The government has dodged a bullet with today’s pre-election fiscal update, or Prefu, signalling a recession has been avoided.

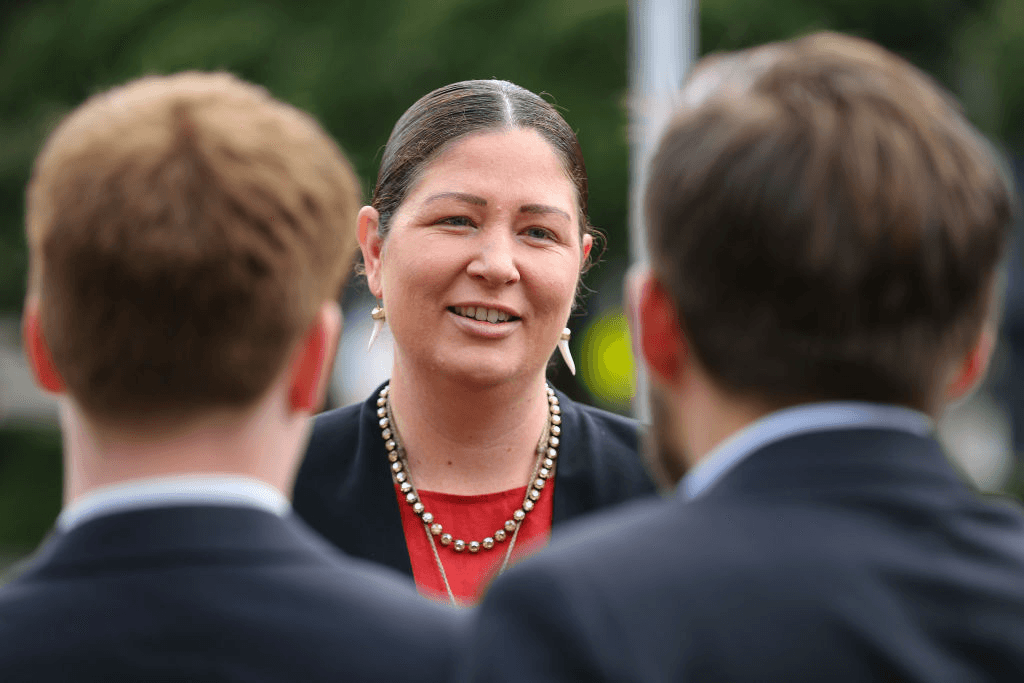

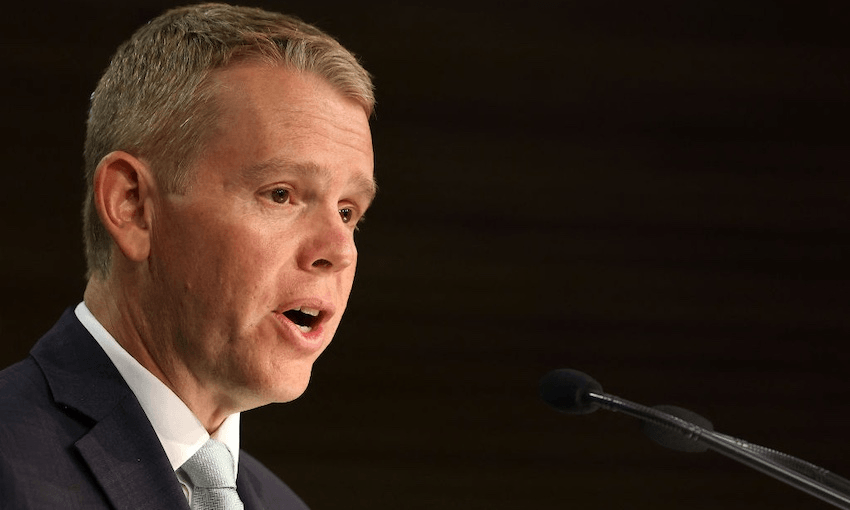

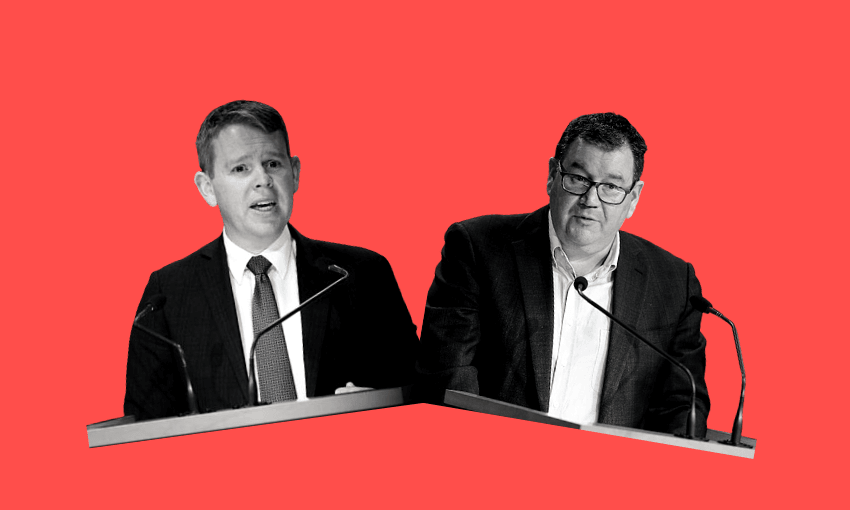

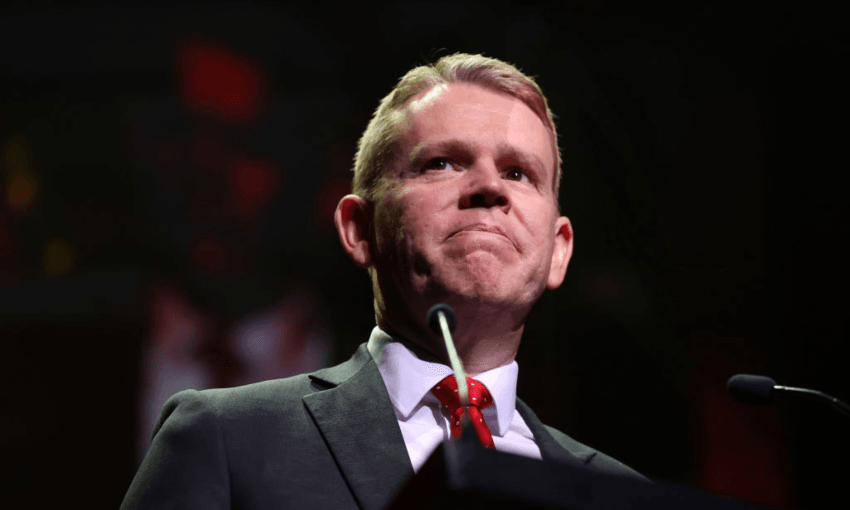

Treasury is forecasting average annual growth of 2.6% between 2023 and 2027, the addition of 105,000 new jobs and wages to grow faster than inflation, said finance minister Grant Robertson.

“The economy is 2.9% bigger than a year ago and close to 7% larger since the start of the pandemic in 2020. The number of people in work rose by 113,000 in the June year – 69,000 more than forecast in May’s budget,” he said.

But it’s not all good news. The return to surplus projected in this year’s budget has been pushed back a year from 2026 to 2027, after several years of anticipated deficits. This year it is expected to hit $10 billion, while next year’s predicted to be even higher – $11.4 billion – and up from the $7.6 billion forecast in this year’s budget. It’ll eventually drop down to $1.6 billion in 2026 before hitting surplus the following year.

Treasury said recent tax levels had “fallen short of expectations”, which in turn lead to a weaker fiscal position.

Meanwhile, inflation is expected to drop down within the normal range by the end of next year. In the meantime interest rates are forecast to remain elevated.

Robertson said today’s update showed the economy was “turning a corner” but acknowledged the challenges remained real. “New Zealand continues to feel the ongoing ripples of the 1-in-100 year economic shock from the global pandemic. Earlier this year, the country also experienced its second largest natural disaster,” he said. “The economy is holding its own in an uncertain global environment.”

Treasury predicted the unemployment rate would peak at 5.4% in 2025. “Slow economic growth is forecast to continue over the next eighteen months as high inflation necessitates high interest rates. Domestic inflationary pressure has remained persistent, and with ongoing domestic demand pressure, interest rates are expected to remain at their current level over the next year in order to reduce inflation,” said a statement.

“High interest rates are expected to constrain economic growth to a quarterly average of 0.4% over the next year.”

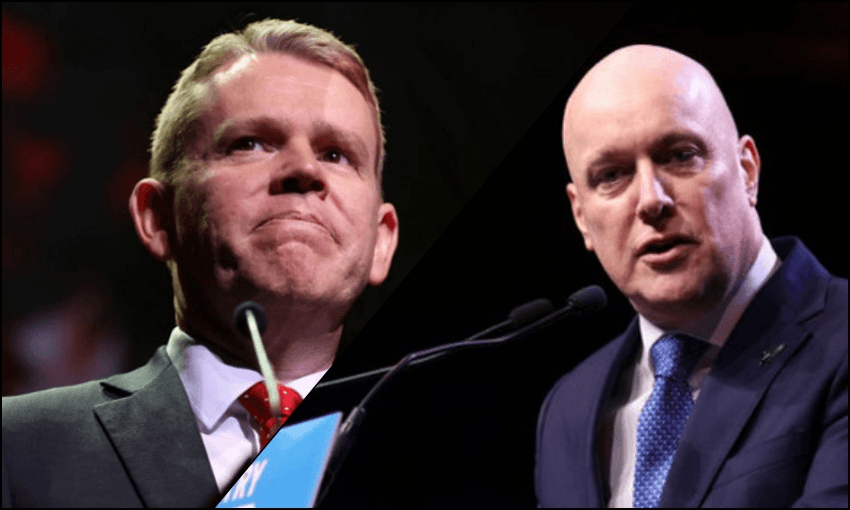

Act’s David Seymour said the state of the books showed why a change of government was necessary. “Prefu shows Labour has no plan for paying off debt, no plan for turning things around, every year forecast the country borrows more and more until we lose first world status,” he said.

As noted by Interest.co.nz, today’s Prefu also signals tighter budgets for successive governments. While New Zealand’s fiscal position was forecast to improve, government budgets for the next 15 years would need to be smaller than this year’s. The official update from Treasury doesn’t paint a rosy picture for the next few years.

“Households and businesses are expected to remain under pressure. Subdued house price growth and easing labour market conditions will dampen households’ wealth and incomes, constraining growth in household consumption,” the statement reads.

“For businesses, rising costs and subdued domestic demand will weigh on investment, offset partially by the North Island weather event rebuild. Meanwhile, the outlook for real government consumption, a measure of goods and services provided by the government, remains much flatter than has been previously experienced.”