Rampant house prices mean saving money for a deposit on a home is becoming increasingly fruitless. But just how long does it take in today’s market compared to a few years ago?

Of all the essential and obscure pecuniary concepts that we learn throughout life, saving is one of those things many of us pick up the earliest. While it often requires discipline and guidance early on, the idea of saving is a fairly easy one to grasp, even for children – we take a portion of money we receive, say through pocket money or a part-time job, and we put it away in a piggy bank. The aim, of course, is to one day have enough to buy something we like.

Children can relate to the idea of saving because it yields results. Put away $1 every day over a month and enjoy a new toy in a month’s time. It’s a simple, compelling equation, and it usually works.

But what if it wasn’t so simple? What if the child had to pay their parents increasing expenses out of every dollar, and ended up with only 10c to put in their piggy bank every day? What if the price of the toy inflated by 10% every week – how much longer would it take to afford it? The equation becomes far more complicated, far less appealing, and the prospect of the new toy far less likely.

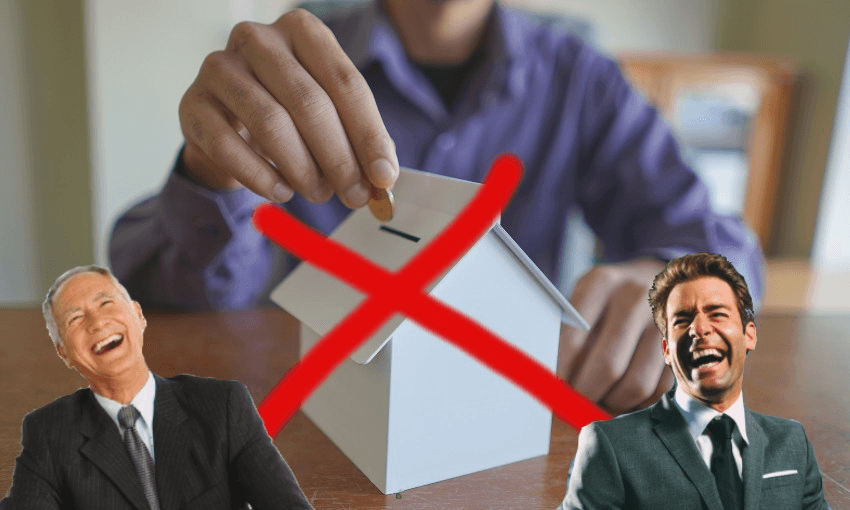

In many respects, this conveys the futility of many New Zealanders’ quest to save a deposit for a first house. With property prices sky high and climbing, and the cost of renting and living doing the same, those who are trying to save a deposit are in a difficult position, struggling against the tide, watching the yawning chasm between their savings and the required size of a deposit stretch wider almost every day.

The vastness of that gulf – and the time it takes to save a deposit – depends on income and cost of living. However, one thing is undoubtedly clear: based on the increasing house prices and cost of living, it takes much longer to save a deposit today than it did five years ago.

According to data released by Canstar, in 2016 it would have taken five years and seven months for an average-income two-person household to save enough for a 20% deposit on a median New Zealand property in that year, if they were starting from scratch. However, such has been the growth of national median house prices relative to incomes, in 2020 it would take that same household nine years and eight months to save a 20% deposit.

Looking just in Auckland – the hotbed of house price inflation – in 2016 it would have taken an average-income household nine years and seven months to afford a deposit. In 2020, that has grown to almost 14 years.

It’s important to note the data is quite generous, in that it presumes a two-person household can save 25% of their income to put toward a deposit. The reality for single income households is obviously even more stark. In reality, based on today’s rents and costs of living, saving that much is an outlandish prospect for many. This only illustrates the seriousness of the situation – for those who save less, the time to save a deposit is even longer.

But what about moving forward? Assuming house prices keep inflating at their current rate – not such a farfetched prospect considering house price growth has repeatedly defied so many forecasts – how wide might the gulf between deposits and savings spread?

According to the data, the increase in required deposit will indeed continue to outstrip savings, making the objective virtually impossible unless prices start to stagnate or come down. For example, if you began saving for a 20% deposit for a median-priced New Zealand house in 2021, by the time you saved enough it would be 2030, but by that time the required deposit amount, based on the new price of the house, would have increased by $168,000.

The government’s housing package announced last month was designed to address these issues and make it easier for people to step into first-home ownership. Other than increasing supply through the infrastructure fund, one of the most significant policies was changes to the First Home Grants, which gives those eligible up to $5,000 to go towards existing properties, or up to $10,000 for new properties. The income caps to access the grant will be lifted from $85,000 to $95,000 for single buyers, and from $130,000 to $150,000 for two or more buyers.

However, based on the data, Canstar’s general manager Jose George said it wouldn’t make much of a difference in saving a deposit.

“The government’s housing policy announcements could well cool the market, but the real problem for first-home buyers remains raising a deposit. We know from our research that raising a deposit takes several years for a couple on average incomes, and is almost impossible on a single average income.

“So while the move to extend eligibility for the First Home Grants is welcome, it’s hard to see it will make much difference to those struggling to pull together a 20% deposit.

“The bigger issue for the housing market in New Zealand is supply. If we really want to support first-home buyers onto the property ladder, we simply have to build more houses.”

After years of failed policy and limp results, it turns out building more houses isn’t all that simple. However, the fact remains that until the housing stock catches up with demand and slows down prices, putting money away for a first home deposit will continue to become, for more and more people, one big joke.

In the latest episode of When the Facts Change, Bernard Hickey talks to economists Ganesh Nana and Craig Renney about global capitalism’s ‘doom loop’ and how to stop it. Subscribe and listen on Apple Podcasts, Spotify or your favourite podcast provider.