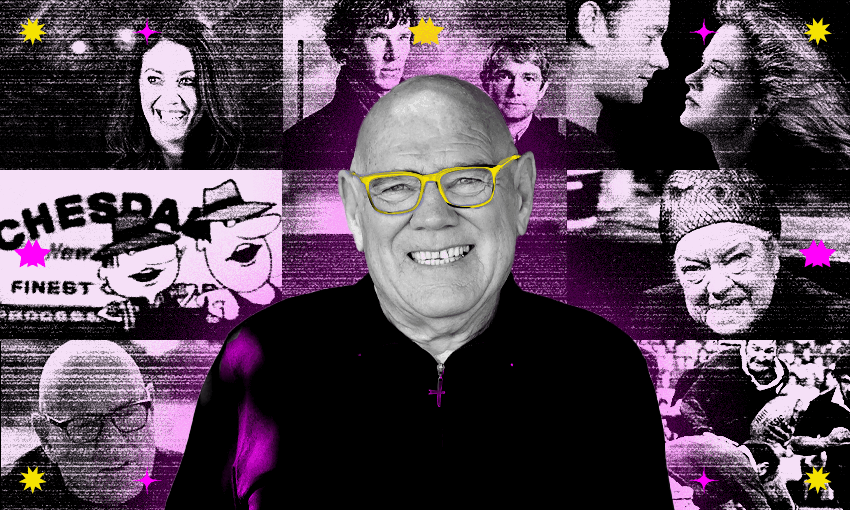

Burnley labourer turned financial figurehead Dave Fishwick appears to have the Midas touch. So what does he have to say to New Zealanders?

No, Dave Fishwick doesn’t want to sit across the table from me. He can’t be bothered faffing about with coffees. We’ve only just shaken hands in an Auckland café when he pulls up a chair in a quiet spot and leans towards my microphone.

He believes he’s got something important to say, and he wants to get down to business as fast as possible. “I want your readers to hear this,” he says, hunching so far forward his elbows rest on his knees.

It might pay to listen. Fishwick is a high school drop-out and self-taught financial figurehead from Burnley who famously, and on a whim, started Britain’s first new bank in 150 years.

That bank, Burnley Savings and Loans, inspired a popular Channel 4 documentary series, then a hit Netflix movie. In Bank of Dave, the award-winning actor Rory Kinnear plays Fishwick. Rock act Def Leppard makes a cameo. It’s not strictly biographical. Fishwick admits parts of it have been embellished.

Yet, in these trying times, Fishwick’s David v Goliath story has found a huge fanbase. Critics have called it a “cheerful warming British underdog comedy” and “a feel-good film about hating banks”. It’s become so popular it’s now doing the big screen circuit in Aotearoa, and Fishwick has jumped on a plane to travel here and promote it.

“It was number one within three days of being on Netflix [in the UK],” he says. “Normally, they spend $100 million to get to number one. They didn’t spend that on mine.” A sequel is now in the works.

But Fishwick has more than his movie on his mind. Money is his favourite topic of conversation. It’s been this way since he was 16, when he dropped out of school, started working as a labourer and began fixing cars on the side.

Those cars turned into vans, then buses. “I scrubbed them and cleaned them and advertised them in local magazines,” he says. He made a small profit on each, then used his meagre savings to buy a small home, which also needed fixing up.

By the time of the 2008 global financial crisis, he’d stopped labouring and was running his vehicle rehab business full-time. But banks had stopped lending his customers money. “They just stopped lending to businesses,” he says. “All they wanted to do was send money to America to buy credit default swaps, invest in stocks, shares and risky investments … they lost their way.”

So he did the research, filled out the paperwork and started a bank of his own. “I thought, ‘This banking malarkey’s not that difficult. I’ll open a community bank run by the community, owned by the community.'” Bank of Dave, he says, is “old-fashioned banking”. Any profits go straight to charity.

Like his vehicle business, that bank is still operating. Fishwick has continued to do very well out of his various business interests, including starting a successful investment company in America. Along the way, he’s become an in-demand economic commentator, a man-of-the-people dispensing useful advice in his affable way.

He admits he has made as much money as he needs. “I’ve got the helicoptor, I’ve got the Ferrari,” he says. “I don’t need to spend the next 20 years putting zeroes on the end of a number.”

So what does get him out of bed these days? Fishwick says he just wants to help anyone who might have been in his situation at the age of 16, broke with no education and a lifetime of labouring ahead of him. His first piece of advice? “If you can learn to communicate, you will earn 50% more in your lifetime,” he says.

The man with the Midas touch believes he’s accumulated some wisdom over the years. He’s been in Aotearoa the grand total of 24 hours, but based on a conversation with strangers in a hotel lobby earlier in the day, he’s ready to dispense some advice.”They were worried about the price of milk, vegetables … the price of real food. It’s 25% more.”

Yes, he agrees. Times are tough. Food prices are through the roof, inflation is sky high, so are interest rates. The cost of living crisis continues to bite. If you’ve got savings, don’t spend it on a holiday, says Fishwick. “The best thing I can tell you to do is, if you’ve got any savings at all … pay down your most expensive loan first,” he says.

That, he admits, might not be enough for some. “If you’ve no savings whatsoever, then you need to think about selling something to try and keep that mortgage going if you really want to keep the house because otherwise you’re gonna lose it. It’s a really difficult one … look for opportunities,” he says. “Never, ever give up.”

His left leg bounces up and down as he talks. Fishwick admits he has so many ideas rattling around in his head he finds it hard to sleep at night. He saw all the crop fields flying in and is stunned to see how much our food costs. “At the top of this will be greed,” he says, addressing our supermarket duopoly. “There’ll be a small amount of people making a lot of money.”

For the first time, he stops talking and gazes out over the city. “The people I’ve been talking to are concerned and worried and frightened,” he says, pondering a solution. He suggests one he has already proved works himself. “You could definitely have community banks here.”

Then he has a eureka moment. “Energy prices are through the roof. What I’d like New Zealanders doing is, get together in a Facebook group. They put some money in a pot each and they buy a block of energy and then split that discount between them,” he says. “That’s the benefit of bulk-buying. It wouldn’t take much to put that together, just a couple of people to get that going. Maybe a school gets together with the teachers and the parents.”

With that, Fishwick extracts his elbows from his knees, bounces up and shakes my hand firmly. He’s got more people to meet, more people to talk to, more advice to dispense, more ideas to think up. “If you’ve not got a reason to get out of bed in the morning, that is a very, very bad thing,” he says. And he’s off.

Bank of Dave is in theatres now.