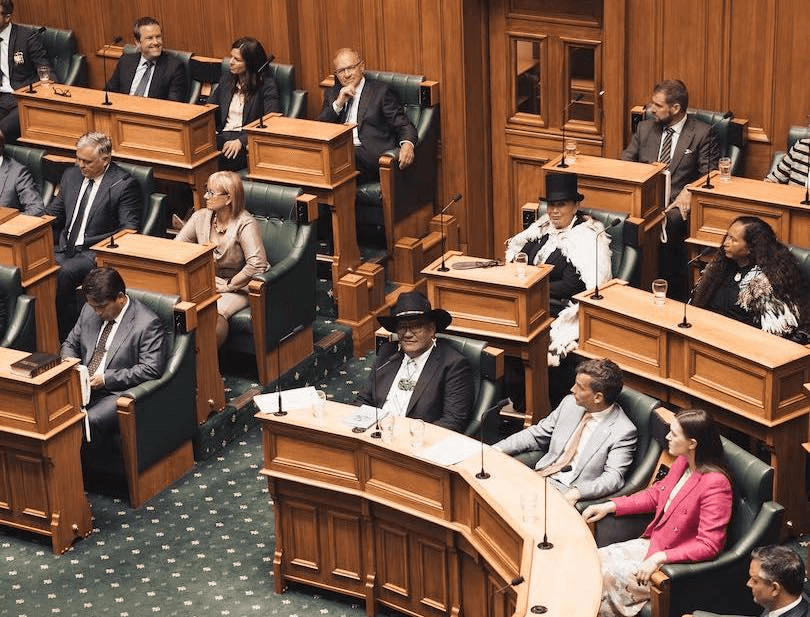

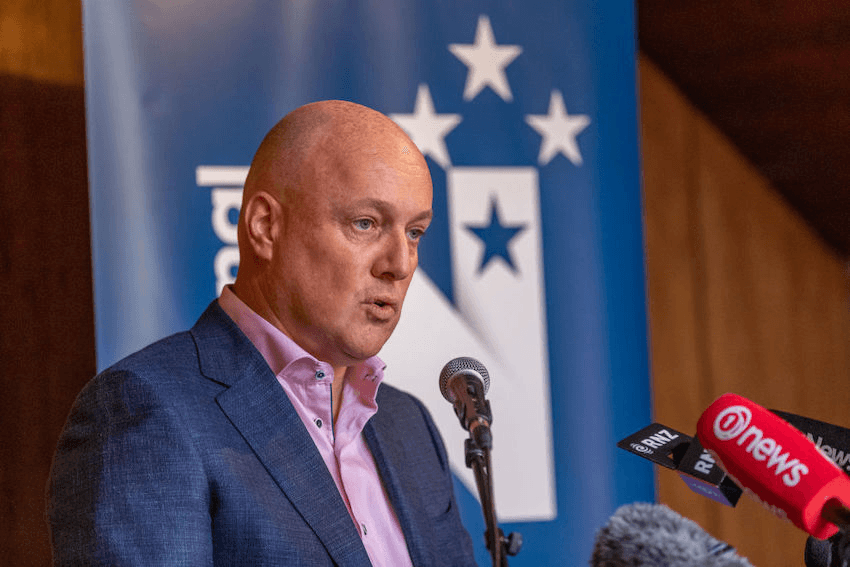

National’s leader has labelled this year’s budget the “blowout budget”, while Act has titled it the “build back broke budget”.

At the very least, neither are impressed. Christopher Luxon said the prime minister had broken his promise of a bread and butter budget. “What he delivered was a spending spree creating a massive increase in deficits and debt climbing for years to come,” said Luxon.

“This is the blowout budget, the culmination of Grant Robertson’s massive spending spree as finance minister for six years.”

Luxon reiterated his belief that the government should have adjusted the tax brackets for inflation, something he said would have been “the right thing”.

He added: “New Zealanders hoped today for some relief from the tough conditions that Labour’s economic mismanagement has produced. What they will get is cheaper bus rides for those who qualify, but still nothing for the majority of hard-working New Zealanders.”

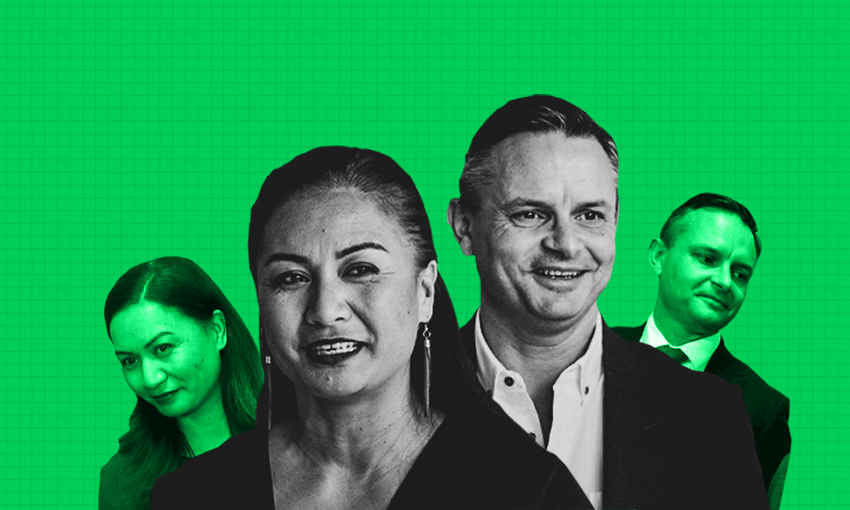

Act’s David Seymour was largely in line with these criticisms. “Labour’s build back broke budget will mean a blowout for the government’s books as it tries to buy the election,” he said.

“They’ll blame the cyclone, they’ll blame Covid-19, they’ll blame the Russians. They’ll blame everyone but themselves. The truth is that only $1 billion of their $7 billion blowout is for cyclone recovery. Oil prices are lower than before the war. Covid-19 is officially over. The common denominator in big spending is Grant Robertson.”