This morning Te Pāti Māori announced their tax policy for the 2023 election, including a tax-free threshold of $30,000, erasing GST on food and increasing taxes for earners above $200,000 a year.

The campaign group Better Taxes for a Better Future has said the policy is innovative, going beyond tweaks to deliver change to the tax system. “New measures to curb land banking and introducing ‘ghost house’ taxes are excellent examples of forward thinking tax policy, and using tax to change behaviour for the public good,” said Fair Tax Coalition chair Glenn Barclay.

Meanwhile, in a press release, National’s campaign chair Chris Bishop has criticised the policy, saying it would “send a wrecking ball through the economy” and was “Labour Party policy by stealth.”

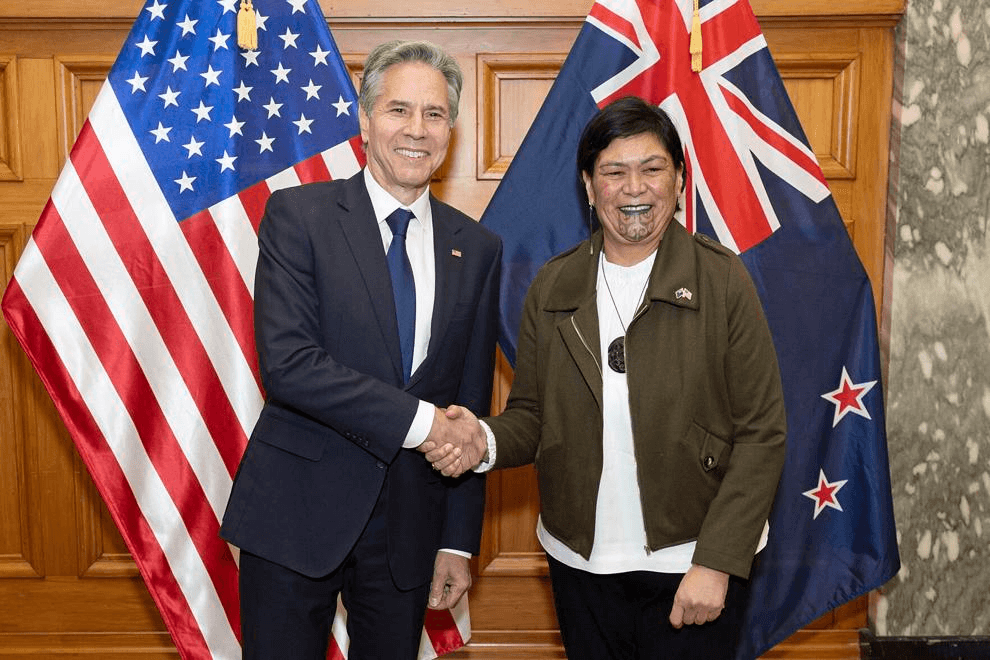

Bishop emphasised the “coalition of chaos” line the party has been using to criticise the government, describing revenue minister David Parker’s dissent over Chris Hipkins’ position on wealth tax and saying that a coalition with the Greens and Te Pāti Māori would be ineffective. “Perhaps this is why Meka Whaitiri defected to Te Pati Māori – they’re basically the same as Labour on policy but with the added perk of not having to be part of the dysfunctional Labour Party.”