Afterpay or Afterbae – whatever you call it, Richard Meadows says this online shopping enabler is too good to be true.

Shop now. Pay later. You may have noticed this tantalising option popping up on Trade Me listings recently, and on several other major retail sites. If you shop online, you’re about to start seeing a whole lot more of it.

These four little words are the calling card of Afterpay – or as it sometimes styles itself on Instagram, ‘Afterbae’.

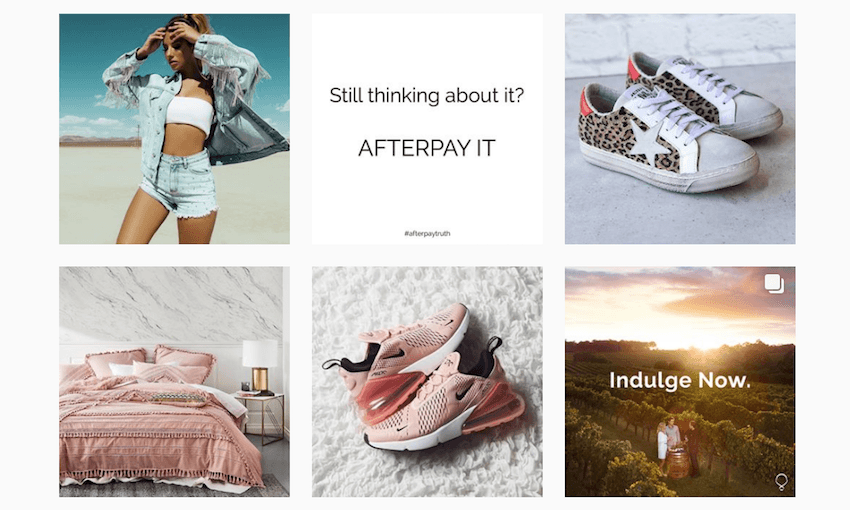

Scrolling through the Afterbae feed is fascinating, in the same way as rubbernecking at the scene of a grisly car crash. There are immaculate models and aloof hipsters and sunglasses and perfumes and makeup and carefully-styled avocado on toast, interspersed with conspiratorial text images and incredibly bleak memes: ‘Life is so boring when you don’t have an online order to look forward to.’ ‘I have enough clothes and shoes, I don’t need to go shopping – said no woman ever.’ ‘When your man looks away… Afterpay!’ Everyone is tanned and gorgeous and living their best life. Even the avocado somehow manages to look smug.

While the price tags have been removed from all the tat on display, they needn’t have bothered. The message is clear: For four easy fortnightly payments, you too can find happiness! You don’t even need the money upfront! Keep buying stuff to try and plug that gaping hole in your chest! Just don’t tell your boyfriend, hahaha! We know it’s a borderline addictive behaviour which will ruin your finances and provides no lasting fulfilment… but that’s what makes it so naughty! (devil emoji, clapping emoji, dancing girl emoji).

If you asked a panel of grumpy old men to hoick up all their favourite stereotypes about entitled, self-obsessed youth of today lacking impulse control, and then sculpted the sputum collection into the personification of a brand, this is probably what you’d get.

Afterbaeeeee! It’s an entirely new breed of financial technology made by millennials, for millennials – and it’s going to consume us all.

For a glimpse into the future that awaits us, we need only look to Australia, which is where it first launched in 2015. Today, a quarter of all clothes sold online are now being paid for in Afterpay instalments, and 8% of all online retail. The app has been downloaded more than a million times, and one in every seven millennials has already signed on as a customer.

Afterpay was Australia’s FinTech Organisation of the Year last year, and its shares are hotter than a fidget spinner in a blast furnace. Wunderkind CEO Nick Molnar, who is himself a tender 28 years old, puts it down to the win-win nature of the business, with positive outcomes for both customers and retailers. How can that be so?

Let’s say you’re eyeing up a new jacket on TradeMe. Instead of having to stump up $160 to get the goods, you can pay it off via four $40 fortnightly payments, with no extra fees or interest. Unlike a traditional layby, the seller sends you the goods immediately, and is paid in full by Afterpay, which takes a small commission for its troubles.

In theory, this is great for shoppers. You get to spend someone else’s money, and hold on to your own for a bit longer. There are no charges or fees. You might even convince yourself that it’s the smart, fiscally responsible thing to do – which is certainly the line that Molnar is pushing.

In a TEDx talk he gave in Sydney last year, Molnar said it was an “outright myth” that millennials were financially irresponsible, citing the fact that 85% of Afterpay’s transactions are linked to debit cards, rather than credit cards. In fact, these sort of stereotypes were nothing more than “character assassination”.

There are one or two awkward facts undermining this argument. Afterpay charges a $10 fee for failed payments, then another $7 if the payment isn’t made a week later. Let’s say you miss one of the $40 instalments on that jacket from earlier: The late fees mean you’ll pay an extra 42% penalty in the space of three weeks. On an annualised basis, that’d be like paying an interest rate of more than 700% (though Afterpay says customers can seek an alteration to their payment plan, and has a hardship policy in place).

Afterpay’s marketing material claims it makes money by charging merchants, not customers – in fact, “this is our north star, our guiding light”. There must be a big old smudge on the lens of the telescope, because the truth is that a full 22% of Afterpay’s revenue – more than A$10 million – comes from late payment fees charged to errant customers.

Consumer organisations in Australia and New Zealand are not thrilled about any of this. While companies like Afterpay are effectively purveyors of debt, the payment model falls in a gray area which means they don’t have to play by the same rules as actual lenders. This lucrative loophole has not gone unnoticed, with a number of ‘buy now, pay later’ schemes including Oxipay, PartPay, and Laybuy.com quickly appearing on the scene.

Without an actual consumer credit contract, there’s no obligation for these sort of companies to assess whether borrowers can afford to make repayments. At the same time, they’re still free to set debt collectors on you or file a black mark on your credit report, potentially affecting your ability to get a mortgage or loan down the track.

Laybys themselves are as old as the hills. In fact, there’s a full section of the Fair Trading Act dedicated to them, and they used to have their very own act up until 2014. But because of the differences to the traditional model described in the law, these rules don’t apply either, which has led to some fairly farcical situations.

“We do not consider consumers could believe we provide a traditional layby service,” said Gary Rohloff, the director of a company called Laybuy.com, apparently with a straight face.

Consumer NZ is planning to raise the issue with the Commerce Commission, and has put out a warning about the potential fish-hooks. Given the rampant growth of these schemes, it would be surprising if regulators didn’t step in at some point.

Let’s assume for a moment that everything turns out to be totally hunky-dory. In fact, let’s go one step further and imagine that no-one ever paid any late fees, which is what Afterpay says would be its preferred state of affairs. Even then, there would still be something whiffy about the situation. Why would any merchant in their right mind sign up for the service, and eat into their precious profit margins?

Because it makes them a ton of money, of course. Even if you’re organised enough to dodge the late fees, you’re going to spend substantially more than you otherwise would have. Merchants in Australia using the service have reported higher sales and more new customers, thanks to Afterpay. The cost of the commission is more than compensated for by getting people to spend, spend, spend. Unlike the old-school laybys, where you had to pay off the item in full before you owned it, this is instant gratification with the click of a button.

It’s worth thinking about the broader backdrop of what’s going on here.

In both Australia and New Zealand, house prices have spiralled so far out of control that many young people have given up hope of home ownership. The research suggests we’re instead turning to displacement spending – cars, clothes, meals, treats – to try and at least enjoy our day-to-day lives. When you combine this cloud of disillusionment with high disposable incomes, it’s no surprise that companies are keen to cash in.

And so, while Afterbae shares relatable #content about how glamorous it is to be a self-indulgent hot mess – we’re just like you! – its owners are getting filthy stinking rich. Revenues are soaring, and the share price has more than doubled in the last year.

The depressing thing is that while millennials are used to intergenerational warfare, now we’re eating our own kind.

Molnar was named as one of Vogue Australia’s Game Changers for 2018. He is clearly very smart, highly driven, and scores points for being willing to take the piss out of himself on stage.

But his TEDx talk, which is all about the dilemmas millennials face (‘millemmas’) is a breathtaking study in either cognitive dissonance or rank hypocrisy, depending on how charitable you’re feeling. He correctly points out that even while we twenty-somethings are coming into our place of power in the world, the desire for instantaneous gratification sometimes gets in the way of fulfilling our potential:

“We are absolutely guilty of instantaneous gratification. We live for our five star Uber ratings, we live for our 50 Instagram likes.”

What he fails to mention is that he literally founded a company that makes enormous amounts of money by deliberately encouraging his peers to feed the worst tendencies within themselves – to “Indulge Now”, and to hell with the consequences. It takes some spectacular mental gymnastics to try and contort these tendencies into something positive (“it means we’re very decisive, we’re intuitive, we trust our gut”), and it’s hard to say whether he actually believes the words coming out of his mouth.

Molnar reckons the biggest ‘millemma’ of all is what sort of legacy our generation is going to leave. Without the slightest hint of irony, he tells the crowd of fellow high-achieving young people that he would love to play a part in helping millennials shake off undeserved stereotypes.

“I sure know it’s a mark that I want to be proud of.”

The Spinoff’s business section is enabled by our friends at Kiwibank. Kiwibank backs small to medium businesses, social enterprises and Kiwis who innovate to make good things happen.

Check out how Kiwibank can help your business take the next step.