Labour has attacked National’s tax plan as “dodgy”, with Minister for Finance Grant Robertson accusing the opposition of “voodoo costings”.

Robertson said the plan would mean cuts to early childhood education, canceling cheaper public transport and public services.

“National’s costings of the revenue from their new taxes look dodgy. It appears they have overestimated revenue from a number of sources. The more analysis there is the bigger the hole in National’s fiscal plan gets,” he said.

Robertson claimed National’s proposed cuts to public services would mean worse frontline services – something Nicola Willis denied this morning.

“National will be asking for 8 percent cuts in many agencies and therefore they will not be able to protect frontline services. Despite what they say, the fine print of their document says health and education will be cut to find savings,” he said.

He also claimed there was a hole in the projected $740 million per year revenue figure of the foreign buyers tax.

“The plan relies on more and more foreign buyers coming into the New Zealand market every year, despite putting a tax on them. It also beggars belief that there are that number of homes available every year to be bought up by foreigners to fund National’s tax cuts.”

Greens: “Crumbs from the property speculator’s table”

Green Party co-leader James Shaw labelled National’s tax plans “a cynical ploy to do the absolute least for middle income earners in order to get away with tax cuts for the wealthiest few”.

“The plan to roll back the bright line test to two years from 10 years and reverse the removal of landlords’ ability to deduct interest costs from their tax bill is a blatant handout for property speculators.

“The Green Party is clear that we must urgently stop handouts to property speculators so we can support everyone.”

The Greens offered alternative figures showing lower-and-middle income earners would be better of under their own tax plan.

- A retired couple who would receive an additional $13 a week under National, would receive $32 more per week under the Green Party’s plan

- A family with two children and combined income of $120k would see $50 more per week under National’s plan, and be $188 better off per week under the Green Party plan.

- Students who get no additional support under National’s plan would get support of $385 a week under the Green Party’s plan

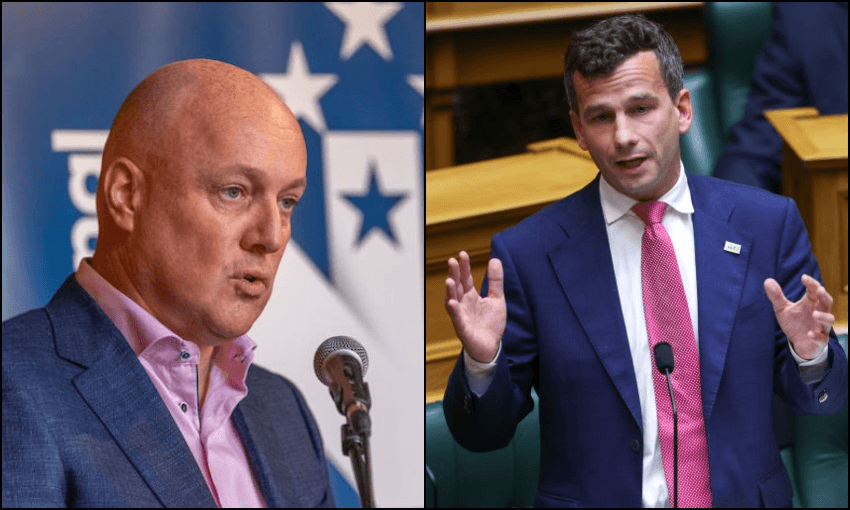

ACT: “This policy could have been announced by Labour”

ACT leader David Seymour attacked National’s plan for not cutting enough spending.

“National criticises Labour for spending an extra billion dollars a week, but they are promising to spend an extra $980 million a week,” he said.

“Their tax cuts promise about half as much as Labour’s Michael Cullen promised 15 years ago, this policy could easily have been announced by Labour,” he said.

ACT is campaigning on two-rate tax system where the top company, trust, and individual income tax rates are aligned at 28%.

NZ First: “Rehashing past failures”

NZ First leader Winston Peters took aim at National’s policies to introduce immigration levies and a foreign buyer tax for houses over $2 million.

“They are clearly relying on mass immigration and a mass foreign buy up of kiwi homes to fund its tax cuts – and their ‘squeezed middle’ will be squeezed further,” Peters said.

“Mass immigration will only put pressure on our failing infrastructure, push house prices up, living costs up, and drive wages down. Low wages and high costs means we will see a flight of mainly young kiwis out of our country.”