Nicola Willis has pledged to find new sources of tax revenue – and profitable organisations with charity status are a smart place to start.

There’s been a bit of a churchy theme running through the early part of the election campaign. The Labour tax plan announcement at a Lower Hutt church. Grant Robertson’s road to Damascus. The bread, the apples.

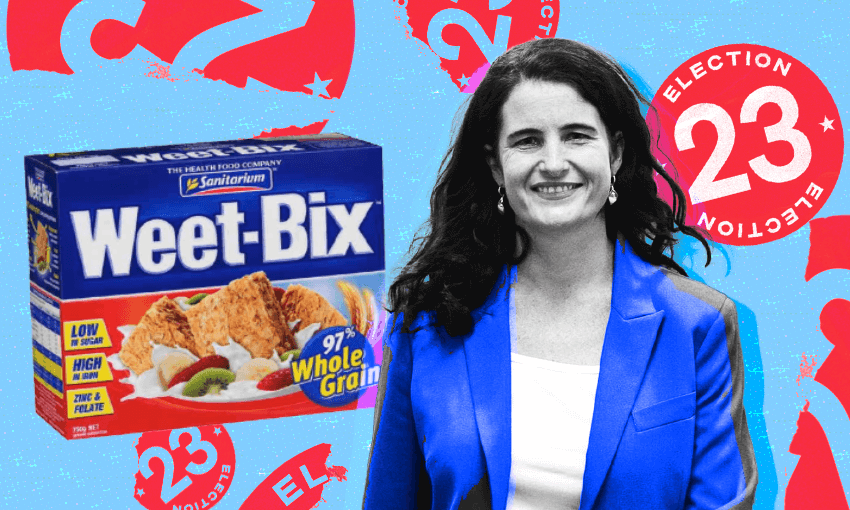

And the tea leaves this morning suggested that National could be adding something more to the mix: scrapping the tax exemption for a clutch of god-fearing charitable organisations, such as Sanitarium, wholly owned by the Seventh Day Adventists, and perhaps the prosperous mega-churches, too.

Nicola Willis has poured cold milk on that Weet-Bix, briefing the New Zealand Herald that churches and charities will hold on to their exemptions. But in an interview on Morning Report this morning, National’s deputy leader seemed notably keen to leave the door open to the idea. Having said that a “very important component” of the party’s fiscal plan, to be unveiled tomorrow, “is about making our tax system fairer with new revenue measures”, Willis ruled out any new tax on, say, pensions, but would not say when Corin Dann asked, “are you suggesting charities? Are you going after charities here?”

At the time, at least, it felt as though Willis’s record of leaking the details of tax policies was continuing, except this time it was her own party, not Labour’s plans.

Tax exemptions were ruled out of scope when the government launched a review of the charities sector earlier this term. Those exemptions mean several large, deep-pocketed charities are exempt. An online petition in 2021 calling on mega-churches such as Brian Tamaki’s Destiny Church to be taxed attracted more than 50,000 signatures. Destiny was deregistered as a charity last year for failing to file annual returns.

It is far from uncomplicated. But the argument is compelling. As Alice Snedden put it in an episode of Bad News: “The government is still giving tax breaks to religious groups. And it’s not just your little neighbourhood chapel getting a free ride. It’s charitable businesses like Sanitarium, that iconic wheat-pusher owned by the Seventh Day Adventists who rake in hundreds of millions in revenue and don’t pay a cent in income tax. Aren’t we a secular society? Why am I not directly benefiting from this tax law? And can I still eat cornflakes if I’ve been baptised but I didn’t really mean it?”

On a similar page is the Act Party. “Taxpaying businesses are at a competitive disadvantage due to certain companies’ tax-free status and this destroys the principle of a competitive marketplace. As I have been calling for since 2016, it’s time to close the ‘charitable tax’ loophole,” said David Seymour in a statement issued this morning after Willis left that door open, bemoaning “an archaic and outdated British law classing advancement of religion as a charitable purpose”.

National has toyed with the idea before. They’ll be alert to the complications and risks, not least creating a policy that dumped a tax burden on, as Snedden put it, your little neighbourhood chapel – to do so would test the devotion of many of National’s most faithful supporters. There are other tricky questions – what about iwi groups and not-for-profits? – and thousands of charities that perform vital roles in the community. A spokesperson for Community Networks Aotearoa warned about the design of any such plan by saying: “I think they need to be extremely careful about doing something that is going to adversely affect the safety net of New Zealanders.”

While a broad removal of the exemption for churches and charities appears not on the cards, something more targeted, to use Willis’s word, could be; something narrowly focused on the large, profitable outfits that in many ways behave like any old business in the marketplace. There is a strong principled argument to make about closing a loophole and levelling the playing field. And it’s a smart political tactic. National is likely to be more comfortable talking tax and Weet-Bix than Labour was talking tax and Ready to Eat Pure’n’Ezy Baby-Beets.

It would bring in fresh revenue – even if unlikely to be enough to disabuse Grant Robertson of his faithful conviction that National’s tax plans take the shape of the Bermuda triangle.

It would further extinguish efforts by a section of Christopher Luxon’s opponents desperate to paint him as secretly plotting some kind of fundamentalist theological crusade.

And it would be a smart bit of political triangulation: appealing at least as much to voters of the left as those of the right. Willis this morning sought to hose down speculation this was one of the revenue measures she’d been teasing. But when you have Alice Snedden and David Seymour singing from the same hymn sheet, you must be on to something.