Every week on The Primer we ask a local business or product to introduce themselves in eight simple takes. This week we talk to co-founder of Reobot, Jason Lovell, whose IBM Watson-powered chatbot allows you to practise conversational Māori via Facebook Messenger.

ONE: How did Reobot start and what was the inspiration behind it?

I want to speak te reo Māori and I want to practise every day. But with work and other commitments, it isn’t practical for me to go to classes every night. So I started looking at other ways to engage more in te reo Māori. When Jonnie Cain, Reobot’s co-founder, demonstrated to me the ease and accessibility of artificial intelligence (AI) technology after he attended an AI Day, I realised this had the potential to help me and others who might face the same challenges. So we decided to create Reobot.

TWO: Did you have any interest/experience in business or entrepreneurship prior to starting Reobot?

Both Jonnie and I are pretty new to this, but we’ve always been interested in new ideas and finding better ways of doing things to make a positive difference.

THREE: How much Māori do you have to know to get the best out of Reobot?

Reobot is currently set up for people who know a few words or are learning te reo Māori, and I’d suggest using it a little bit each day. It’s a way to converse more, build your confidence and keep what you’re learning at the front of your mind.

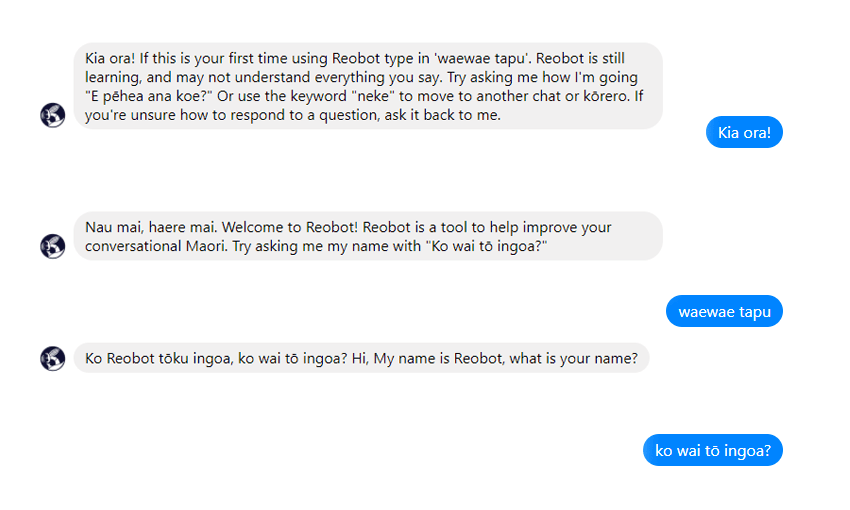

Reobot has a short intro for new users and will prompt you with a few key phrases. Ask the same question multiple times to see a few different responses. Or if you’re unsure how to respond, ask the question back to Reobot.

FOUR: Tell me about the technology behind Reobot. Does it learn to personalise as you converse with it more and more?

Reobot is powered by IBM Watson artificial intelligence. Using Watson allows Reobot to understand what the user is saying and respond appropriately. Like a person, Reobot can still understand when there are spelling (or autocorrect) mistakes.

FIVE: How much of your own Māori language skills have improved as a result of using Reobot? What sort of things do you converse with it about?

Jonnie is a good example of someone who knew very little Māori and Reobot is helping him to build up his basic knowledge and confidence. I tend to use it on the train in the morning as a quick refresher, and I’ve definitely noticed I use te reo Māori more often during the day without thinking about it.

We just follow the Reobot prompts to get us going, Things like ‘How are you today?’, ‘What did you do last night?’ or ‘Do you want a coffee?’

SIX: Other than the lack of places to converse in Māori, what do you think are some of the biggest obstacles when it comes to people trying to learn the language?

I think everyone will have their own opinion. But for me, it’s using te reo Māori in everyday situations, making it heard and making it happen without thinking about it. Reobot supports this by providing a space for anyone to practice at any time and hopefully give them the confidence to go out and use it more on a daily basis.

The other big obstacle is scale. We know a lot of New Zealanders would like to learn te reo Māori, but many classes are in such high demand that there are waiting lists. With Reobot, we’ve created a scalable environment for learning some conversational te reo that can be used every day.

SEVEN: Do you have any other plans to scale/grow further and if so, what are they?

Our aim is to have more people having conversations in te reo Māori. So in addition to building Reobot’s conversational abilities, we’re hoping to have something soon to help people with their pronunciation.

We also want Reobot to help connect people learning te reo Māori so they can support each other. So we’re looking into ways to support that.

EIGHT: Lastly, tell us about a start-up or business that you really admire right now.

Ika Bowl, a little Polynesian poke bar on Snickel Lane in Auckland CBD. They’re new and fresh, taking a different approach to a trend and delivering a great product with a unique New Zealand experience. That’s what we hope to achieve with Reobot too.

The Spinoff’s business content is brought to you by our friends at Kiwibank. Kiwibank backs small to medium businesses, social enterprises and Kiwis who innovate to make good things happen.

Check out how Kiwibank can help your business take the next step.