout to people who are, according to Statistics New Zealand surveys, disproportionately concentrated in the country’s wealthiest tenth. A handout that comes as the government is cutting funds for food banks and wheelchair users. A handout that is, in the final analysis, funded partly by taking away from beneficiaries some of the extra money they would have got under Labour. What was that saying about values?