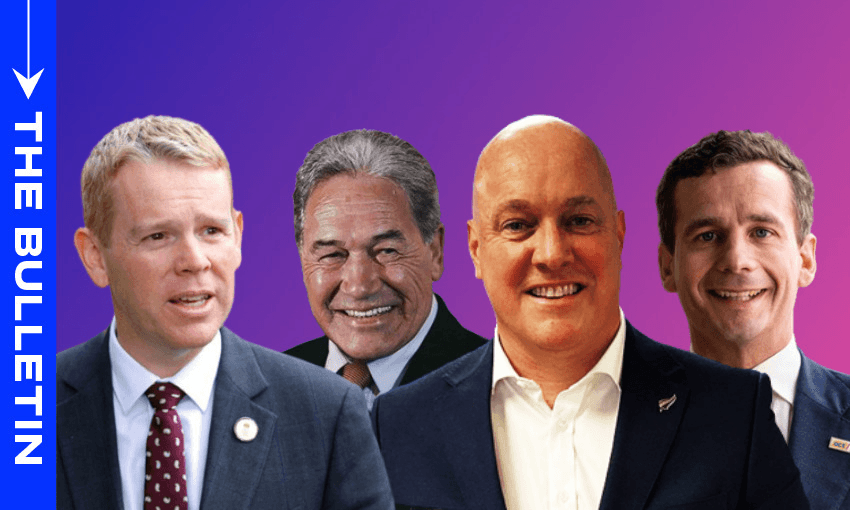

National announced a plan to fix the roads and Labour unveiled its election slogan, while Act and NZ First made news of their own, writes Catherine McGregor in this excerpt from The Bulletin, The Spinoff’s morning news round-up. To receive The Bulletin in full each weekday, sign up here.

A slogan that says everything and nothing

It was, prime minister Chris Hipkins said, a summation of the reason why he got into politics. ‘In it for you’ was unveiled as Labour’s election campaign slogan, and the PM used the opportunity to remind voters that he was a Hutt boy whose upbringing had grounded him in the “reality of working families”. Toby Manhire, who attended the launch on Sunday, says the slogan is “four syllables that are clearly intended to invite – no, to raspingly beseech – you to wonder just who the other lot are in it for”. National’s own slogan, in case you need reminding (I certainly did), is ‘Get New Zealand back on track’. The Green Party doesn’t have an official slogan, but its campaign manifesto launched last weekend was titled ‘The time is now’. The previous two Labour slogans were ‘Let’s do this’ and ‘Let’s keep moving’; based on this year’s policy bonfire, Manhire suggests a more fitting third would have been “‘Let’s undo this’ or ‘Let’s curl ourselves up as teeny-tiny and abstemious as is physically possible.’”

National promises to fill in more potholes

In keeping with National’s apparently transportation-inspired slogan, the party announced a new policy – its 26th of the election campaign so far – aimed at improving the state of local roads and state highways. The “pothole repair fund” would double the current rate of roading renewals, halve the pothole response rate from two days to 24 hours, and give local authorities and Waka Kotahi $500m over three years to address road damage. National transport spokesperson Simeon Brown pointed to Auckland, home to a 1000km road repair backlog, as proof that the country’s pothole problem is at crisis point. The policy would be funded by cutting traffic-slowing measures like “blanket speed limit reductions and excessive speed bump installations, or the failed Road to Zero advertising campaign”, Brown said. Transport minister David Parker retorted that the problem was inherited from the previous National government and maintenance spending on all roads has grown 54% during this government’s time in office.

Act list gives glimpse of potential MP slate

With Act on track to significantly increase its MP count this election, politics-watchers were quick to dissect its party list released on Sunday. Among the winners are first time candidates Todd Stephenson, who scored a number 4 place, and Andrew Hoggard, the former Federated Farmers president, at 5. They come in behind the unchanged top three of leader David Seymour, deputy leader Brook Van Velden and Nicole McKee, all current MPs. Two MPs who will be licking their wounds are Toni Severin and Chris Baillie, moved down to 14 (from 9) and 17 (from 4) respectively. Severin should be safe if the polls hold – at present support levels Act could add another five MPs to their current 10 – but it’ll be a bigger ask for Nelson-based Baillie. Two names missing from the list are MPs Damien Smith and James McDowall who have both announced their resignation from parliament.

Is the ‘freedom’ movement falling for NZ First?

Also making news this weekend was NZ First, though not for any official announcement (that’ll have to wait until their campaign launch on July 23). The Sunday Star-Times splashed with a report by Charlie Mitchell and Katie Kenny on leader Winston Peters’ growing popularity among the self-styled “freedom” movement. Peters attracted attention from the community for a viral video filmed last month in which he suggested vaccines had caused “unusual death rates” – a claim that has been thoroughly debunked by experts. The positive response was clear in an (unscientific) poll by Voters United, which aims to get all members of the “freedom” community supporting one party at this year’s election. In April, NZ First received 11% support, Mitchell and Kenny write. “This week, it received 26% – the highest of any party.”