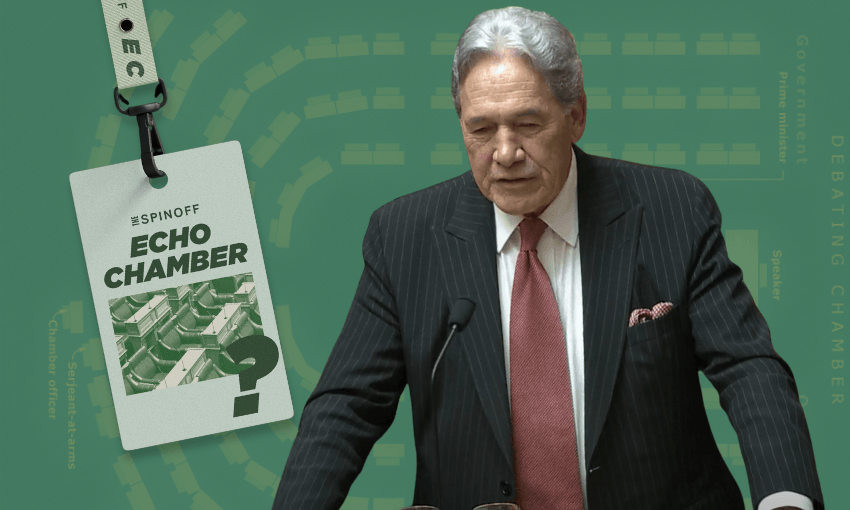

The NZ First leader is one of parliament’s greatest quippers, but his hit rate lately has been well below his career average.

Echo Chamber is The Spinoff’s dispatch from the press gallery, recapping sessions in the House. Columns are written by politics reporter Lyric Waiwiri-Smith and Wellington editor Joel MacManus.

Question time on Wednesday opened as it often does, with opposition leader Chris Hipkins and leader of the house Chris Bishop arguing about an arcane point of the standing orders and speaker Gerry Brownlee mixing up their names.

Hipkins complained that National was using patsy questions to attack the opposition and insisted that Labour had been very good boys and girls after the speaker asked them not to yell so much. Brownlee said it was OK to reference previous governments, but agreed that some answers had crossed the line.

The great tōtara of the house, Winston Peters, made a point of order: “What happened to ‘Sticks and stones can break my bones, but names will never hurt me’? Brownlee replied dismissively, “With all due respect, that completely misses the point I was making.”

The leaders of the two minor coalition parties, David Seymour and Winston Peters, like to use tactical points of order to disrupt the opposition’s lines of questioning or land a biting one-liner. Seymour is particularly good at bailing out his allies when they’re in trouble – especially prime minister Chris Luxon.

Early into the debate, Greens co-leader Marama Davidson sent Luxon into a spiral of what-I’d-say-to-yous over school lunches, while Labour’s Rachel Brooking and Deborah Russell mimicked the prime minister’s finger-wags back to him. He tried to spin his “go make a Marmite sandwich” gaffe by claiming Labour and the Greens were vilifying working parents who give their kids Marmite sandwiches for lunch. Seymour came to his rescue by asking whether the prime minister was aware that Labour’s last budget only funded school lunches through 2025. Luxon took the hint and pivoted into a stump speech.

Peters has a less subtle style than Seymour. He barely tries to pose his statements as questions (“Prime Minister, will you explain to Mr Hipkins…”) and is usually more concerned with landing a witty one-liner than winning the debate. Lately, though, his strike rate on these jokes has fallen well below his career average.

Green MP Kahurangi Carter questioned children’s minister Karen Chhour about reports of overworked social workers when Peters jumped in: “In line with MP Kahurangi Carter’s recent select committee request, if she offers the issue a hug, will it go away?” You could almost hear the cicadas chirping outside. “Yeah, that’s not something that the minister has direct responsibility for,” Brownlee replied.

It was a niche joke that relied on the audience knowing that Carter sarcastically offered a Hobson’s Pledge trustee a hug during select committee hearings for the Treaty principles bill. It also wasn’t particularly well-timed, appropriate or relevant to the topic.

In the echelon of parliamentary quippers, Peters is up there with the best. But like a great athlete in the twilight of their career, he’s not quite what he once was. There are flashes of vintage Winston, but they’re inconsistent. New Zealand First’s coalition partners, who rely on his support, have become accustomed to smiling and nodding through every slurred punchline and questionable statement of fact.

Since being appointed minister for rail in December, Peters has thrown around some bold predictions for the costs of the new Interislander ferries. On Tuesday, he told Newstalk ZB the reported $300 million break fee for cancelling the previous ferry contract was actually “way less than $300 million”. When Barbara Edmonds asked Nicola Willis about this, she replied diplomatically: “I find it is wise to agree with the minister for rail.”

Peters asked whether Willis was confident that the new ferries and port infrastructure would be at least $2 billion cheaper than the previous iReX project. It was intended as a softball so Willis could attack the previous government’s spending, but instead, she had to carefully avoid making a claim that could come back to bite her. “Well, I’m delighted to hear that the minister for rail has these matters in hand,” she said. Edmonds, keen to pin the government to a commitment on the price, asked again whether Willis could confirm Peters’ prediction of a $2 billion saving. “As I’ve just said, I find it’s always wise to agree with the minister for rail,” she replied.

One fun moment

Chris Hipkins and Chris Luxon were in a back-and-forth about school lunches and tax breaks for landlords when backbench National MP Nancy Lu made a rare point of order.

Nancy Lu: “Point of order, Mr Speaker. I think the mic for the prime minister is actually not on, so most of the MPs sitting here cannot hear him at all.”

Speaker Brownlee: “Well, some people might thank the lord for small mercies, but I will ask the technicians to have a look at what’s going on.”