Good morning and welcome to The Bulletin. In today’s edition: Reserve Bank put in bind by Robertson move, Bridges clashes with top cop, and critical migrant health workers can’t get families in while new arrivals can.

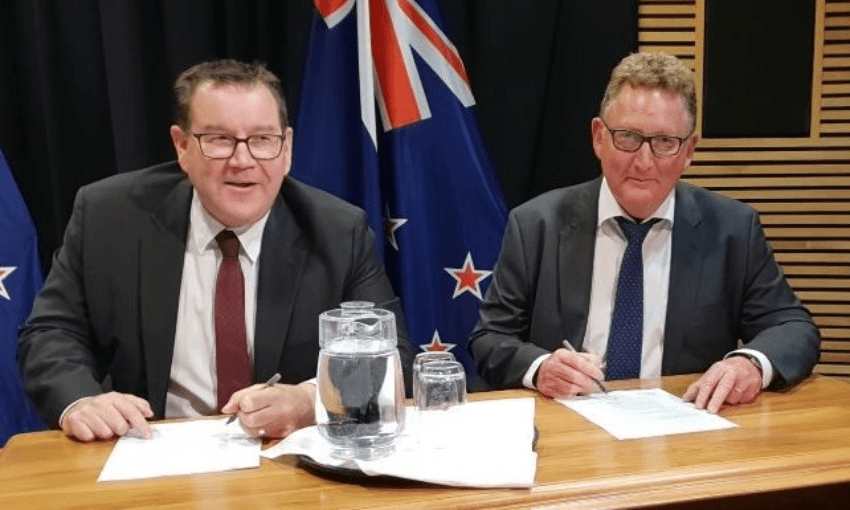

Finance minister Grant Robertson will be requiring the Reserve Bank to consider the impact on house prices when setting interest rates. With prices currently rising out of control, one reason often given for that is because money is so cheap, with the low interest rates. As Interest reports, the remit calls for the Reserve Bank to “support more sustainable house prices, including by dampening investor demand for existing housing stock, which would improve affordability for first-home buyers”. It follows an episode last year, in which Robertson politely asked the Reserve Bank to do something like this, and was equally politely rebuffed.

But how can the Reserve Bank achieve this, and is this just Robertson passing the buck? Some argue that the house price crisis is caused more than anything else by a lack of supply, which the government itself shares some responsibility for. On the demand side, speculators and investors are pushing prices ever-higher, with the prospect of the untaxed capital gains from houses being more attractive than any other form of investment. Robertson said yesterday this was just the first step the government would take in trying to cool the housing market.

It also means the Reserve Bank could have competing priorities. As foolish as such an approach would be, mass unemployment would probably bring down house prices. Right now the main goals of the Reserve Bank are controlling inflation, and maintaining sustainable employment levels – this new remit on housing is intended to slot in behind those on the priority list. So that all raises the question – will squaring this particular circle actually be possible? An opinion piece by Stuff’s political editor Luke Malpass concluded with a line that sums up the broader issue – “the problem is that every intervention will have an effect somewhere else in the system.”

Either way, the Reserve Bank currently expects house price inflation to slow in 2022 anyway. Business Desk’s (paywalled) Rebecca Howard reports the bank’s chief economist told a parliamentary select committee that “all of the factors boosting house prices will either diminish or turn around,” particularly on the supply side. But none of that will change the fact that the horse bolted long ago on this, and now we’re living with the consequences.

National MP Simon Bridges has clashed repeatedly this week with police commissioner Andrew Coster, culminating in a select committee showdown. As Stuff’s Henry Cooke reports, the key questions were around increases in gang member numbers, and the more nebulous concept of ‘policing by consent’. Coster insisted that the focus on preventing and punishing crime was as strong as it had ever been, particularly on gangs, but that the police had to make strategic decisions to avoid alienating the public. Just on those gang numbers, there are questions around whether the increased member figures are wholly accurate, with gang expert Dr Jarrod Gilbert telling Radio NZ that the nature of how the list is calculated makes growth almost inevitable.

The immigration minister Kris Faafoi is under pressure over critical migrant health workers being unable to bring families in, reports Newshub’s Tova O’Brien. And there’s a big inconsistency in the rules, in that critical workers are now able to bring families in – so those who arrived last year could go through the hassle of leaving and coming back to be reunited, but not simply have their families come into the country unaccompanied. One thing that jumps out from this story is how many individual anecdotes it contains – this is not an isolated problem, and a sizable chunk of the critical workforce is affected. Faafoi is currently refusing to commit to fixing it, on said he doesn’t want to give out “false hope”.

We’ve been doing our utmost to bring you all the coverage you need of the Covid-19 outbreak and lockdown. And we couldn’t have done it without the support of our members. If you want to help out our news team with this and other big stories, please sign up here.

An open home took place on Saturday at the residence of a tenant who later tested positive for Covid-19, I report for The Spinoff. The address was not added to the locations of interest register, because the health ministry was able to contact everyone who attended. Auckland was in alert level two at the time, with open homes permitted – however not in cases where a person at the property had been instructed to self-isolate.

Not to be a whinger, but whenever I write pieces to try and make people care about RMA reform they do real weak numbers. So perhaps you’d prefer to listen to something about it instead. The Detail has got Stuff’s Thomas Coughlan in, along with Bell Gully partner Natasha Garvan, to talk about what is being proposed and why it matters. And you know what? It’s very listenable – but then again I would say that.

An interesting story on the pay-TV beat: Stuff’s Tom Pullar-Strecker has reported on the latest round of results from Sky TV, which has suffered many years of bleeding subscribers. The update suggests the company believes it has stabilised itself – but isn’t yet going so far as to describe it as a turnaround. Covid has also had an interesting effect, cutting revenues from the absence of live sport, but in the process also dramatically cutting operating costs.

48 people have been referred to police after allegedly voting multiple times in the 2020 election, reports Newshub. That might sound like an alarmingly high figure (and perhaps it is) but it is not dissimilar to similar tallies of referrals after the previous three elections. For those wondering, no, we don’t know which parties these people allegedly multiple-voted for, if it was any sort of organised effort, or even if any of the alleged multiple votes were for different parties.

A correction from yesterday’s Bulletin: Corrections minister Kelvin Davis was not accusing People Against Prisons Aotearoa of inciting the Waikeria riot, as was wrongly stated. Rather, he said the pamphlet – published after the riot – was “basically inciting people to disorder” in more general terms. Apologies for the error.

Got some feedback about The Bulletin, or anything in the news? Drop us a line at thebulletin@thespinoff.co.nz

Right now on The Spinoff: We’ll start with two pieces about the year we’ve had, and the year to come. A trio of public health experts outline the lessons of the pandemic’s first year, particularly around maintaining the success of the elimination strategy. And Justin Giovannetti looks ahead to this time in 2022, seeing plenty of reason for worry about the virus, and pointing out some of the difficult choices that may have to be made.

In other stuff: ADHD and Autism advocate Rory McCarthy heavily criticises a crowd-funded device intended to be worn on the back of the neck. Nevada Wolfgramm, a year 13 student at Mount Aspiring College in Wānaka, writes about why it’s wrong that the clothing choices of girls are framed as a problem for distracted men and boys. Angela Walker writes about the years of making her gymnastics dreams a reality. Gavin Bertram writes about Weta, a rock band that was good enough but never quite cracked the world. And Josie Adams ranks New Zealand’s 13 best abysses to gaze into.

For a feature today, a great feature on a topic I’m becoming increasingly obsessed with – the business of football. The New York Times (soft paywall) has looked at the sad decline of FC Barcelona, and how they’re being strangled by financially flying too close to the sun. The beautiful, liquid football they used to play came at a staggering cost, the bill of which is now coming due. Here’s an excerpt:

For now, the club has been scrambling to renegotiate some of what it owes with its creditors, but it is likely that any attempt will mean doing so on worse terms.

It is exploring whether it can be granted an advance on future television income — worth around $190 million per season — or strike an innovative deal, designed by Goldman Sachs, to raise $240 million by selling a stake in a basket of Barcelona’s nonsporting assets — including its content creation business and its merchandising operation. The response, according to people familiar with the offer, has been positive.

Font said officials had pitched details of the money-raising plans to him, but he remains unconvinced. “We have a saying in Spanish: bread for today, hunger for tomorrow,” he said.

Martin Guptill is a new six-hitting T20I world record holder, after a monster return to form innings in yesterday’s match. He moved past India’s Rohit Sharma, while cracking 97 – in the process setting up a narrow win over Australia and an unassailable series lead. It’s a nice vindication for Black Caps batting coach Luke Ronchi, who just yesterday was talking up Guptill as being an innings away from being back to his best.

Sticking with cricket, I can now reveal that exciting news: The Offspin podcast is back for the World Test Championship. In the first episode back we talked about how India might well end up paying Kyle Jamieson to beat them at Lord’s, and I had a big chat to White Fern Frankie Mackay about finally making it back to international cricket, winning the Super Smash, the current state of professionalism in the women’s game, and her best book recommendations as a librarian.

That’s it for The Bulletin. If you want to support the work we do at The Spinoff, please check out our membership programme