It’s one month until election day! Welcome to The Spinoff’s election live updates for Thursday, September 14. I’m Stewart Sowman-Lund.

Reach me on stewart@thespinoff.co.nz

Learn more about the political parties and what they stand for at Policy.nz

The agenda

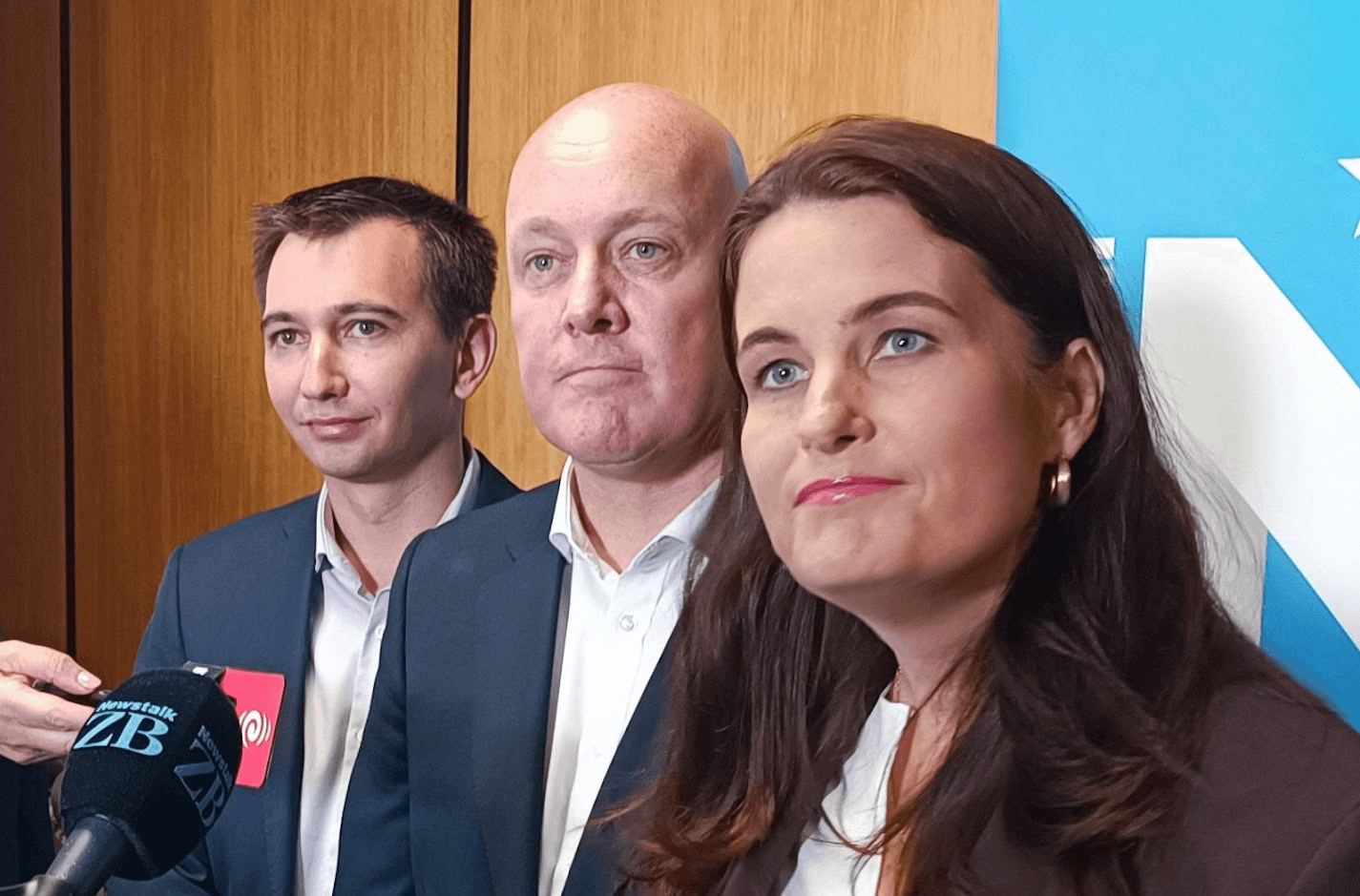

- A trio of economists from across the political spectrum have claimed there is a multimillion-dollar hole in National’s proposed plan to tax foreign buyers. You can also listen to an interview on RNZ’s Morning Report with one of the economists here.

- Christopher Luxon is standing by the plan, telling Newstalk ZB the public were on board.

- On The Spinoff: I headed up to Northland for a chat with Labour’s Willow-Jean Prime who’s facing a tough battle to keep hold of the traditionally blue seat. And a great read from our Wellington editor Joel MacManus who interviewed property developer Ian Cassels.

- In The Bulletin: More on the questions hanging over National’s tax proposal, plus putting a price on the cost of a smokefree New Zealand.

- Coming up today: Both Chris Hipkins and Christopher Luxon are in the South Island. Expect policy announcement, tax questions and pies.