With Prefu out, both parties were blowing a victory horn of sorts yesterday, but the economic seas ahead will not make for plain sailing, no matter who’s in charge, writes Anna Rawhiti-Connell in this excerpt from The Bulletin, The Spinoff’s morning news round-up. To receive The Bulletin in full each weekday, sign up here.

Everybody was Prefu fighting

To start this morning, I’ll be honest and say I’d quite like to just recommend the crossover podcast event of the fiscal election season “Everybody was Prefu fighting” and leave it there. But we press on with 31 days to go until the election. I really do recommend listening to Toby Manhire and Bernard Hickey talk through yesterday’s Prefu and what it means in a bonus episode of Gone by Lunchtime. Great historical context on why the pre election economic and fiscal update is now such a big feature of the lead up to our elections and Hickey provides some helpful global context.

For those who prefer to read, here are the topline facts and figures:

- Treasury’s forecasts were not quite as bad as expected, signalling a recession has been avoided

- Average annual economic growth of 2.6% is forecast between 2023 and 2027

- Return to surplus has been pushed back a year from 2026 to 2027

- The tax take has “fallen short of expectations”

- Inflation is expected to drop down within the normal range by the end of next year, while interest rates are forecast to remain elevated in the meantime

Record net migration a saving grace but interest rates will stay higher for longer

As BusinessDesk’s Patrick Smellie writes (paywalled), it was immigration to the rescue, again. “Inward migration is underpinning a slightly stronger economic growth outlook over the next year and an earlier-than-expected turnaround in house prices,” he writes. Provisional estimates from Stats NZ show New Zealand experienced a record net migration gain of 96,200 in the year to July. Treasury secretary Caralee McLiesh noted yesterday that the surge in migration of recent months was likely to make it harder for the Reserve Bank to get inflation back into its target band and it’s now expected that interest rates would need to stay higher for longer than was forecast at the Budget update.

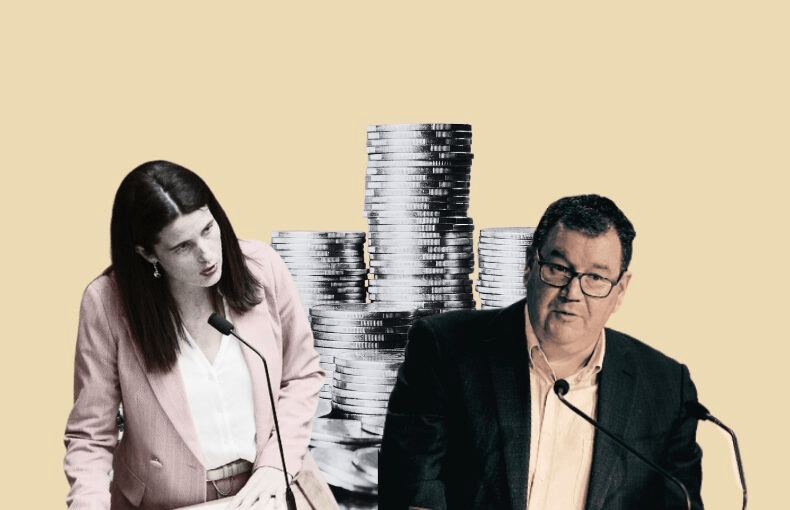

Different sides of same coin, same warning no matter who is in charge

Labour’s Grant Robertson and Chris Hipkins said the forecasts were a sign the economy was turning a corner. National leader Christopher Luxon said the country was seeing economic mismanagement on a scale it had not seen before, labelling Robertson “one of the worst finance ministers this country has seen“. Newsroom’s Marc Daalder writes that the Government’s books gave little cause for celebration or catastrophising, which didn’t stop politicians from doing both. interest.co.nz’s Dan Brunskill has a good read on what Prefu really means for future governments. Treasury has essentially warned that future governments will have to keep a tight lid on spending for more than a decade. Max Rashbrooke finds little cause for celebration, noting that while Prefu might not have delivered any short-term shocks, it’s a reminder that Labour has not solved the long-term problems that bedevil the economy – such as a tax system that doesn’t raise enough revenue. The Herald’s Thomas Coughlan (paywalled) analyses the serious questions Prefu presents for all political parties.

Cost of petrol, food and rent

Electronic card spending data was added to the bundle of economic information yesterday. Overall spending on cards rose by 0.9% last month but petrol was a significant contributor, with the rising price of fuel cited as the key reason. There are a couple of final touches to add to the economic snapshot today, with the release of the Stats NZ food price index and rental price indexes. Data from a rental firm on Monday indicated the number of prospective tenants viewing a rental property in Auckland had increased to 50 on average from an average of five over the past six months. Keep in mind, this is the last set of chunky economic forecasting and data we get before the election. The next round of inflation data via the consumer price index doesn’t land until three days after the election.