The cost of housing in South Auckland just keeps going up and up. Do record real estate prices spell the end for Māngere as we know it?

Chaotic scenes have been playing out around the quiet suburban streets of Māngere East over the last two weeks.

According to witness reports, a gang member was run off his motorbike and gunshots were heard on Yates Rd on October 30. A few days later over 20 rounds were fired into a house on the same street. Police said the young family who live there, who are not connected to any gang, were very fortunate not to be injured or killed.

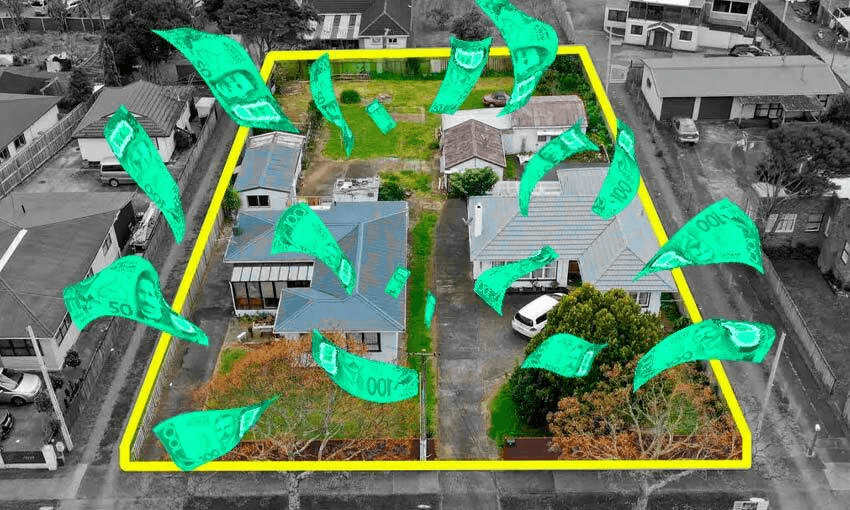

But just a few weeks earlier, and only a few minutes’ walk away, there was a different type of chaos as a property on Vine St sold at auction for $2.343 million. According to the real estate agent who sold it, Xavier Tofilau, the sale is the largest ever in Māngere East for a property in a single house zone.

Tofilau says it’s not the only massive sale he’s recently overseen, with another of his properties going for $1.9 million.

“At the moment any three-bedroom house in Māngere East is selling for $1.3 to $1.4 million – and these houses are not the best looking houses – and it’s just increased over lockdown,” he says on a uncharacteristically quiet Saturday morning, a result of the level three restrictions on open homes. “I’m selling over 10 a month. I’ve got another 10 auctions lined up for November and it will probably be the same for December.”

What surprised him most about the Vine St sale was that even though the lot has two houses on it, it can’t be subdivided or developed further under its current zone and there’s no guarantee new zoning rules will change that. “It’s got zero development potential,” he says. “I thought maybe it would go to $2 million so for it to go for $2.343 million is mindblowing.”

It’s not just Tofilau who’s hit the South Auckland property jackpot in recent weeks. Fellow Ray White agent Pat Lapalapa says he has sold almost $40 million worth of property since the beginning of lockdown.

“I’ve now sold 31 houses over lockdown and we’re getting between 18 to 26 bidders registered for each auction, so the demand has definitely been there. This is definitely above my normal average.”

He says despite not being able to hold open homes, people are still just as motivated, which he puts down to the market’s “perfect selling conditions”.

“There’s a real fill-your-boots mentality right now with developers because of the government’s policy changes, so a lot people are just looking at the land site, not the inside of the house.”

He says there’s also a number of first-home buyers who are cashed up but have been priced out of the North Shore and West Auckland, “so they are migrating to South Auckland which is pushing up the prices”.

But while parts of South Auckland appear to be experiencing a property boom, Real Estate Institute of New Zealand chief executive Jen Baird says it’s a much different picture elsewhere in the city.

“Since lockdown began we’ve seen a real slowdown in the volume of sales. There’s been a 44% drop in sales, between August and September. But I would expect to see lower levels of sales because it’s an unusual situation and level three and four are far from ideal conditions for real estate.”

She also believes the government’s announcements and the Reserve Bank’s moves to increase the official cash rate are all starting to take effect.

“I think the demand headwinds are gathering strength. The government announced a number of measures to deal with the demand side, so a lot of those measures are actually starting to flow through the market.”

Trade Me’s property sales director Gavin Lloyd has noted similar trends, with Manukau City hitting a record-breaking $852,700 average asking price as overall demand across Auckland drops off.

“Demand for properties in the Auckland region as a whole dropped by 38% since the country went into lockdown on August 18 when compared with the same period last year, [and] supply in the Auckland region has also dropped by 49% since August 18.”

But with so much interest in areas like Māngere, is the dreaded “gentrification” now an inevitability?

“It’s hard to say,” muses Lapalapa, a Māngere East resident himself. “All my family and friends are still in the area – and I still see the same people at the supermarket. I’m also still selling to a lot of locals, who are either living in Māngere or grew up in Māngere and are moving back because this is where their family and friends are.”

But Tofilau believes over time the suburb will see significant changes.

“About half of the [houses] I’m selling are families who are downsizing, clearing their mortgage, and moving out of Māngere, unfortunately. But a lot of people do stay in Māngere because they know people are friendly and everyone looks out for each other.”

Despite the gang-related crime headlines, both Tofilau and Lapalapa agree that for those who call Māngere home, it’s the community spirit and friendly Pacific culture that keep them there, and they’re hoping that won’t change anytime soon.