The free money couldn’t keep coming forever. As a sector, we need to engage in positive discussions to ensure the policy works, writes Mark Todd, founder of Ockham Residential.

The quickest route to getting wealthier in this country has been buying an existing home, renting it out, and spending as little as possible on it while the capital gains accumulate. The problem is: nothing is being created. Societies thrive on the creation of new wealth, not the hoarding of existing wealth.

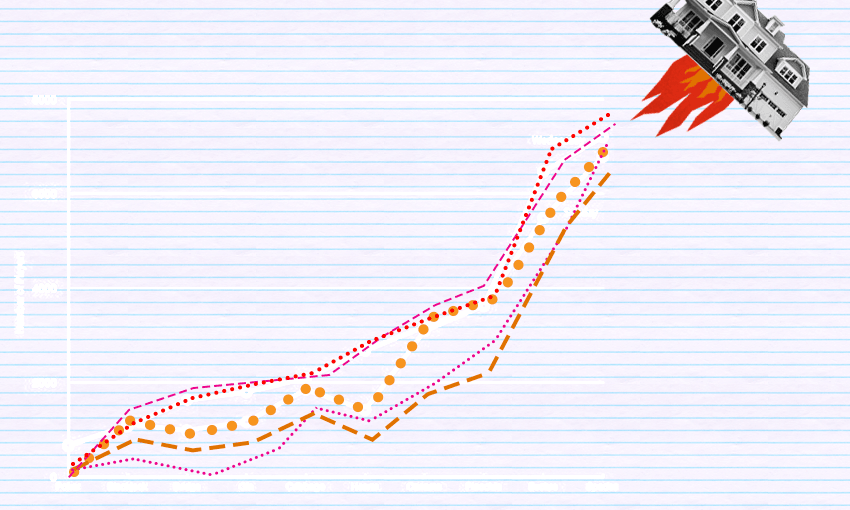

So, it should come as no surprise the government has pulled out its trump cards to make investing in existing homes less attractive. With home price inflation running at 25% and more and more young families being shut out, they had no choice. The exact mechanism – removing mortgage interest deductibility – was a surprise to many, but everyone knew the free money couldn’t keep coming forever.

Unfortunately, the headlines have been dominated by landlords threatening to take revenge on their tenants, which has only made the government’s case easier. I’m a landlord but I cringe at these stories. As a sector, we need to stop looking like spoilt brats and engage in positive discussions to ensure the policy going forward works.

Mortgage interest deductibility for existing rentals is coming to an end but there’s opportunity here.

The message should be: if you want to invest in housing, build a new home.

The government has said that new-builds will be excluded from the new policy – you will still be able to claim mortgage interest deductions for them. But we haven’t seen the details yet, and the details matter. How long will this exemption last? Will it transfer to new owners? How will Build to Rent, a sector the government wants to grow, be treated?

If the exemption is too short (say, only 10 years), or it doesn’t transfer to new owners the economics of investing in a new build will be severely undermined and we may see developments delayed or cancelled. On the other hand, the right policy design might make investing in new builds much more attractive than investing in existing homes, and spur the building a boom to new heights.

What specific rules am I talking about?

- 25-year exemption for new builds. For the first 25 years after completion of a new dwelling, mortgage interest can be claimed as a deduction for investors. That’s only quarter of the expected lifetime of a building but its effectively forever from the investor’s point of view – long enough that it doesn’t disincentivise investing in building now. Once the 25 years are up, the home is no different to any other existing home, and investing in new build is more attractive.

- Transfer to new owners. If the home is sold within that 25-year period, the remaining time carries over to the new owner. This is important because a home is only worth what you can sell it for. If an investor knows they can sell their new build and the next buyer also benefits from deductibility, it makes investing in new build less risky.

Coupled with the new exemption to the Bright Line test for new builds, these measures would definitely tilt the balance towards investing in building more homes. More investment in new homes will help ease the housing shortage.

There also needs to be a specific new treatment for Build to Rent projects, just as there are for student accommodation and retirement villages. Build to Rent is very different from the typical new development. These large-scale developments, usually apartments, are designed to offer long-term secure rentals to tenants – who are the customers – and provide dependable returns over time for investors. The model is all about purpose-built, high quality, low maintenance accommodation. It’s a great option for people who choose to rent and a secure investment, boosting housing supply without competing against homebuyers in the general housing market.

A model for Build to Rent would preserve mortgage interest deductibility, make it subject to GST, ease the OIO treatment, and allow deprecation, while requiring a higher standard of accommodation and security of tenure than standard rental law.

With the right rules, this change makes investing in new-builds and Build to Rent looks a lot more attractive. That’s a good thing, because when an investor puts their money into these projects they are helping create new wealth – new housing to meet our housing shortage – rather than concentrating the houses that already exist in fewer and fewer hands.