Seven people have died with Covid-19 overnight, the highest number of deaths reported in a single day since the start of the pandemic. Of those, five were in Auckland, one in the Waikato and one in the Southern DHB area. One person was in their fifties, four were in their 70s, one was in their 80s, and one person was in their 90s. Four were male and three were female.

Speaking from Auckland, NRHCC’s clinical lead Dr Andrew Old said it highlighted that while omicron was mild for many, it could be more severe for others.

In its release, the Ministry of Health added: “Covid-19 related deaths can lag behind a rise in cases and hospitalisations and an increase in deaths was not unexpected given the high number of cases over the past two weeks.”

Hospitalisations have also risen today up to 856, with 601 of those in Auckland. There are now 20 people in intensive care.

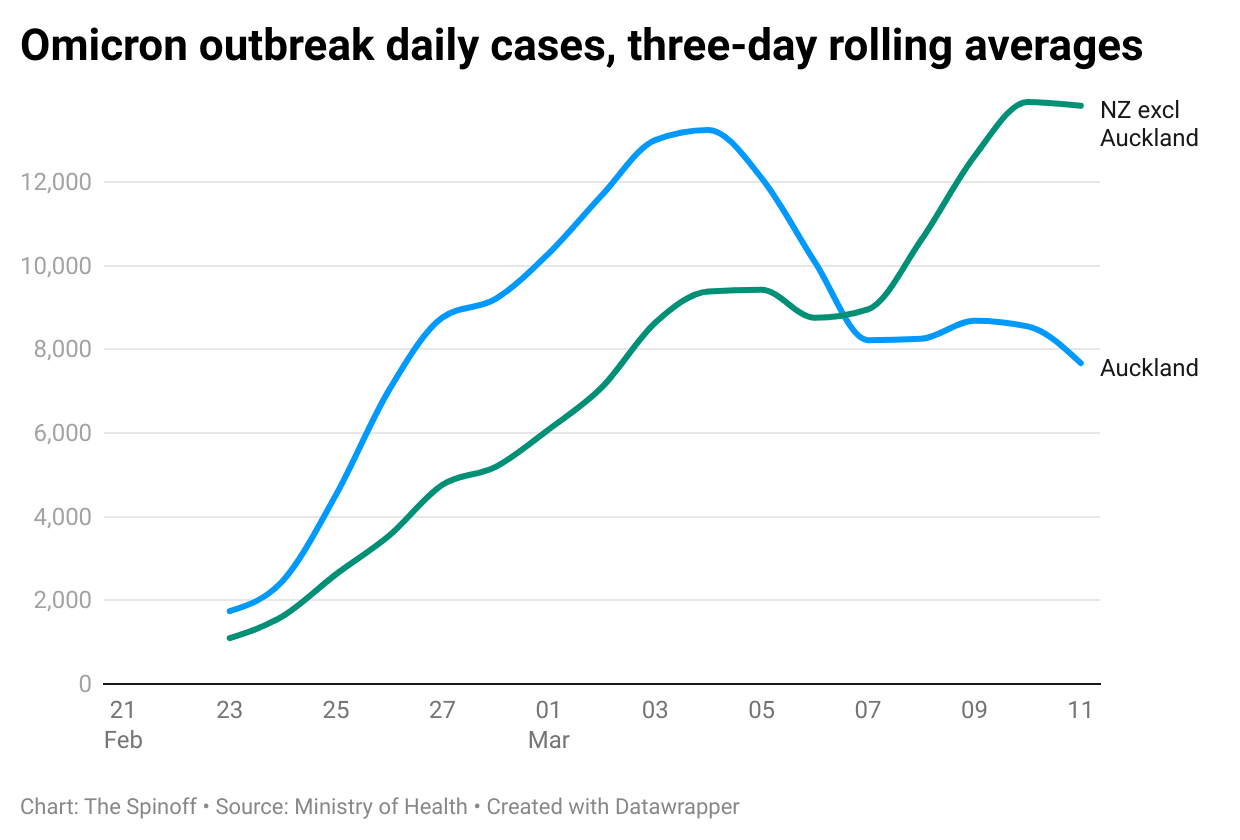

There are 20,989 new community cases, with 7,172 of those in Auckland. Old said that he remained “cautiously optimistic” the omicron outbreak may now have peaked, but it was still too early to say definitively. The three day rolling average in Auckland has been about 8,500 per day.

“We were expecting hospitalisations to increase this week, and they have,” said Old. Hospitalisations remain about half a percent of current cases, he said.

On vaccinations: the current health advice was to wait three months to get your Covid booster if you have caught Covid-19. Children, who are unable to be boosted but can have the regular two doses, should wait three months before either their first or second dose if they have caught the virus.

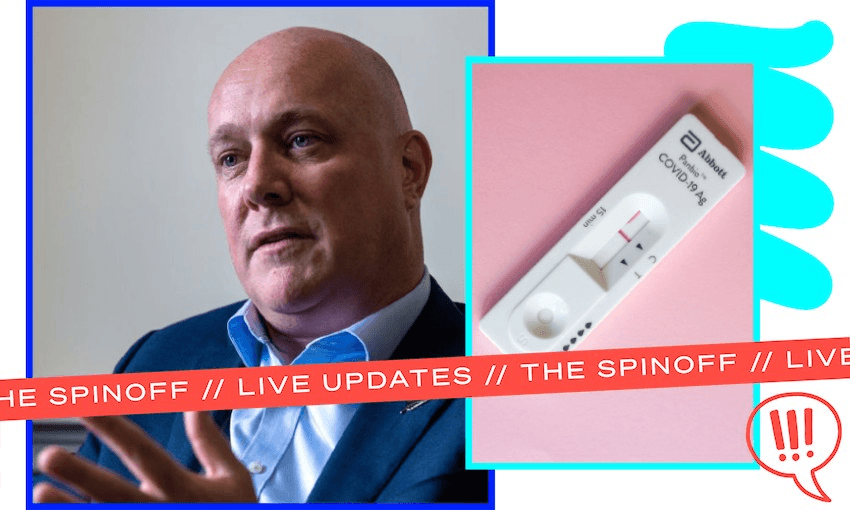

Auckland testing sites have now handed out two million rapid antigen tests since March 1, with half a million results being reported. Positivity rates range from 28% for supervised tests at GPs, to 46% for self-reported results.