Wellington City Council should keep its 34% ownership share in Wellington International Airport, argue Unions Wellington spokespeople Finn Cordwell and Ashok Jacob.

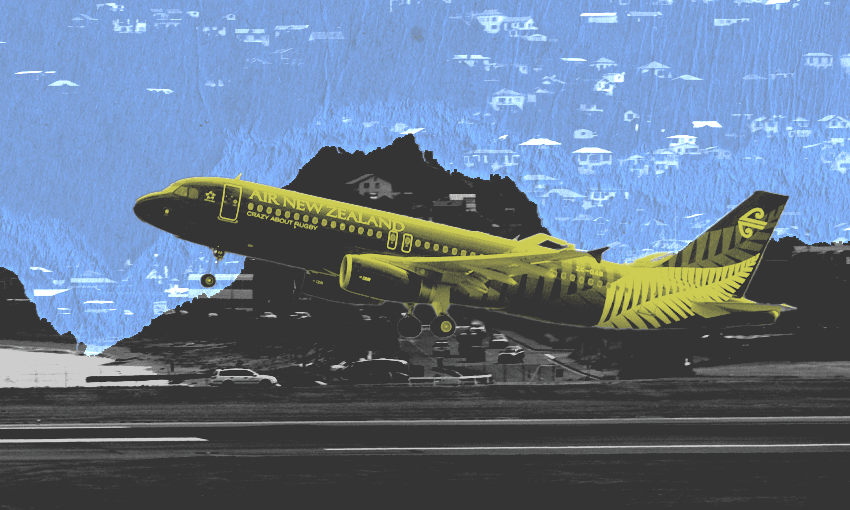

Insanity, as the saying goes, is doing the same thing over and over again and expecting different results. Wellington City Council (WCC) is yet again proposing to dispose of its 34% share of Wellington International Airport Limited, the company that owns and operates the lower North Island’s only international airport. The council optimistically expects its shares to net them $500m on the open market, which it is proposing to put into a “Green Investment Fund”.

Here’s why the proposed sell-off is a really really bad idea.

Privatisation benefits the few, not the many

It has been 30 years since the mass privatisations of the 1990s. Now, amid a productivity crisis, stagnant wages, inflation, and the accumulation of staggering amounts of wealth by a tiny minority, you would think politicians wouldn’t be proposing privatisation as a solution to our financial woes. Yet, here we are in 2024, and a left-majority council is proposing to sell the city’s largest asset as a band-aid solution to a national financial crisis.

The reason the private sector was so excited to purchase our public assets during the 1990s was that natural monopolies allow owners to gain huge returns unconstrained by market competition. This was classically demonstrated by WCC’s sale of its line company Capital Power in the 1990s to an overseas investor, which promptly flipped it to another buyer, netting its shareholders a cool $300 million. As well as the sale of New Zealand’s assets, there are international examples such as Sydney Airport, which was sold to Macquarie Bank in 2002 for $5.6 billion and quickly became one of the bank’s most profitable investments.

If the council decides to sell the shares, there will be no shortage of willing buyers, just as there wasn’t during the days of mass privatisation. There is a good reason for that: private companies know that natural monopolies like airports are cash cows.

The airport is a really good investment

The council’s minority stake in Wellington Airport performs consistently through economic downturns, growing at a rate over 10% – well above what you could expect from any private investment fund. Aside from a short period during the pandemic, the shares cost WCC very little to own, and its own financial officers admit it’s a great investment.

The perpetual investment fund is a fantasy

The long term plan consultation is asking Wellingtonians to submit for or against selling the airport shares, without providing a clear understanding of what the “around $450 million” proceeds of the sale will be spent on, other than an amorphous “Green Fund”. Other important details about the fund are also lacking, such as who would manage it and what is the basis for the assumptions on returns of this fund?

So let’s look at an example of a council-managed fund in action. New Plymouth District Council’s managed fund is often held up as the gold standard of these schemes, with proponents saying it turned a beleaguered council into a sleek, financially solvent local body, funded by the sale of New Plymouth’s regional lines company, PowerCo.

The council’s managed fund provided good returns for a few years, on the upper end of what you could expect from an investment fund. However, when the global economy tanked in 2008, the fund collapsed in value and has yet to return to its inflation-adjusted opening balance, and now often underperforms inflation.

A public stake is important for the future of the airport

While it only owns a minority stake in the airport, this ownership allows the Wellington City Council to have veto power over major transactions. The most widely understood use of this power is to potentially block a proposed airport extension.

The extension is a big decision, and it goes to the crux of whether we want a larger airport or not. Selling the shares removes a lot public control over this decision, leaving it in the hands of private shareholders who likely will have the interest of profit in front of mind rather than the interests of Wellington.

The airport is not just an asset in WCC’s investment portfolio; its operations have real consequences for the people of Wellington and the environment. Without our shareholding, we lose our ability to decide collectively on the future of this major natural monopoly in the heart of Wellington.

It’s better for workers and the environment

Wellington City Council control two out of the six seats on the airport board. Those two directors can and should push for changes in how the airport runs. This includes ensuring all staff are paid the living wage (whether contracted or directly employed), prioritising engagement with the union, pushing for a just transition climate plan, and ensuring the surrounding environment of the airport is cared for.

The Companies Act requires directors to act in the “best interest of the company”, a concept that is no barrier to the airport creating an ambitious sustainability strategy for people and the environment.

Unions Wellington and our environmental allies (Generation Zero, 350 Aotearoa, and Clinic Clinic) hope to push the council to use its shareholding in a more active way in the best interest of the Wellington people and the environment. We have public representation in the boardroom. Let’s use it.