The latest round of NZ On Air’s highly influential ‘Where are the Audiences?’ survey shows a definitive tipping point has been reached for the transition from traditional to digital media.

Data visualisations by Renee Jacobi of Daylight

It’s been two years since the last full edition of Where Are the Audiences? (WATA for short), the deep audience research study conducted by Glasshouse and put out by Aotearoa’s media funder NZ On Air. That’s a long time in a rapidly evolving media landscape, but also means this is the first fresh research to arrive after the pandemic. WATA day is always a huge day in our media year, as it provides an independent test of which mediums, brands and platforms are rising and falling, and how fast. I must confess to being particularly obsessed with it, and have covered each edition since 2016.

NZ On Air uses it to help inform the content it funds, and the strategy behind those decisions. But it’s also scrutinised by many other organisations, from advertising to communications to culture, to get a sense of the evolution of our media consumption at a population level. It’s made up of a statistically robust sample of 1,400 people, and importantly it asks about yesterday’s usage, which gives a sense of daily behaviour.

It’s controversial in some circles, as it consistently differs from research funded by the likes of TV and radio networks. Some of this is down to methodological differences, and there are legitimate critiques to be made of it, including the emphasis on video and audio distorting its portrayal of digital news trust and consumption. But there is nothing else like it, and the fact it has been conducted for such a long time now gives it a rare weight and meaning.

NZ On Air’s aim is to “reflect New Zealand’s cultural identity and help build social cohesion, inclusion and connection”. The WATA findings suggest that continues to get a whole lot harder, as we migrate from a small number of well-financed monocultural platforms to a plethora of niches from all over the world. However, the job of those in the media and those who interact with us is best done with as much information as possible – so with that in mind, here are 10 themes that leap out.

1) 60 is the new 40…

The most powerful revelation from this research concerns the older half of New Zealand’s population. The median age of New Zealand is around 38, and as recently as 2021, older New Zealanders were more likely to keep up old habits. Open a newspaper over breakfast, turn the radio on during the day and watch linear TV in the evenings. That was even more strongly true for over-60s, whose habits had proven much more durable than any other demographic.

In 2023, that changed. “For the first time, the study is showing significant declines in traditional media use among 60+ year olds,” the study says. Chillingly for our media – which remains largely funded by advertising on traditional mediums – it goes on to say that “40-59 year olds are now at the cross-over point where digital media audiences overtake traditional media.”

2) …but there are still big differences between the way young and old watch content

We also see this in total minutes consumed. Across all New Zealanders, online video (eg YouTube), subscription video on demand (or SVOD, dominated by Netflix) and TV (such as TVNZ1) are all strikingly even, at around 90 minutes apiece. This represents a big decline for TV, back from 162 in 2014, and 118 as recently as 2021. But that similarity masks differences – younger audiences are mostly on YouTube, middle-aged on Netflix and older audiences on TVNZ1.

3) Even retirees are streaming now

For the most part, the data in WATA shows the continuation of long-established trends. Some tapering, some accelerating. But there is little truly shocking in here for those who have been reading this study for a while. There is one glaring exception to that, and it’s the adoption of on-demand viewership (services like TVNZ+ and ThreeNow), particularly by 60+ audiences. Where previously this was a fairly atypical behaviour, something just 14% of the group did on a daily basis, it’s now surged to 38% usage.

This is actually significantly more than under-40s, part of a jump on demand from 23% to 35%, the largest rise of any digital media form. Likely related: a move away from Sky TV, which at 28% is less than half the 57% daily usage of 2014. The commentary is stark. “It’s clear in 2023 that the older generation is now adopting digital media in far greater numbers.”

4) A powerhouse result for TVNZ

Overall, this is a very challenging survey for traditional media, and it asks hard questions of some brands, mediums and ratings agencies (more on this further down). Yet one media company should be very proud, and that is TVNZ. In fact, by one crucial measure, it is the single most impactful media brand in New Zealand, reaching fully half of all New Zealanders each day. This is achieved despite the continued decline of linear television, and of its powerhouse TVNZ1 brand. It happens because TVNZ+ is a phenomenon, leaping from 17% to 27% daily usage – it’s the only local streamer reaching more than 10% of the country each day (ThreeNow is next on just 7%). On the downside, TVNZ2 reaches just 11% of audiences, well behind former rival Three on 17%.

One careful-what-you-wish-for caveat: TVNZ appears to have done this by converting much of its older evening audience from linear viewers to TVNZ+ users. This is a triumph, but also fraught with danger, as it currently runs far fewer ads on TVNZ+, thus making much less money per viewing hour. Until it can start to create digital income to match its linear revenues, it will continue to financially stress the organisation, even as it celebrates a very significant achievement.

5) RNZ and Whakaata Māori face profound questions

If TVNZ will be celebrating, two other state broadcasters come away with some challenging numbers. RNZ’s radio audience slips precipitously, from 12% to 8%, in line with a fall in the radio industry’s survey. While it’s still the biggest brand in radio, its lead over ZB has vanished (it should be noted that the GfK survey has ZB with a substantial lead in mornings). Concert barely exists at 1%, and RNZ’s audiences for video and podcasting are not bright spots. It has been given $25m a year to fix some of these issues; on the evidence of this survey it has a lot of work to do.

Whakaata Māori is similarly challenged within the survey. Its television and digital audiences are 1% and 2% respectively, and given the relative youth of Māori (median age: 26), the relative resourcing of linear TV to achieve its goals needs to be questioned. There is a caveat which the data does not attempt to capture, though, and that’s the strength of brands off-platform, and Whakaata Māori has a lively and engaged TikTok presence. Still, the relative weakness of both RNZ and Whakaata Māori shows the need for meaningful media intervention or reform remains strong even after the collapse of the merger. There is also a clear case for opening TVNZ+ up to other content providers, as there is no local platform for longform video content that appears viable at this point.

6) Radio is starting to really fade

Radio has a well-earned reputation as the cockroach of media, thanks to its inclusion as default entertainment in cars. However, the steady rise of public transport and inclusion of CarPlay and Android Auto in more modern cars mean increasing amounts of choice. The biggest impact, though, is the rise of streaming for music consumption, which is now up to 50% daily usage. A pair of shocking statistics: almost as many people use Spotify every day (33%) as listen to radio (39%, down from 67% in 2014), and streaming music has even overtaken radio in the crucial morning segment. Even the reach of podcasts, at 17% and still rising, is starting to gain on radio, particularly for young people, where the gap is now just 5%.

Even older listeners are starting to desert the medium. This most obviously impacts its advertising revenues, but also culturally, with streaming now ahead of radio for new music discovery, especially among younger audiences (NZ on Air continues to emphasise radio play for music funding, this result says that needs to change). No individual audio brand has a double digit audience share, and only RNZ, ZB, More FM and the Breeze reach more than one in 20 New Zealanders each day.

7) How does this match up with TV and radio surveys?

The WATA survey is a paradox – perhaps the most widely scrutinised research in New Zealand’s media, but also its most widely dismissed and disputed, in part because it differs from industry-funded research or first-party data at times. NZ On Air clearly takes it seriously, and uses it to help guide its funding decisions and audience strategy. But so do New Zealand’s media buying agencies, who use it to independently test how various brands and mediums are tracking against one another.

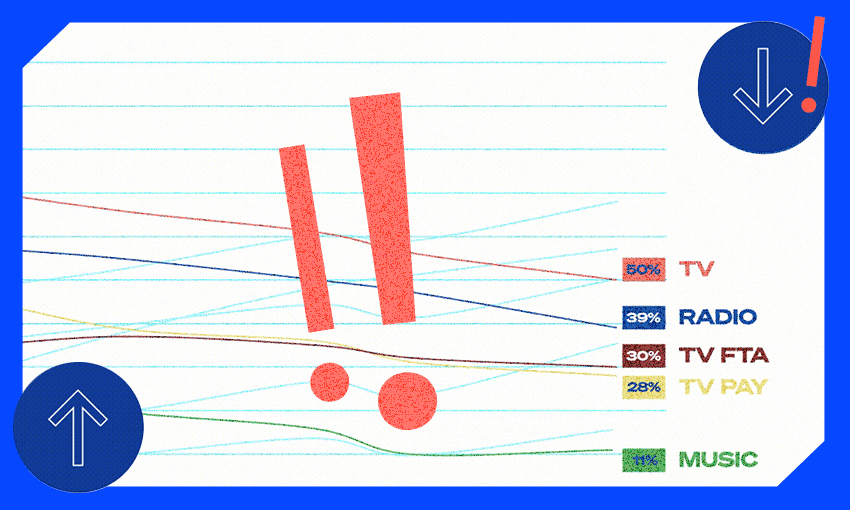

Ultimately, those who work within any branch of the media pay attention to surveys within their medium most closely. Most notably Nielsen’s TV and digital ratings along with GfK’s radio ratings. In some respects, the numbers match or even flatter. Think TV, an industry advocacy group, claims a 44% daily reach for TV, while WATA says it’s 50%. Either way, half of us don’t watch TV, and that number is rising. Radio talks about weekly rather than daily listeners, but its audiences look swollen compared to the WATA data. A couple of brutal numbers: the number of households who say they have access to a working TV or radio in 2014 versus 2023. For TV it has declined from 93% to 69%; for radio even more sharply, from 86% to 50%.

8) The end of primetime?

One big change since the last survey is the extent to which primetime has evolved from being dominated by live linear television to a much more even race. As mentioned before, even older viewers are streaming now – but largely as a complement to, rather than a replacement for, their linear TV viewing. This is why the 6pm bulletins combine for nearly a million viewers at times. But thereafter, increasingly older New Zealanders often switch to streaming.

Everyone else is already there, with a strikingly even distribution among SVOD (paid streaming, where Netflix remains incredibly dominant), on-demand like TVNZ+, and social video sites, mostly YouTube. It means that the traditional motherlode audiences of primetime TV just don’t last like they used to – we become a much more splintered audience, watching tens of thousands of different niche pieces of content across myriad channels.

9) Closed captions are now essential

Historically, captioning was unfortunately seen as something of a nice-to-have, making accessibility something only intermittently available to those New Zealanders who just can’t consume local content without it. Now, driven by auto-captioning on social media, multi-screening or sound-off viewing from younger audiences, a huge 44% of us use it daily. Fast-rising too are audio descriptions, used by 9% of audiences. This should see increased use of organisations like Able, as well as sharp use of AI tools, with adroit support from NZ On Air to help ensure as many New Zealanders as possible can consume all that we make.

10) Demography is suddenly less interesting

The function of this research is ultimately to help NZ On Air guide its content investments so as to serve all the different communities which make up Aotearoa in something approaching an equitable way. For most of the last 10 years, that has been incredibly difficult, as media consumption varied across ethnicity, gender and age across mediums and brands. It’s far from uncomplicated still, but now “age is the only consistently strong differentiator of media behaviour”, according to the study. This means the platforms used by Māori, Pākehā, Pan-Asian and Pacific New Zealanders are likely more similar now than they have been at any point since the pure linear era.

That’s a positive for NZ On Air in some respects, allowing it to focus less on the “where” and more on the “what” and “who”. The big challenge that still remains, as NZ On Air chief executive Cam Harland acknowledged in our interview for my podcast The Fold yesterday, is that younger people are far more likely to use platforms curated by algorithm. Spotify, YouTube and a surging TikTok (up from 11% to 19% daily usage) are inherently difficult for it to fund content for. It’s a sign of what remains important and challenging about the WATA research, and why it will continue to be a cornerstone of – and I know this sounds lofty, but I mean it – our understanding of how we relate to one another. Worth paying attention to, right?

Follow The Fold on Apple Podcasts, Spotify or wherever you listen to podcasts.