Bernard Hickey was shocked at how shocked readers were at his loss of hope last week for the housing futures of young renters. Challenged to come up with new ideas unconstrained by political and financial limits, he went in search of hope elsewhere and dreamed up a big new idea of his own.

Follow When the Facts Change on Apple Podcasts, Spotify or your favourite podcast provider.

I thought everyone already knew this in their bones and that stating it out loud wouldn’t surprise many or change much. So I’ve been shocked at how shocked people were about my declaration of hopelessness about the futures for young renters wanting affordable housing in their lifetimes.

Most people were sympathetic in their texts, emails, voice messages and on social media, if more surprised and chastened than I thought they would be. But some of the feedback stung. Some readers challenged my courage and stamina and imagination. They told me to buck my ideas up and find a new solution that would put voters and politicians on the spot.

My knees initially jerked along the lines of replying I had proposed everything and it had been shot down in four elections and a series of policy U-turns and capitulations in the face of the all-powerful property-owning median voter and voting ratepayers.

But what if I’d missed something, or the facts had changed in some way that made those political economies surmountable? OK, I thought, I’ll have a crack. I asked a range of people: what needs to change and how they would change it if they didn’t need to get re-elected and there was no Treasury edict limiting the Crown’s ability to borrow and invest for the future?

I spoke to Centre for Research, Evaluation and Social Assessment (CRESA) Director Dr Kay Saville-Smith for this week’s When the Facts Change podcast. She is an adviser to the Ministry for Housing and Urban Development and is the programme co-leader of the Affordable Housing for Generations stream within the Building Better Homes, Towns and Cities National Science Challenge.

She told me she was more hopeful than she’d been in decades of housing research and policy advice. She said policy makers, politicians and many in the sector had finally realised the scale of the issues and the need to change many things, through regulation, investment and policy changes.

She was positive about the role of community housing providers (CHiPs) and Kāinga Ora in building new homes, and also pointed to the potential for councils to use special rates to capture value uplift on land values when councils rezone areas and/or make the land more valuable by investing in infrastructure in and around it.

It got me thinking again about taxing wealth in land to pay for infrastructure, which acts like one stone killing two birds. It could even kill three birds with a tweak. The core problem with our housing market is that houses have become financial assets for capital gain, rather than just structures to provide services.

These financial incentives have become weaponised over time as land buyers have seen enormous and leveraged capital gains land on their heads tax free, simply because of high migration, supply constraints and a structural fall in interest rates. This is unearned wealth that is untaxed. It would have seemed radical to say it a decade ago, but the best way to reduce inequality and maximise societal wellbeing is to transfer unearned wealth into public investments that maximise the wellbeing of everyone, usually by building infrastructure that makes raising healthy and thriving families and communities easier, safer and faster. That is all about housing and transport.

The big idea

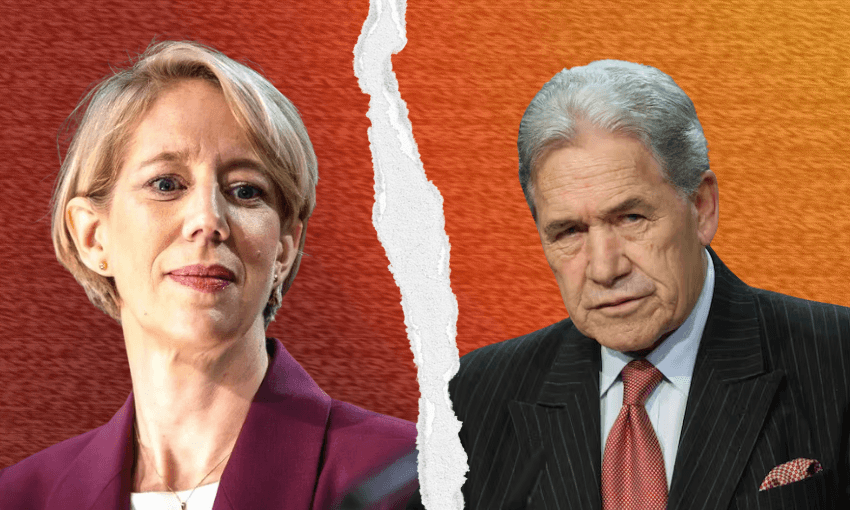

The idea of a land tax was briefly raised in the early stages of the Tax Working Group set up in the first term of this current Labour government, but was ruled out in the first draft of the report by members concerned about the complexity and cost of carving out farmers, iwi and owner-occupied land. Remember that Labour’s policy going into the 2017 election was only to have a capital gains tax beyond the family home. PM Jacinda Ardern subsequently ruled out a CGT in her political lifetime in 2019 after deputy PM Winston Peters rejected the proposal in the Tax Working Group chaired by Sir Michael Cullen.

A land tax was proposed by the first Tax Working Group set up during National’s first term under PM John Key. Its final report in 2010 included an option for a 0.5% land tax that would raise $2.3b a year in revenue on the value of land then of $460b. An initial paper on a 1% land tax by Motu’s Arthur Grimes and Andrew Coleman estimated an immediate 17% fall in land prices.

Key rejected the idea on the grounds he didn’t think the banking system and economy could handle such a land price shock in the immediate wake of the Global Financial Crisis. Instead he chose an income tax cut paid for with an increase in the GST rate from 12.5% to 15%, which he had promised not to do.

Since then the value of land has risen to $780b and a 0.5% flat land tax would now raise $3.9b a year. The government is also spending around $2.4b a year on accommodation supplements and a further $2.6b a year providing subsidies and other spending on state housing. Making the market affordable for people to pay for rent comfortably from their own income would potentially free up $5b in government spending. A combined amount of almost $9b could be used to service up to $450b of debt raised to pay for infrastructure and public transport to make housing affordable over the next 20 years.

Also, there is the opportunity for councils to impose value capture special rates for areas being rezoned or where they were investing in infrastructure for housing and transport that increased land values. Another way to incentivise the much more rapid development of land being land-banked for capital gain would be to charge a multiple of an annual land tax on undeveloped bare land that is already zoned and serviced for housing. That would set the clock ticking to more rapidly develop land.

That revenue could then be hypothecated to an independent Reserve Bank-like affordable housing and climate infrastructure commission with independent powers to raise debt, plan projects, fund projects and appoint the operators and maintainers of these projects. They could easily be local councils.

Reset expectations and aim low

One national project that was successful through the late 1980s and early 1990s was New Zealand’s conquering of consumer price inflation and the resetting of expectations. Through the 1970s and 1980s consumers, workers and businesses began to expect and “bake in” inflation in their price and wage setting behaviour. Then both sides of politics decided to appoint an independent operator of monetary policy with a clear target that everyone could see. It eventually became a one to three percent range around a mid-point of two percent. The Reserve Bank achieved that quickly by increasing interest rates and resetting expectations, which are now firmly at or below two percent and have been for nearly 30 years.

What if we were to set a national target for such an independent commission to achieve housing affordability for buyers and renters by a certain date? It would be a clear and independent mandate for a commission to achieve with the right tools for investing in infrastructure, regulating building and consenting, regulating rental standards. Just as NZTA currently spends a hypothecated pot of money each year from fuel taxes and road user charges on road building and maintenance and public transport, an affordable housing and climate infrastructure commission would do the same from a land levy for such infrastructure.

New Zealand house prices are currently over 10 times income, which more than triple that of the two to three times income seen as affordable as recently as the early 2000s. New Zealand has the highest proportion of low-income residents who spend more than 40% of disposable income on their rents in the OECD.

So what should be targeted?

Most social policy analysts would say no household should have to pay more than 30% of disposable income on rent or their mortgage to affordably live in a house. The average equivalised disposable household income after taxes in the year to June 2020 was $47,517, Stats NZ reported in February.

That would imply the affordable rent should be around $275 a week, which is just over half the median rent currently. Assuming a 6% mortgage interest rate, which is the threshold banks currently use to assess the affordability of a mortgage, that would mean an affordable mortgage would be around $240,000. Given a deposit of around 20% of the value of a home, that would mean an affordable home at current mortgage rates would be $300,000, not the average property value currently of just over $900,000.

This may seem a daunting task, but so was a two percent CPI inflation rate when New Zealand had seen 10-15% CPI inflation for much of the 1970s and 1980s.

How it would work

An affordable housing and climate infrastructure act would create a new affordable housing and climate infrastructure commission that administered the proceeds of a housing and climate infrastructure levy on land to achieve carbon zero and affordable housing by 2050.

Affordable housing would mean owning or renting a dwelling should cost no more than 30% of the average equivalised disposable income by 2050. The commission, which could combine NZTA, Kāinga Ora and the Climate Commission, would be given independent powers to achieve those two targets of 30% of disposable income and zero net carbon by 2050.

It would be able to issue debt, plan housing and transport in tandem, procure infrastructure and ensure it was paid for. It would administer congestion charging, value capture uplift rates and the operation of that infrastructure. It could also ensure a much faster take-up of public transport, cycling and walking by making buses and trains free to use, and subsidising electric cars and bikes. It would have the power to reconfigure roads and motorways for less carbon intensive ways of getting around.

This affordable housing and climate infrastructure commission would also be enabled to help raise capital and provide land for community housing providers to build and operate social housing. That isn’t happening much at the moment.

I was inspired by Ronji Tanielu, who is a Manukau-based policy adviser at the Salvation Army’s social policy unit. He proposed much more help from the government for CHiPs in this week’s podcast.

So there’s the big idea. I challenge our readers and listeners to find a politically viable way to make that happen. PM Jacinda Ardern ruled out a land tax before the 2020 election for the current term. It would be unacceptable to National.

My feeling is it would not fly with a Labour-alone government, which is one reason I haven’t seen it as viable. But, unlike housing, my dreams are free and they sure do help you find a glimmer of hope.

Follow When the Facts Change, Bernard Hickey’s essential weekly guide to the intersection of economics, politics and business on Apple Podcasts, Spotify or your favourite podcast provider.