The half-year fiscal update offers the prospect of a fragile recovery – just as higher interest rates threaten to complicate the government’s election year story, writes Catherine McGregor in today’s extract from The Bulletin.

To receive The Bulletin in full each weekday, sign up here.

A recovery that exists mostly on paper

The government’s six-monthly Half Year Economic and Fiscal Update (Hyefu) shows a recovery that remains stubbornly just out of reach. As Lyric Waiwiri-Smith notes in The Spinoff, the topline findings are familiar by now: weaker growth than previously hoped, unemployment staying higher for longer, debt rising further and the long-promised surplus again pushed out.

Writing in The Post (paywalled), Luke Malpass says there was a sense of deja vu about this Hyefu. The government’s fiscal strategy relies once again on a recovery that is always just around the corner, relying on optimistic projections of economic growth while new spending is tightly constrained. The problem for the government, Malpass says, is that “everything must go right: that spending restraint is maintained, that economic growth ticks up, and that there are no major earthquakes, floods, disasters or external shocks.”

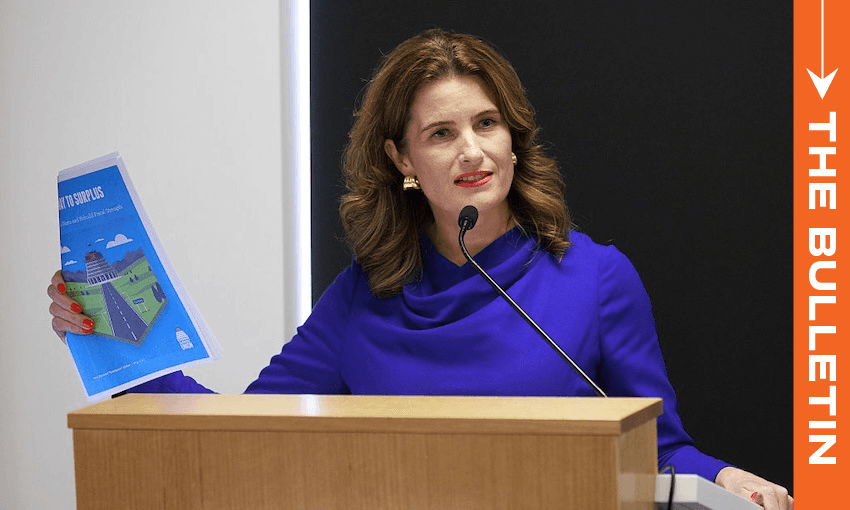

Willis takes the fight to her critics

As the Herald’s Thomas Coughlan reports (paywalled), Willis arrived at the lock-up armed with a draft budget produced by the Taxpayers’ Union, alongside figures prepared by her office to model what a hypothetical Labour budget might look like. It was, Coughlan writes, “quite an extraordinary political intervention”.

Willis used the material to accuse both the union and Labour of (theoretical) fiscal recklessness, arguing that deeper cuts of the sort proposed by the Taxpayers’ Union would gut support for families. It was the latest salvo in her war of words with the TPU, which this week stepped up its attacks on her economic stewardship via the medium of chocolate fudge. That feud was meant to culminate in a post-Hyefu debate between her and TPU chair Ruth Richardson, but it now appears unlikely to happen. Richardson said on Wednesday she would not take part in a “circus or sideshow”, effectively pulling the plug on the whole shebang.

RBNZ governor on clean-up duty

While ministers were parsing fiscal forecasts, the new Reserve Bank governor, Anna Breman, was cleaning up after November’s Monetary Policy Statement (MPS), widely read by markets as signalling the end of OCR cuts. On Monday, Breman responded with an unusual, out-of-cycle intervention, noting that financial conditions had tightened “beyond what is implied by our central projection for the OCR”.

Her comments were, wrote David Hargreaves of Interest.co.nz, “clearly a response to an increasing clamour for the RBNZ to clarify its position”. Kiwibank’s economists have been particularly biting about what they see as the central bank’s longstanding “miscommunication” issues, summing up a familiar post-Covid pattern: “Over the last few years the November decisions have been ‘hawkish’, only to be followed by a “dovish” (we stuffed up) February, then a “hawkish” (we’ve misread it again) May, and a “dovish” (sorry about that, again) August.”

Breman’s ‘laser focus’ may be a problem for Luxon

The mixed signals from the Reserve Bank have already helped push some banks’ interest rates higher – not ideal for a government about to head into an election year. As Richard Harman notes in Politik (paywalled), both the prime minister and finance minister take every opportunity to bask in the relief lower rates have brought over the past year, both for homeowners and the wider economy. The “purist” Breman, however, has been explicit that her only concern is the bank’s core mandate: low and stable inflation.

That could put her on a potential collision course with a government that is talking up the prospects of an economic recovery – one which, if successful, could force the RBNZ to increase rates to keep inflation under control. “[While] the overall economy may be able to carry on regardless if interest rates start to creep up, homeowners with mortgages will not be so sanguine,” writes Harman.